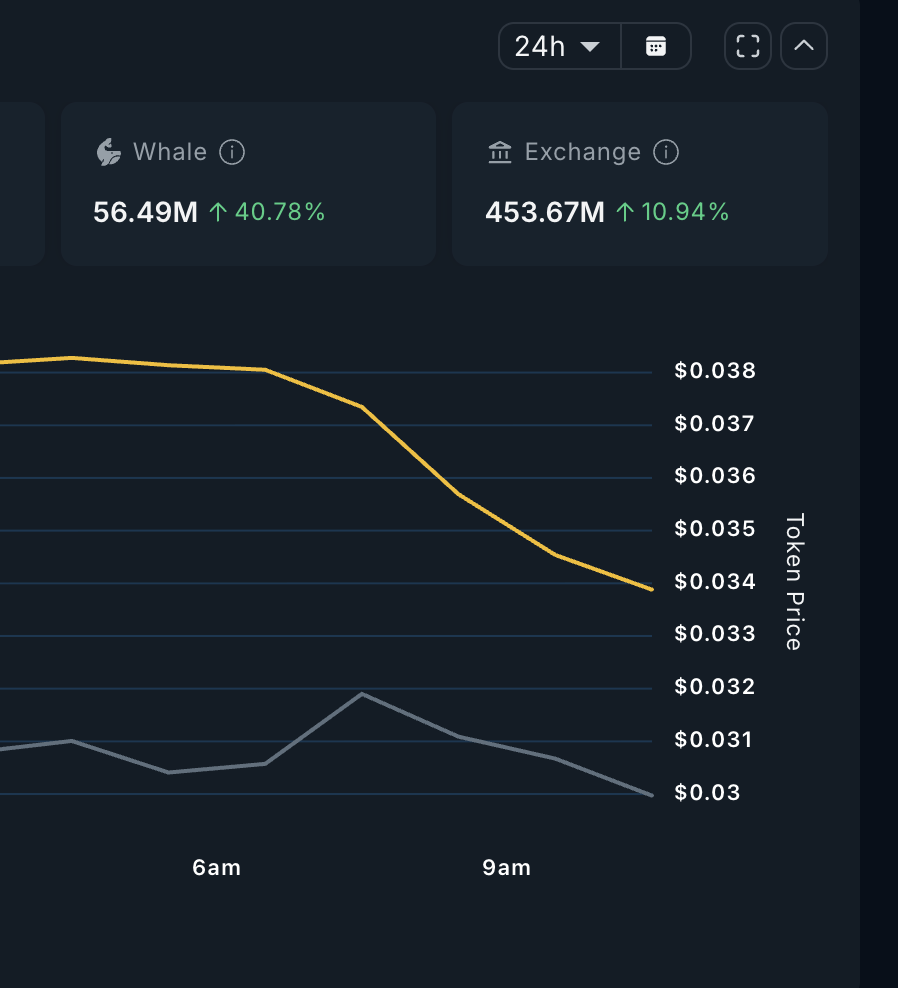

The price of the researcher has entered a phase of decline. After achieving a strong 200% post-launch rally earlier this week, SKR is now down almost 25% in the last 24 hours. This change becomes all the more important as the buyers behind the movement have changed.

In our previous analysis, we showed how smart money absorbed the airdrop sale and helped stabilize the price. This configuration is no longer intact. The smart money has started to reduce its exposure, FX balances are increasing and yet the whales are quietly being added. The result is a market pulled in opposite directions, with a 5% cliff now in sight.

Critical Outage Triggered Smart Money Release

The first crack appeared on January 24.

On the hourly chart, Seeker price has lost its volume-weighted average price (VWAP) line. VWAP represents the average price paid by traders, weighted by volume.

When price holds above, buyers are in control. When it breaks, it often signals distribution rather than healthy consolidation.

Researcher loses VWAP: TradingView

Want more token information like this? Sign up for publisher Harsh Notariya’s daily crypto newsletter here.

