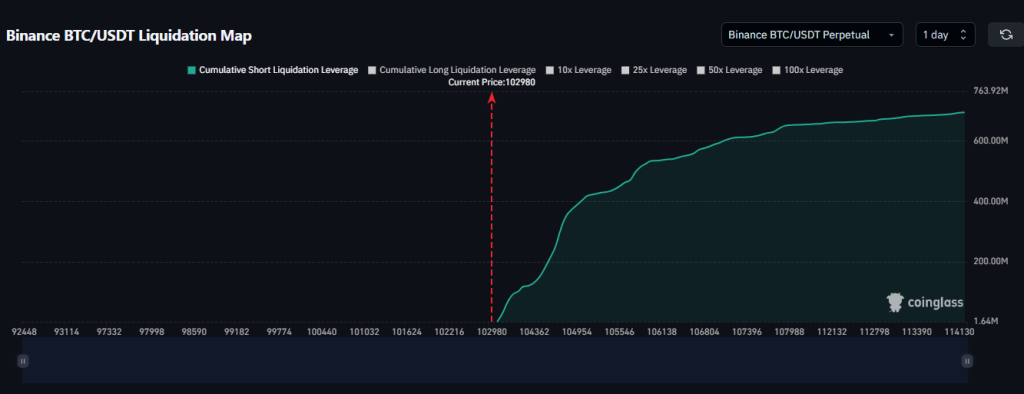

Bitcoin-BTC witnessed a wave of other fluctuations on Tuesday morning, because the price briefly decreased in terms of $ 102,980, before settling again, and this decrease caused an increase in forced liquidation operations. Weeks of the past few weeks.

This movement highlights that traders who use a high financial lever on their positions – whether speculative at a low price or its height is a great danger and that the sensitive Crapto scene of macroeconomic factors has been extended.

It should be noted that 73% of these liquidation operations came to speculative centers at a high price, stressing the fragility of these centers in the midst of quick price reductions. It is reported that the largest individual liquidation process came to the BTC / USD contract with a value of more than $ 11 million on the Bybit platform.

The American consumer price index (ICC) is lower than forecasts and supports the prudence of the federal reserve, while Bitcoin responds quietly

The emission of American consumer index (IPC) for the month of April has increased uncertainty on the market.

RUP:

* US CPI 0.2% m / m, exp. 0.3%

* US CPI Core 0.2% m / m, exp. 0.3%

* US CPI 2.3% y / y, exp. 2.4%,

* US CPI Core 2.8% in y / y, exp. 2.8%pic.twitter.com/iqh5v6utqk

– Investing.com (@investtingcom) May 13, 2025

On the other hand, these data have contributed to reducing certain fears of inflation, supporting the expectations of the federal reserve to increase interest rates.

Although inflation data is less than expected, the price of Bitcoin has not increased directly, which indicates that the broader market is still in cautious state, and it seems that investors balance the drop in inflation pressure on the one hand, geopolitical risks and the risk of opening centers with high financial raids on the other hand markets.

The Bitcoin price is higher in terms of support at $ 102,750 with bulls aimed at re-tester $ 105,000

The expectations of bitcoin prices seem positive, as they currently circulate at $ 102,951 after having re-test the level of resistance to $ 103,382 for a short period and the level of correction of Fibonacci 23.6% at $ 105,716 that Bitcoin reached in its last increase at the last price.

The price remains supported by the average scalp an average satellite index in a 50 -day range (50 EMA) at $ 102,757, which is largely approaching the level of support at $ 101,951, which is made up of the level of the level of correction of Fibonacci 38.2% and the line of ascending trend.

This meeting between technical indicators indicates that the upward trend is always its full strength.

For its part, the MacD index began to take a path up, indicating a weakness of the descending momentum. Consequently, the higher price height at the level of $ 10,382 and the above stability will confirm the upward trend of around $ 105,716.

On the other hand, a break of $ 10,950 and the decrease below will result in exposure to the risk of decrease in $ 100,722 and perhaps up to $ 99,600.

Suggested trading strategy:

- Purchase area: $ 102,750 to $ 103,000 (that is to say on the steering line and the medium movement measured in 50 days)

- The first objective: $ 105,000

- The second goal: $ 107,000

- Loss of stop: Without $ 101,900

New traders should wait for an emerging candle over $ 103,382 or MacD High. In order to confirm the upward trend, and as long as the Bitcoin price stabilizes on the management line, the momentum will remain in the interest of the Bulls (high prices speculators).

The result of BTC Bull is more than $ 5.7 million thanks to flexible mortgage income attractive of 72%

BTC Bull (BTCBLL) continues to draw the attention of many after its result exceeded $ 5.7 million, approaching the funding target of the current stage of $ 6.69 million. With the low price of $ 0.00251, BTCBLLL has turned to become more than another MIM, due to its various practical uses thanks to a flexible mortgage mechanism which offers the possibility of obtaining exciting yields.

The flexible mortgage model attracts investors wishing to obtain large returns

The BTCBUL mortgage program is designed to attract those who wish to obtain high yields without compromising liquidity. The program currently provides 72% to investors (APY) without any restrictions on booking periods or fines for the decoding of currencies, making it an excellent option on this volatile market, because this flexibility allows investors to make decisions and to move quickly according to market transformations without reservation of currencies for long periods.

Current subscription data:

- The result of the subscription: 5,713,835.67 $ on 6,690,863 $

- The current price:$ 0.00251

- Total mortgage complex: 1,452 1330 885 BTCBLL currencies

- The estimated return: 72% per year

In conclusion, BTCBull is distinguished from other MG currencies by providing functional uses via its flexible mortgage platform, and this approach has attracted investors who seek to obtain yields, in particular with the emerging market cycle that approaches 2025.

It is reported that the subscription is progressing rapidly, because it remains less than a million dollars on the next price increase. Thus, those who are interested must join it quickly.

Follow us via Google News

The expectations of the Bitcoin prices of the position: Bitcoin filtering of more than $ 730 million after a drop in price is less than $ 102,000, are you watching a wave of drops? APPLERDIRST on Arab Cryptonews.