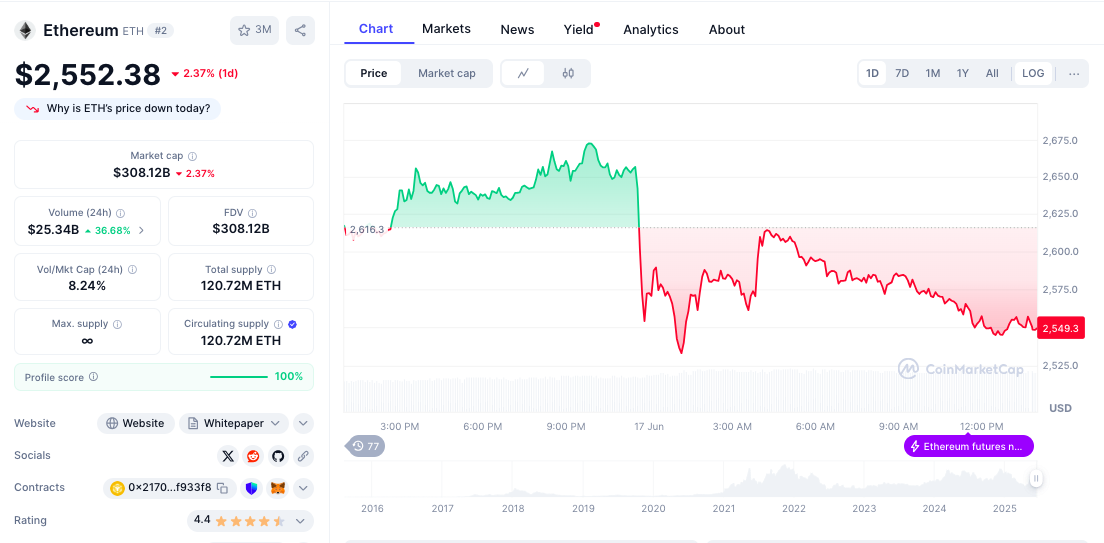

The price of Ethereum-Eth decreased today by $ 3% to $ 2,555, laboratory, so its relative stability extending for months, which varied between $ 2,400 and $ 2,800. The price has been limited to this range since its increase of 80% compared to its low level recorded in April, or $ 1,385.

Despite this decrease, the market value of Ethereum, amounting to $ 308 billion, and its daily negotiation volume of 25 billion dollars of amazing levels, which kept traders in a state of extreme anticipation of the next prices penetration.

Is the low piece of ethereum that extends in a period of 3 years to think about the upward trend?

The price of Ethereum is now testing its 50 -day average index (EMA) nearly $ 2,333, which helped the price wave in 2020, and was followed by a price leap to reach the level of $ 4891 in 2021. If the price of ETH currency is at this level, analysts expect the level of $ 3,000 and can be obtained. Mint is a greater gain.

For its part, the blockchain financial statements have supported these expectations, because Cryptonews said that the governor – which contains between 1,000 and 10,000 ETH – bought more than 800,000 ETH per day last week. On June 12, this governor bought 871,000 ETH.

Consequently, these large investors now have a total of 14.3 million ETH currencies with these intense purchases show their growing confidence in Ethereum currency and their conviction that its price can enter the main levels of resistance to predictable duration.

For almost a week, which the acquired was exasperated 800K #EthPushing the assets in wallets from 1K -10K to> 14.3 m #Eth. Only June 12, #Ethereum Where added more than 871K $ ETh – The highest daily net influx YTD.

This purchase scale was not seen Sink 2017. pic.twitter.com/zcmj9hx6ft– Glassnode (@glassnode) June 17, 2025

Blackrock and Foundtety pump $ 21 million in Ethereum; Do you have $ 3,000, the next price station?

Institutional investors seem to participate actively in this assembly. According to Sosovalue data on June 16, investments received at ETF ETF ETF were only dollar $ 21.3 million with BlackRock and Fidelity in general. Thus, the total investment gains Ethereum – recorded since the start of this month – exceeds $ 800 million.

In the past, constant purchase pressures have preceded strong altitudes. For its part, the TEDPILLOWS (TEDPILOWS), an investment partner on OKX -PLATEFORM, underlined the formation of the price movement of the Ethereum currency on its graphic plan, a golden intersection, and its latest costs in May led to the price of the ETH of 35% in just three days, while the stronger height is expected.

$ ETh Golden Cross is approaching.

The last time it happens, ETH filled 35% in a few weeks.

Eth Big Pump arrives.pic.twitter.com/wevf9629zh

– Ted (@tedpillows) June 16, 2025

Despite its calm price movements now, Ethereum still plays the role of the dominant actor in the decentralized financing sector (DEFI). With more than 1,374 protocols on the Ethereum block, the network retains a total reserved value (TVL) estimated at around 65 billion dollars, bypassing the total reserved value of decentralized funding (DEFI) in all other combined blockchain networks.

Etheerium also exports the stable currency sector with a market value of more than $ 127 billion, ahead of Tron-Tron, which has a market value of $ 79 billion. Solana and Benanns Smart come in the following ranks by a large difference, each of which has around $ 10.5 billion.

However, Solana-Sol’s work has experienced a new climbing cycle, while the Eterium Coin is still stuck at its peak in 2021, and this difference in performance was supported by the negative public mood on the market on the low performance of the ETH piece significantly, and it needs a rapid dynamic to catch up with its counterparts.

The Ethereum golden crater can cause upward penetration to a level of $ 3,000

The current price of the Eterium currency revealed its transverse movement in the middle of the model of a parallel channel, and this period of lateral movements is extremely important, because it indicates that money can be created to penetrate an imminent. In addition, relative stability around the level of $ 2,541 during the formation of this rule may indicate the continuity of institutional investors and small currency.

If the price of ETH currency succeeds in hacking the upper limit of the parallel canal, supported by the stabilization of solid trading volumes linked to this scenario, the price objective will become $ 3,000, which is more able to check, which represents an increase of 18% compared to current levels and will make it clear technical meaning.

Ethereum prices penetration of the resistance level of $ 2,801 can pay around $ 4,500

The ETH price movement has shown a promising increase model near the level of support of $ 2,440, and if this model is confirmed, it can increase several climbing waves with the following price: $ 3,300, then the level of $ 3,800 followed by a level of $ 4,500, and this will be a possible increase in its current levels.

Before this increase in this increase, the price must first enter the main technical barrier at the level of resistance of $ 2,801, which will confirm this optimistic scenario decisively and can also be accelerated from the frequency of the purchasing dynamics.

The post Etherum-Etheum-Ethereum-Eterium Baleines buys 871,000 currencies, and the Blackrock and Fidelley investments indicate an imminent penetration of $ 3,000 apppet first on Arab cryptonews.