Bitcoin-BTC dominated one of the most serious strikes on the Crapto market after liquidating more than a billion dollars in financial cranes, while the BTC is now negotiated at $ 104,957, with a slight decrease of 0.17% yesterday, while merchants re-evaluate their bait for the risk.

According to the Correglass website, more than 247,000 transactions were liquidated within 24 hours, and the most important of these qualifications included speculative offers at a price of 200 million dollars on the Binance platform, which is considered the largest liquidation event for this year. In this case, the platforms of binance and appeal came as the most affected, they won $ 834 million from the centers that were liquidated.

Update: more than a billion dollars have been liquidated in the last 24 hours, with $ 943.31 million in long positions. pic.twitter.com/vlxe4f3km

– Cointelegraph (@cointelegraph) June 13, 2025

Consequently, speculation was at the high price of the vast majority of these qualifications after excessive traders in the use of the financial lever effect according to the momentum supported by the IPO (IPO) of a circle and a renewed interest in the protocols of decentral financing (DEFI) in the United States.

It works Forced qualifications As automated margins and when traders do not meet the guarantee requirements, platforms have concluded these transactions to protect their system. But during periods of acute volatility, the pace of implementation of these measures is often accelerated, resulting in a rapid decrease in intense prices and sales waves on the market as a whole.

Bitcoin domination increases with the deterioration of alternative currencies

In the midst of this event, alternative currencies have undergone heavy losses, which supported the expectations of the Bitcoin price of a height of more than $ 104,000, because it seems that intensive sales waves can push investors to use Bitcoin because they represent a relatively safe refuge.

This has increased the domination of Bitcoin – an indicator that measures the share of the BTC currency of total market value of the CRIPTO market – strongly indicating that traders flee from dangerous assets to the sector leader.

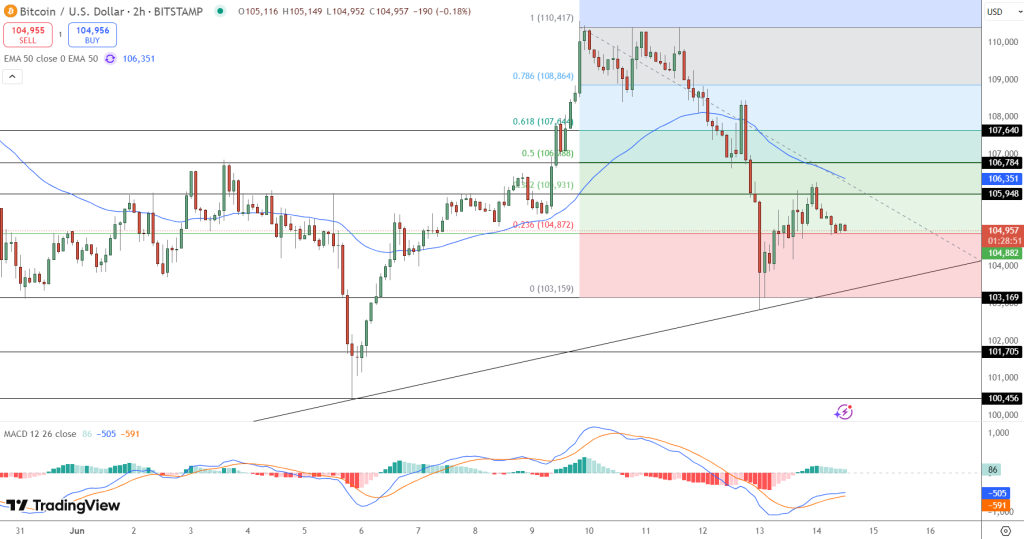

At the technical level, Bitcoin is negotiated above the Fibonacci correction level 0.236 to $ 104,872 and supports its position on the rise in trends in its price movement since early June.

On the other hand, the MacD index remained constant, in an early indication of the drop in the descending momentum. And if the bulls (high price speculators) can restore the movement index so average for 50 days (50 functions) almost $ 106,351 and exceed the level of fibonacci 0.5 to 106,788 $, the possibility of moving the price will remain at the level of $ 108,864 fully list.

In general, this scheme suggests the possibility of mounting the stockings, especially if the relative stability continues for the price of bitcoin, while the formation of small trading candles indicates the lack of certainty and assembly, a usual behavior near the bottom of the correction lessons.

Short -term prices: Bitcoin targeting is $ 108,000 if its upward dynamics continue

Despite market fluctuations, the BTC graphic graphic has remained positively in terms of technically, because the price movement indicates the highest level of $ 106,350 to short -term penetration, which confirms the opposite price of its current management, and the BTC can push $ 107,640, followed by $ 10,8864.

Ideas for merchants:

- Entrance point: The highest level of $ 10,350 with good trading sizes

- Loss of stop: Less than $ 104,000

- Targeted levels: $ 107,640 (initial level), then $ 10,864 (extended)

Given the deterioration of the performance of the main alternative currencies and the risk of the risk, the cohesion of Bitcoin can attract prudent investors. Unless the price is less than $ 103,169, its ascending direction will remain, in particular in the light of the current environment, because Bitcoin is not only a digital currency, but rather a safe refuge.

BTCBLL’s subscription is an approaching $ 8.1 million and a 58% mortgage turnover attracts late investors

The BTC negotiating nearly $ 105,000, the attention of investors began to turn to alternative currencies, in particular the BTC Bull project (BTCBLL), which has hitherto collected 7,152,878.88 of its objective of $ 8,216. Consequently, there are less than a million dollars before the next price increase, knowing that the BTCBLL is currently offered at $ 0.002,565, and its price should increase as soon as the project reaches its next objective.

The value of the BTC bull is closely linked to the performance of the Bitcoin part through two main mechanisms, namely:

- A bonus of its owners with free sales of Bitcoin, where priority comes to participants in the subscription.

- BTCBull currencies are burned automatically each time the BTC price increases by $ 50,000, which reduces the circulating offer of the first currency.

The project also provides an annual mortgage (APY) of 61%, while its mortgage maintains more than 1.73 billion currencies, and providing the following:

- There is no seizure or costs

- Liquidity availability

- Provide income without problem even during periods of fluctuation on the market

This mortgage model attracts both experienced and novice investors in the decentralized financing sector (DEFI) seeking to reach a quick and easy income. With a few remaining hours and approaching the maximum financing objective, the rhythm of accumulation of the positive impetus of the BTCBull which combines the binding of its value with the BTC currency with mechanisms which guarantee the rarity of the supply and the flexible mortgage, which can increase demand. Therefore, people interested in the project should move quickly before the next price increase.

Expectations of the price of bitcoin with their growing domination after liquidations of $ 1 billion; Will BTC consider the only refuge? APPLERDIRST on Arab Cryptonews.