The Bitcoin-BTC price stabilized the highest level of $ 107,000 in the midst of traders attempted to absorb the indications of different macroeconomic indicators, where the latest reading of the personal consumption index of the basic PCE (Basic PCE) in the United States, the priority of 2.7% on the American federal scale of 2.6%. The same index increased on a monthly basis of 0.2%, while its main counterpart increased only by 0.1%, in an indication to go through obstinate inflation.

These data support prudence followed by the federal reserve on interest rates reduction, and the federal president – Jerome Powell – advised to be patient about future decisions, indicating that there is risk of inflation which include the probable customs definitions of the US President Trump. Nevertheless, Bitcoin maintained its strength and price coherent at the highest level of $ 106,000, in the middle of other high pressure risk assets.

However, the currency was not subject to a remarkable sale even after the issuance of negative inflation data, which prompted market players to wait for developments at the macroeconomic level or decisive technical penetration.

Metaplanet doubled his bet on BTC

The confidence of the Bitcoin currency institutions remains continues in the middle of the Double Japanese company (Metaplanet (Metaplanet) its bet on the head of the sector to become the axis of its strategic assets in store, because the company has collected $ 300 million by offering obligations that are not due to accelerating the rate of its plan based on the BTC Balance Balon the president’s share.

Recent disclosure reports indicate that the company bought 1,111 bitcoin during its last drop in prices, as part of its collection plan for 21,000 BTC currencies by 2026 and 210,000 by 2027, in a similar approach to its microstrate ((microstrategygyy its activities.

- Funding of $ 300 million has been collected to continue Bitcoin purchase activities.

- The company collected 1,1111 BTC currency during the back of the market.

- Objective: collect 21,000 BTC currencies by 2026 and 210,000 of them by 2027.

- Metdelmannit seeks to make Bitcoin the origin of his only store.

The strategy of this company can be the beginning of a new wave of institutional adoption, while acquiring its approach to the momentum of individual assets inside and outside Japan.

Technical analysis indicators: the wave of stability suggests an imminent launch

At the technical level, the price of the BTC / USD currency pair tackles decisive penetration one week after its relative stability, where Bitcoin is currently negotiated at $ 108,215 corresponding to the upper limit for its price channel formed in the range of 106,450 to $ 108,980.

BTC / USD approaches an escape after a week’s survey. The price is tested

Entrance: long above $ 109,000

Targets: $ 110,448 / $ 111,944

Stop: less than $ 106,450 pic.twitter.com/rx5k1qhqbc

– Arslan Ali (@Forex_erslan) June 29, 2025

An increase in Swallow Trading has also been formed at the resistance barrier, which paid the price of stability to the average average SISII 50 -day index (EMA 50) at $ 106,257, indicating the enjoyment of the launch of the force.

In addition, the positive reading of the MACD indicates that the momentum can be restored if the following height wave is accompanied by the increase in trading sizes, and the weighting of closing up to the level of $ 108,980 will pay the price to test the barrier of $ 110,448 and perhaps $ 11,944.

A trading agreement proposed against Bitcoin:

- Entrance: To speculate on the height with a decisive penetration of the barrier of $ 109,000

- Goals: $ 110,448 and $ 111,944

- Limit arrest losses: Less than $ 106,450

On the other hand, the failure of prices to penetrate the resistance barrier can allow the market to end up at $ 106,450 if buyers defend the medium support level of the management. Until a Percée Claire occurs, the price of the price of the Bitcoin mail price should not move in a direction in the foreseeable range, but its upward structure will remain very strong.

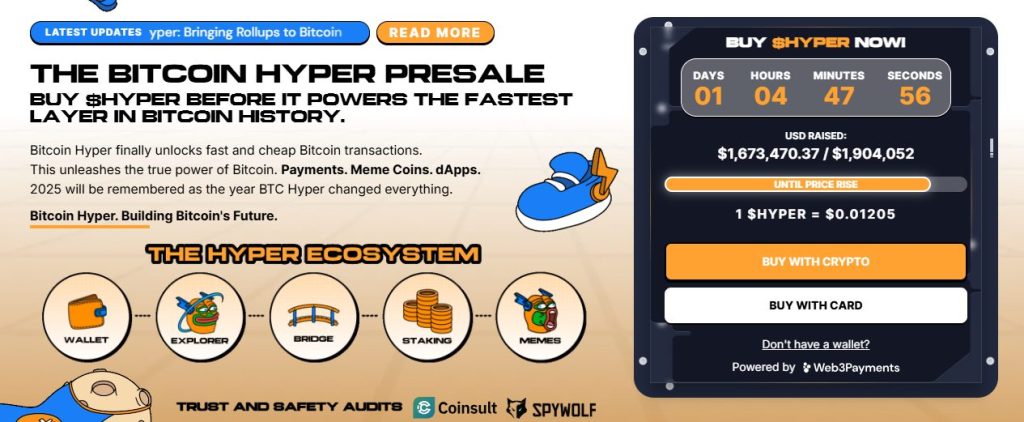

The result of the hyper-hender bitcoin is more than $ 1.77 million, the price increase

Bitcoin Hyper-Hyper Has Succeed-Provided for the First Bitcoin Bluex Expansion Solution from the Second Layer Operating On The Solanna Virtual Machine (SVM) -By Collecting Financing Of A Value Of More Than $ 1.77 million, and its Outcoma Recorded $ 1.779.917 Out of $ 1.974,249, and the Currency is Currently Being Followed at a price $ 0.012075, and is Scheduled to increase in a few hours by its new phase.

With its design to combine the safety of the Bitcoin blockchain, the speed of Solana Bluecine, allows functions of intelligent contracts, decentralized applications (DAPS) and the possibility of launching and circulating MC currencies at a high cost at low cost, with a smooth connection tool with BTC. Consequently, the intelligent project of the project was designed to guarantee the ability to develop, reliably and simplicity – has successfully undergone the consultation team.

Thanks to its insurance both for the attractiveness of MG currencies and practical uses, Bitcoin Hyper has become one of the most eminent competitors of second layer solutions for the year 2025, in particular after its acquisition of Strong Momentum following its unique mortgage mechanism, its fascinating under-conception and the full launch provided for its new solution during the first quarter of the next year.

The expectations of Bitcoin-Btc Bitcoin-BTC prices: the investor approach to keep its savings to pay the price of the BTC currency? APPLERDIRST on Arab Cryptonews.