The performance of the Ethereum part was strongly during the American negotiation session, as it was exchanged at a price of $ 2,457, by more than 1.27%, which complies with increasing expectations that the price can reach $ 10,000 during the current market cycle, while browsing a price channel that has passed for several years since 2017.

Regarding this, TED pillows highlighted the importance of long -term emerging currency, because the previous points of contact along the lower limit of this channel have triggered net price increases, with increases of 300 times in 2017 and 50 times in 2020. And although these enormous increases are less likely due to the market value of the Etherum (Ethereum) Dollars, bilosis, estimates that the price of the price of the price is still possible.

The analyst is long -term that Coul sends ETH to $ 10,000 #Crypto #Ethereum

– Coindoo.com (@coindoo) June 29, 2025

Technical resistance must first be overcome, because the price of Ethereum (Ethereum) failed twice to penetrate the level of $ 2,600 in June, because analysts such as Crypto Patel indicated the possibility of clear penetration, and that the fence of the price greater than 2800 will confirm its ascending direction, which can push it to target the level of $ 4,000 and beyond.

The activity of whales and clouds reflects long -term confidence

The blockchain data supports the Ascension scenario, where the governor of whales (main investors) and the institutions buy and collect the piece of Ethereum regularly even with the movement of its price remaining in a narrow range. Lookonchain Data also indicated that Sharplink Gaming had bought $ 4.82 million in Eterium currencies through over -the -counter sales offices (OTC), which increased its total property to $ 478 million.

Sharplink Gaming bought an additional $ 4,820,000 $ ETh Via OTC.

They represent 425,470,000 Etareum. pic.twitter.com/0qtddhcuas– Ted (@tedpillows) June 28, 2025

Additional signals indicate confidence:

- Place $ 4.56 million in the network of tag chain for Ethereum, for the mortgage.

- Remove $ 293 million from the platforms, which should be transferred to the cold governor.

- Low fluctuations accompanied by high values.

These models indicate that whales are preparing for the high price of Ethereum in the future instead of negotiating in the short term.

Network growth against market price: a blatant difference or a hidden opportunity?

The activity of the Ethereum block is experiencing a significant increase, because daily transactions have exceeded 1.5 million transactions, the number of active titles exceeding 356,000 titles, which are the highest levels recorded since the start of 2023. Gas fees have also increased by 130% in a week, reaching $ 10.26 million, indicating an increase in demand for decentralized financial platforms (DEFI) and non-plaflages symbolism (NFT).

Despite this, the performance of Ethereum currency is still low and the main indicators indicate the need to be careful:

- Network value to transactions (NVT ratio) It increased sharply to 2044, indicating that the price can be advanced on the network use rate.

- The percentage of the market value of the value obtained (MVRV Z-SCORE) It has decreased in the negative zone, which is likely that the foreign exchange owners will undergo losses.

This blatant difference between the price and the basic pillars can be a hidden opportunity to buy, or a sign of an exaggerated feeling.

The final decision on the performance of Ethereum currency and the adoption of the start of its price to the main levels

In light of the optimistic prices of Ethereum, will its price really cost around $ 10,000? In fact, this verification depends on the following elements:

- Its price penetration level $ 2,800 to confirm management.

- The whales continue to be careful and continue the mortgage.

- Translate the use of the network in price gains.

If the price of the Ethereum part maintains its level of support around $ 2,400 and the domination of Bitcoin currency, this can follow its start. Xforceglobal analysts expect a price movement similar to the Wyckoff style model about $ 9,400, if the positive time increases.

Currently, the increasing Ethereum path seems solid, while its high price depends on its recovery levels of the main resistance and the confirmation of the conviction of long -term investors by continuing trade and the assembly.

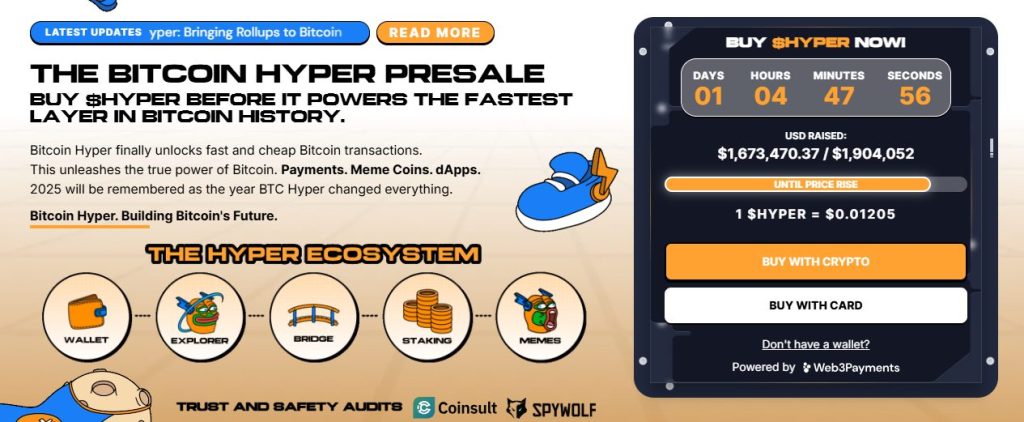

Bitcoin Hyper is more than $ 1.74 million with the increase in the next prices

Bitcoin Hyper – whose project offers the first second place solution on Bitcoin Bachelor – supported by SVM (SVM) – 1.74 million dollars, where $ 1,748,091.98 was noted from its lens of $ 1,974,249. Although it is now available at $ 0.012075, it will attend an imminent price increase in a few hours.

With its design between the safety of Bitcoin Bluecinin and the speed of the Solana network, the solution of the second layer of the project is improved by the speed of intelligent contracts and provides low costs and decentralized applications and confidence and simplicity.

Thanks to its insurance, the attractiveness of MG currencies and real functional uses, Bitcoin Hyper has become a solid competitor in a second -class sector worthy of follow -up in 2025. With the characteristics of the mortgage, the success of its subscription and the full launch expected by the first quarter, Bitcoin Hyper is gaining morale.

The position The expectations of Ethereum-Eth prices: targeting $ 10,000 again with the formation of an emerging channel on several courses; Should the price of ETH currency begin? APPLERDIRST on Arab Cryptonews.