Solana-Sol’s play continued its incredible launch, currently regulating at $ 176.51 after reassembling its highest level recorded in the last two months at $ 178.33, recording 47% compared to its value last month and 20% compared to its level a week ago; The strong launch of Solana was motivated by successive artistic breakthroughs, the increase in decentralized financing activities (DEFI) and has improved the general mood of the market.

The domination of the DEFI sector and the increase in blockchain investments are the launch of Solana Momentum

The growing impact of Solana in the decentralized financing sector is one of the most important factors that has caused its latest launch, according to the Defilma platform, the decentralized negotiation volumes in Solana in the last 24 hours have reached $ 3.32 billion, which represents approximately 29% of total speed, which makes decentralized exchanges.

Solana low -Ke eating the earth a bridge at a time.

In the past 30 days, $ 165 million in liquidity have been combined in Sona. Ethled with $ 80.4 million in transfers, followed by ARP with $ 44 million, by Debridge Beow. Base, BNB and Sonic chain of 20 million, $ 8 million and $ 6 … pic.twitter.com/nvnd0relio– Pixelrainbow (33.3%) (@pixelrainbownf) May 10, 2025

Last month, Solana also attracted investments on the blockchain worth more than $ 165 million, the majority of which came from Ethereum of $ 80.4 million, and the arbitrum and the base (BNB) and Bas (BNB) (BNB) (BNB) ((BNB)) and Sonique (Sonic (Sonic for investments Balcochene ball, confidence in the Balcochene Soelana, the Balcochen and the transaction procedure on the blockchain.

Main DEFI indicators:

- Huge investments have been received at the Solana Bluena de Etheerium and Erbetrom.

- Record trading volumes of $ 3.32 billion on Solana in the last 24 hours (to take advantage of a marketing share of 29%).

- Investments of $ 165 million in other blockchain systems in Solana.

The resolution of technical breakthroughs indicates that the possibility that the price of the soil continued to increase

The expectations of Solana prices are still very promising, in particular after the success of soil price movements by penetrating the average index of 200 days of the EMA (EMA-200) and the Fibonacci extension from 1.618 to 167.39 $ recently in confirmation of the reflection of the pricing path; The movements of soil prices have also formed the artistic model “to three white soldiers” in an indication of the continuity of purchase pressures and the possibility that the price continued to increase.

Currently, the nearest level of resistance is placed at $ 178.33, followed by $ 183.95, followed by $ 189.60 with a vague height continuous to grow, but the MacD index has shown signs of early deviation, which suggests a slowdown in the momentum. Thus, traders should look at a price correction to the level of support of $ 167.39 near the EMA-50 index at $ 165.66.

The technical levels to be monitored:

- The nearest support: $ 167.39, followed by $ 164.01, then $ 157.15

- The nearest resistance: $ 178.33

- Next barriers: $ 183.95, then $ 189.60

$ Soil Perspectives: It looks like we have recovered the Daily 200 EMA with conviction. Looking for a fund pic.twitter.com/jlib5qwes

– Javifx (@real_javifx) May 11, 2025

Decisive penetration and price cohesion can open the level of $ 178.33 to continue the increase in weeks and months to come, and perhaps the repetition of their strong starting waves.

The macroeconomic factors of the claw help to improve the general mood with a decrease in the severity of trade tensions

The positive general atmosphere of the market supports the way to the rise of Solana, the recent declarations of President Trump on the progression of commercial talks between the United States and China has reduced global fears, which has strengthened the risk of risk through various assets, and also improved the general mood to push the total market value worldwide to 3.33,000 billion dollars, favorable atmosphere of high assets like a soil mount.

Basic points of macroeconomic factors:

- Improvement of risk appetite, alternative currencies will benefit.

- Trade tensions between the United States and China has recently calmed down.

- The total market value of the crapto assets amounted to 3.33 billions of dollars.

Family summary: Does Sol Price reach $ 200 soon?

The solid technical environments of Solana prices movements as well as the increase in DEFI activities and the overall economic atmosphere may be able to move the resolution price to $ 200 in the coming weeks, but traders should be careful not to correct imminent due to the indication of the MacD twice the momentum.

Although the success of the soil price by entering the barrier of $ 178.33 can lead to a brand of $ 200, the drop may indicate below $ 167.39 to a temporary correction.

Flexible mortgage income of 74% draws the attention of investors and means that the BTC bull is a sign of $ 5.58 million

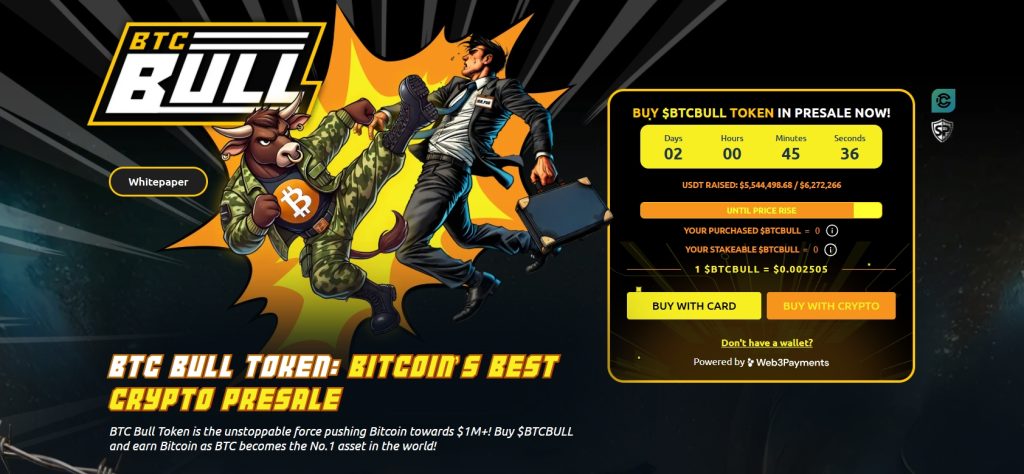

BTC Bull (BTCBLL) continues to gain momentum with its success by collecting $ 5.58 million and its approach to reach the target result for the current stage of $ 6.27 million, and despite its low prices of $ 0.00,2505, BTCBLL has proven to be more than another MIM, it offers real advantages thanks to gravy yields for flexible image.

Economic data derived from practical uses are designed to light the demand

Unlike traditional miles, BTCBull is characterized by the combination of the severity of the chipto cultivation with remunerative mortgage yields, because it allows its investors to obtain an annual mortgage (APY) with 47% with the possibility of a mortgage in the event of a need for without fine of early drawing or adherence to specific reservation periods; To receive these unique mechanisms by the approval of investors who seek to gain a stable return without sacrificing the freedom to reach their assets, in particular in the atmosphere of the very volatile Crepeau markets.

Last subscription developments:

- The current result: $ 5,581,603.93 on $ 6,272,266

- The price of the current subscription: $ 0.002505

- Total mortgage complex: 1 342 549 903 BTCBLL

- The estimated return: 74% per year

As less than $ 650,000 remains to collect and start the next subscription phase, the time has started to run out quickly, so that budding investors must obtain the highest possible gains without sacrificing the freedom to act in their accelerated investments to participate in the BTCBLL subscription, which quickly became an ideal option in the exciting cycle of 2025.

Follow us via Google News

The expectations of Post-Solana prices: the next $ 200 floor price after success to reach the highest level recorded in two months? APPLERDIRST on Arab Cryptonews.