Author

Ahmed Salam

Author

Been part of the team since

August 2018

partner

Last update:

World Liberty Financial, a decentralized finance project linked to US President Donald Trump’s family, has entered the cryptocurrency lending market as the value of its $1 stablecoin surpasses $3.5 billion in circulation.

The company launched its lending and borrowing product, “Freedom Global Markets,” on Monday, according to a company release.

World Liberty Markets is now operational and designed to give users access to transparent and efficient liquidity markets provided by @dolomite_io. You can earn on the assets provided or borrow from your wallet with fast and flexible liquidity. WLFI Markets is designed to create these tools…

– WLFI (@worldlibertyfi) January 12, 2026

The new web application allows users to lend and borrow digital assets within a single blockchain marketplace built around USD1, the platform’s USD-backed stablecoin, and its governance token, WLFI.

Users can pledge assets including Ethereum, a tokenized version of Bitcoin, and major stablecoins such as USDC and USDT, with the underlying infrastructure powered by Dolomite.

Blockchain lending rebounds as World Liberty Financial boosts USD1 stablecoin momentum

World Liberty Financial said the launch represents the second major product launch under the project, following the USD1 product launch last year.

The stablecoin has grown rapidly, reaching a market capitalization of approximately $3.48 billion, with the entire issued amount already in circulation.

USD1 maintains its peg at one dollar and is spread across multiple blockchains, with the largest stake being in the BNB smart chain with around 1.92 billion tokens, followed by Ethereum with around 1.31 billion.

Smaller but growing customizations exist on Solana, Aptos, Plume, Tron, and many newer networks.

The launch of the lending service comes as lending on blockchain has regained momentum following the collapse of several lenders in the CeFi sector during the previous cycle.

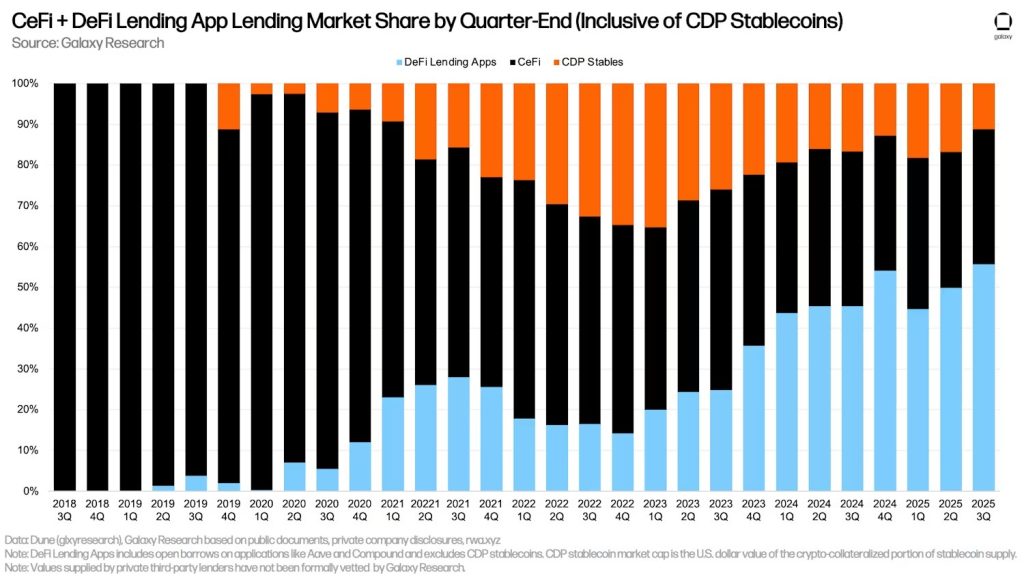

Cryptocurrency-backed loans reached an all-time high of $73.59 billion at the end of the third quarter of 2025, surpassing the 2021 peak, Galaxy Research reported.

DeFi lending apps accounted for $40.99 billion of that total, capturing 55.7% of the entire lending market and growing nearly 55% quarter-over-quarter.

