Circle Internet Group has unveiled an ambitious roadmap for 2026 centered around Arc, a layer-one blockchain technology designed to serve as “ Economical operating system “Global Finance.

The company aims to move Arc from testnet to production while scaling its Circle Payments Network and StableFX applications to capture institutional market share in stablecoin-backed settlement.

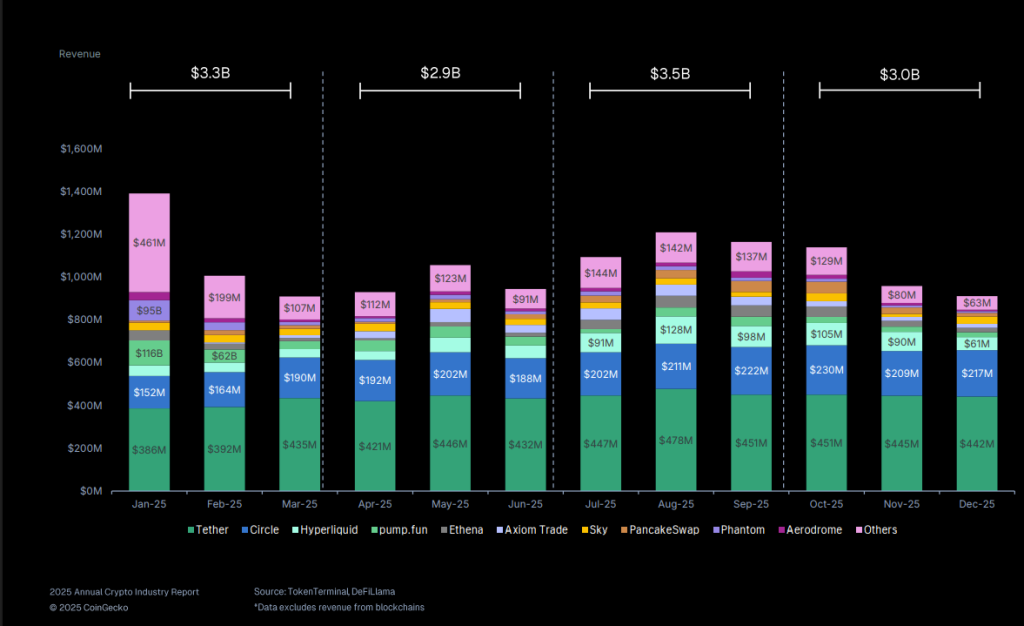

The strategy comes as Circle faces growing competition from Tether, which generated $5.2 billion in revenue through 2025 and now controls 60.1% of the $311 billion stablecoin market via USDT.

Circle’s USDC token has a market share of 24.2% with a trade value of $72.4 billion, significantly lagging behind despite growing 108% year-over-year.

We are moving towards an Internet financial system through Arc, USDC, Circle Payments Network and our interoperability services that connect them.

The goal is simple: to make money movements and value exchanges efficient, programmable and accessible worldwide. Read our product…– Nikhil Chandhok (@chandhok) January 29, 2026

Arc testnet processes 150 million transactions

Arc’s public testnet has processed more than 150 million transactions since its launch in October 2025, with nearly 1.5 million transaction wallets with an average settlement time of approximately 0.5 seconds, according to Circle’s latest product update.

The network attracted more than 100 institutional participants, including BlackRock, Goldman Sachs, BNY Mellon, Société Générale and Visa in its first 90 days.

Nikhil Chandok, chief product and technology officer at Circle, said the company is working to be production ready through “ Develop the pool of listeners towards wider distribution “And” Establish a governance model that aligns with business expectations for risk and compliance “.

The network uses USDC as its primary gas token and offers deterministic sub-second finality designed specifically for regulated financial transactions.

The company has integrated Arc into its cross-chain data transfer protocol, which now connects 19 blockchains and has processed a cumulative volume of $126 billion as of December 2025.

Circle introduced Gateway, a supply chain-agnostic system that unifies USDC balances across networks, and launched Build, a suite of AI development tools alongside App Kits, to accelerate application development.

Tether dominance and Fed payment pressure put Circle in the market

Circle’s institutional attack is evolving as Tether expands beyond stablecoins into traditional finance, recently raising 140 tons of gold worth $23 billion and launching USAT, a federally regulated stablecoin under the new U.S. GENIUS Act framework.

Tether CEO Paolo Ardoino told Bloomberg that the company “ It will soon become one of the largest gold depositories in the world, e.g. While you buy more than a ton per week.

Tether became the most profitable cryptocurrency entity in 2025, accounting for 41.9% of all stablecoin-related revenues and maintaining its position as the world’s third-largest digital asset with a market capitalization of $186.8 billion.

The company holds more U.S. Treasuries than Germany, South Korea or Australia, strengthening its role as a player in the macroeconomy.

Meanwhile, Circle’s payments network has signed up 29 financial institutions since its launch in May 2025, of which 55 are under review for eligibility and 500 more are in the pipeline.

The network operates in eight countries and has reached $3.4 billion in annual trading volumes, through partnerships with Binance, Corpay, FIS, Fiserv and OKX.

Leading Financial Institutions Signal Shift in Transaction Settlement via Blockchain Technology

BlackRock is preparing to expand its cryptocurrency business, announcing digital asset jobs in New York, London and Singapore, while offering salaries of up to $350,000 per year for managing director positions.

The asset manager accepted the BUIDL token fund as collateral on Binance and identified Bitcoin exposure as a key part of portfolio construction for 2025.

Visa also announced in December 2025 that it would enable U.S. financial institutions to settle transactions using USDC on the Solana platform, providing “seven-day availability and increased flexibility.” During weekends and public holidays “.

The first participants, Cross River Bank and Lead Bank, have already started settling their Visa transactions in US dollars, with a plan to extend the US expansion until 2026.

” Financial institutions prepare to use stablecoins in their treasury operations said Rubel Berwadker, global head of growth products and strategic partnerships at Visa.

The payments giant serves as a design partner for Arc and plans to operate a verification node once the blockchain launches.

Visa Inc. is set to allow stablecoin-based settlement on its U.S. payments network, expanding its range of crypto-related services.$USDC #Visa https://t.co/i6vVCqWAiH

– Cryptonews.com (@cryptonews) December 16, 2025

Circle’s partnership strategy extends to Asia, where the company signed a memorandum of understanding with Lian Lian Global in December 2025 to explore stablecoin-backed payments infrastructure for international merchants.

This collaboration will evaluate how USDC can Support faster, more flexible transactions, especially in high-volume international payment flows “, according to the announcement.

The company’s tokenized money market fund, USYC, has grown more than 200% since June 2025 to approximately $1.6 billion in assets as of January 2026, while StableFX launched on the Arc testnet to enable 24/7 stablecoin institutional forex trading.

Circle reported net profit of $214 million for the third quarter of 2025, as USDC trading reached $73.7 billion.

Chandok emphasized that Arc and the broader platform aim to “ Moves value with the same openness, reliability, determinism and speed as information “, which puts Circle in a position to compete as stablecoins become ” The connective tissue of the global digital economy “.

Post Circle Targets Banks Via New Institutional Blockchain – Will It Succeed? appeared first on Cryptonews Arabic.