Etyhirom is currently negotiated at $ 1,831.1, in the middle of its cohesion without a major technical barrier represented by the resistance range of $ 1871, which was previously prevented without the continuation of the Ethereum-Eth price 3 times, forming a “high-high-high triple” diagram which can be considered a psychological obstacle now for buyers.

Despite the presence of this barrier, the ETH prices movements are always supported by the noisy steering line and the average of 50 hours of movement if (EMA-50), which is currently stable at around $ 1821, generally provides the convergence of the management line and the average of the movement if is an area decides to acquire the upward dynamics, targeting $ 1,910 and perhaps $ 1,950.

- Entrance point: Pirate the $ 1,871 barrier and the closure above.

- The goal: $ 1,910 followed by $ 1,950.

- Stop losses: Breaking the level of $ 1821.

As for new traders, it is preferable to wait for a decisive increase in the increase, because price movements in such a narrow range lead to serious fluctuations.

The indicators of the US economy decrease in an increase in imports

While the Ethereum price continues to maintain its location, the US economy indicators indicate possible future problems, the US trade ministry reported a drop in GDP (GDP) for the first quarter of 2025 on an annual basis at an accelerating rate of purchasing pace to avoid customs tasks caused by the trade war announced by President Trump.

Rumpe: American GDP growth slows down at -0.3%, marking the first negative growth well Q1 2022

Welcome to the discovery scene. pic.twitter.com/5mleo9q2q– Maine (@Themainewonk) April 30, 2025

It should be noted that the value of imports is deducted from GDP accounts (GDP), so the data can indicate twice slightly exaggerated, but this is the first quarterly decline since the beginning of 2022.

For its part, the markets of Wall Street expected an expansion of 0.4%, but the repercussions of the trade war pushed many economists to reduce their expectations just before the issue of data, and it is likely that this data will be held to the mission of the Federal Reserve; Poor growth can justify the reduction in interest rates, but the continuous dazzling is always a strong obstacle, which can lead the federal reserve managers to balance recession indicators and maintain prices stability.

The labor market shows strength, at least so far

Despite the drop in GDP, the American labor market is still solid. The Ministry of Labor (the Labor Department) said that 177,000 new jobs were available in April, bypassing expectations. The unemployment rate is currently 4.2%, while the average wages of work per hour increased from $ 0.06 to $ 36.06, an increase of 3.8% compared to last year.

#NFP Overview LS | After non -Fram expects 135k; Unemployment rate at 4.2%

What the main economists plan from the 1:30 p.m. job report on Friday: pic.twitter.com/yieririnsf– Livesquawk (@livesquawk) May 2, 2025

On the other hand, other data can draw a mixed image, because charming, gray and Christmas have reported a reduction in employment from April 105,000 in April; A questionnaire conducted by ADP for private jobs has only shown 62,000 jobs, which is its lowest reading since July 2024, which called on experts to warn that the increase in the gap between the growth of the main jobs and the future trends in the profitability of companies suggests a potential slowdown in employment rates.

With uncertainty about commercial policies and the increase in companies’ caution, customers on the markets are currently heading for digital assets such as Ethereum-Eth in order to turn; While central policies bend, decentralized assets draw the attention of investors looking for alternatives to maintain value.

Final opinions

The movements of Ethereum prices and the dynamics of the total economy go through a decisive crossroads; Like the growth of the American economy and the capacity of traditional markets stumbled in the absorption of commercial transformations and employment, digital assets such as ETH seem like a convincing bet for many.

If the Ethereum price can exceed the barrier of $ 1,871, it will be a change in the general mood of investors to digital currencies in the middle of a continuous lack of confidence in traditional financial markets.

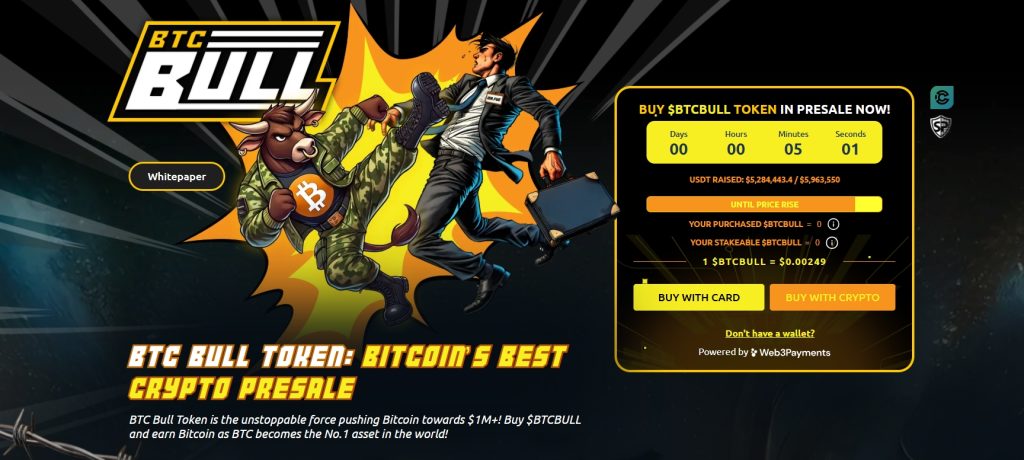

The income of the 78% flexible mortgage draws the attention of investors and makes the BTC bull is a sign of $ 5.3 million

BTC Bull (BTCBLL) continues to draw the attention of many after its result exceeded $ 5.3 million, approaching its objective of $ 5.96 million. With the low price of $ 0.00249, BTCBull turned to become more than a simple MIM, due to its various practical uses thanks to a flexible mortgage mechanism which offers the possibility of obtaining exciting yields.

Economic data derived from employment uses designed to increase demand

Unlike the traditional currencies of M., BTCBull managed to mix the attractiveness of the culture of MG currencies with concrete mortgage yields; It allows its investors to be currently subject to their assets purchased and to benefit from an annual return (APY) of 78%, while maintaining the possibility of deciphering it whenever they wish without any deduction or period of entry, to attract a flexible mortgage mechanism The interest of many investors who wish to obtain a return without sacrificing the possibility of repeating the accessions.

Current subscription data

- USDT’s subscription product: $ 5,313,693 out of $ 5,963,550.

- The current price: $ 0.00295 per BTCBull.

- Total mortgage complex: 1 342 549 903 BTCBLL Coin.

- The estimated return: 78% per year.

As it remains at less than $ 650,000 before the start of its next phase, the subscription is close to the approach of its end, allowing those looking for a currency that offers high yields and unprecedented mortgage flexibility for a narrow moment to participate, because BTCBUL continues to be ready to be a solid competitor during the exciting Cripto cycle of 2025.

Follow us via Google News

The Post Ethereum price is about $ 1,800 in the midst of uncertainty over the American economy and the continuous intelligent investors of Paris on digital assets appeared first on Arab Cryptonews.