Unlike the previous cycle, growth was driven by fully collateralized loans, transparent liquidation mechanisms and on-chain risk management.

The role of the USD1 stablecoin is expanding to include banking and cryptocurrency markets.

World Liberty Financial’s move places the company squarely in this evolving sector, where demand for borrowing on digital assets is increasing as investors seek liquidity without selling their holdings.

The World Liberty Markets platform is designed to expand the use of $1, allowing holders to deploy the stablecoin while accessing borrowing opportunities, the company said.

Users who deposit 1 USD are entitled to benefit from the project’s existing points program, which distributes bonuses according to specific conditions. The company also launched an early adopter bonus campaign, offering WLFI incentives for deposits of $1.

Besides USD1, users can also provide WLFI, ETH, cbBTC, USDC and USDT to earn or unlock borrowings through Dolomite.

Deposits made through the WLFI Foundation Treasury are not eligible for rewards. It all goes to real users, contributing to fast and flexible USD1 liquidity markets…

– WLFI (@worldlibertyfi) January 12, 2026

The timing of the launch coincides with growing institutional and regulatory engagement around stablecoins.

Earlier this month, World Liberty Financial confirmed that its lending entity had filed an application for a U.S. national banking license with the Office of the Comptroller of the Currency.

USD1 has gained popularity due to its remarkable market activity. In December, Binance launched a limited-time “USD1 Boost” program, offering enhanced returns of up to 20% per year on this stablecoin through its “Simple Earn” product. This promotion coincided with a sharp increase in the market cap of $1 and followed Binance’s decision to expand fee-free $1 trading pairs and replace BUSD with $1 as the underlying security asset on the exchange.

Binance has placed USD1 as an integral part of its collateral framework, further integrating the coin into the core trading infrastructure.

The broader credit market has continued to evolve alongside these developments.

Although centralized lenders still account for a significant portion of outstanding loans, data from Galaxy Research shows that blockchain-based platforms are now dominating the new growth.

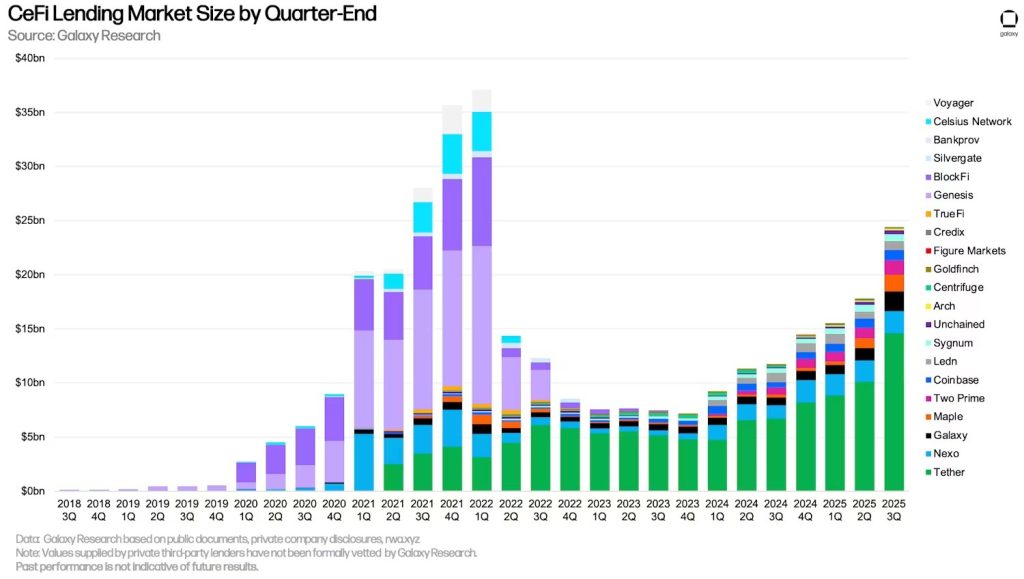

Lending in the core financial space reached $24.37 billion at the end of September, with Tether accounting for nearly 60% of the tracked market, but the remaining lenders in the CeFi sector have moved to fully collateralized and public reporting models.