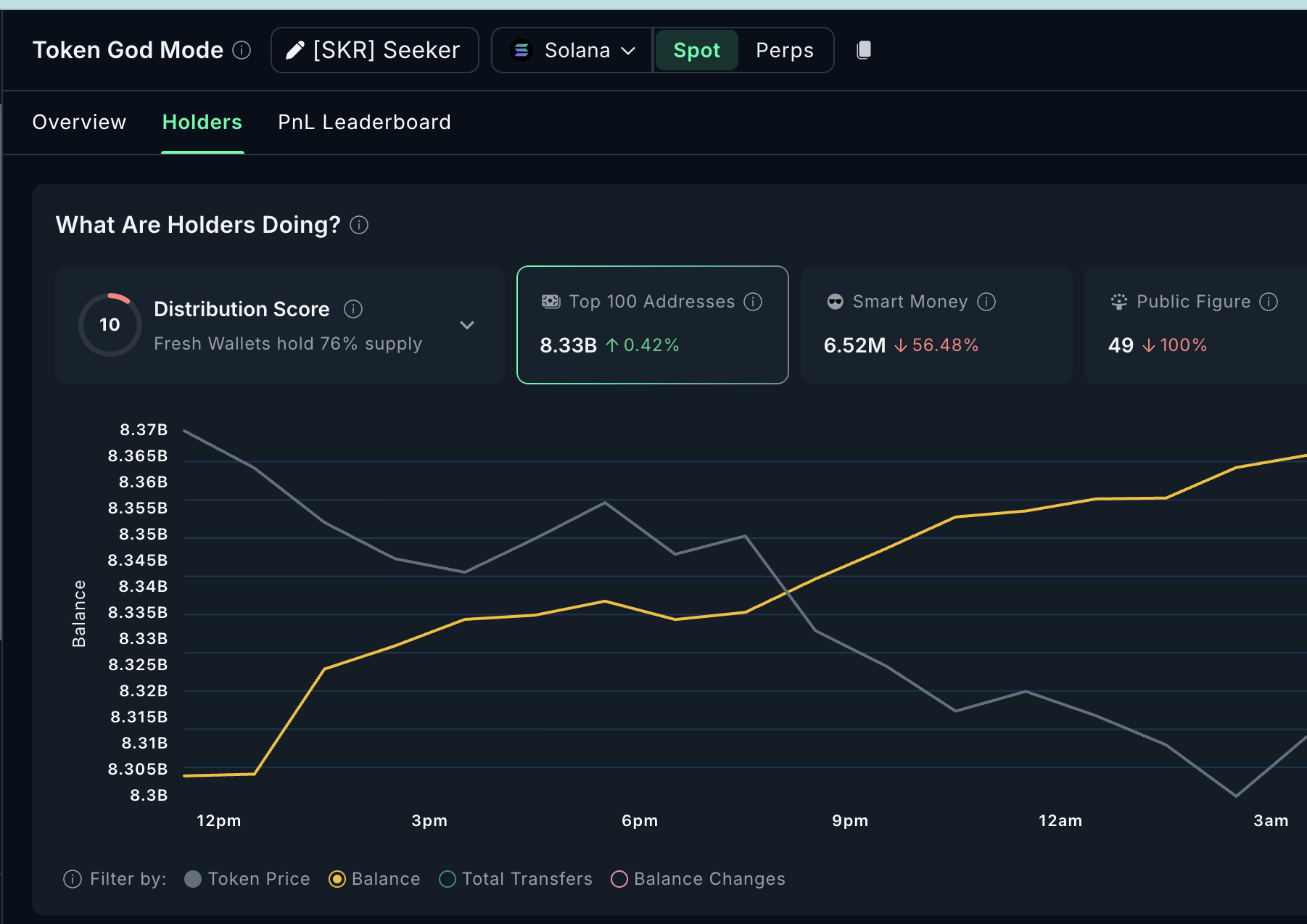

This distribution closely matches smart money behavior.

Over the past 24 hours, smart money wallets have reduced their SKR assets of 56.48%. Based on on-chain data, this cohort reduced by approximately 8.5 million SKR of their positions in a single day. It wasn’t a slow cut. This is a decisive exit following the loss of short-term structure.

Smart money reduces supply: Nansen

This is important because smart money tends to act first. When they pull back after a VWAP loss, it generally indicates that short-term upside no longer offers a favorable risk-reward ratio.

This explains why Seeker’s rebound attempts have been muted, even as the price attempts to stabilize. But selling silver smartly is only part of the equation.

Whales Buy the Dip as Divergence Signals Accumulation

While the informed traders were moving out, the whales were moving in the opposite direction.

From January 23 to 24, Seeker price continued to decline, but the Money Flow Index (MFI) increased during the same period. The MFI tracks buying and selling pressure using both price and volume. When prices fall while MFI rises, it signals accumulation below the surface.

Dip Buyers: TradingView

This divergence helps explain whale behavior.

Over the past 24 hours, whale stocks increased by 40.78%, bringing their total balance to 56.49 million. SKR. That means the whales added about 16.3 million SKR During withdrawal.

Unlike smart money, whales do not trade short-term structures. They are positioned in weakness, which corresponds perfectly to the downward purchases of MFIs.

Research whales: Nansen

This creates a clear contrast in intention. The smart money disappeared after the VWAP failed. Whales stepped in as momentum cooled and dip buy signals emerged.

However, whale accumulation does not automatically translate into price strength. Whales can absorb supply, but they can’t stop the decline if sales pressure elsewhere continues to grow. This sheds light on exchange behavior.

FX Flows Keep Research Price Breakdown Risk Alive

Despite whale purchases, supply pressure remains high.

Foreign exchange balances rose sharply over the past 24 hours, increasing by 10.94% to 453.67 million. SKR. This represents approximately 44.8 million SKR moved to exchanges during this period. Smart money outflows contributed to this flow, and retail profit-taking likely added to the pressure as well.

This change in supply is clearly evident in the volume data.

On the four-hour chart, on-sale volume (OBV) trended downward even though the price remained high between January 21 and 24. OBV tracks if volume confirms price movements. When prices hold up, but OBV falls, it indicates that rallies are driven by reduced demand rather than strong accumulation.

This is why the purchase of whales has not yet translated into bottom-up tracking. Especially since, as exchange flows increase, they easily outweigh their accumulation figures.

Technical risk is now clearly defined. On a four-hour closing basis, $0.028 is the key level, representing a 5% move from the current level at press time. A sharp close below, accompanied by a break of the OBV trendline, would signal that selling pressure dominates the accumulation, opening downside risk towards $0.0120.

Researcher Price Analysis: TradingView

On the positive side, Seeker needs to reclaim $0.043 to restore confidence. Beyond that, $0.053 remains the most important resistance zone, where previous supply was concentrated. Without a change in volume behavior, these levels remain difficult to achieve.

The structure tells a simple story. The smart money has been put aside. The whales are piling up. The exchanges are filling up. As long as this imbalance persists, Seeker price remains vulnerable.