Hashflow (HFT) triggers 66%: four drivers behind the increase and what it means for price predictions

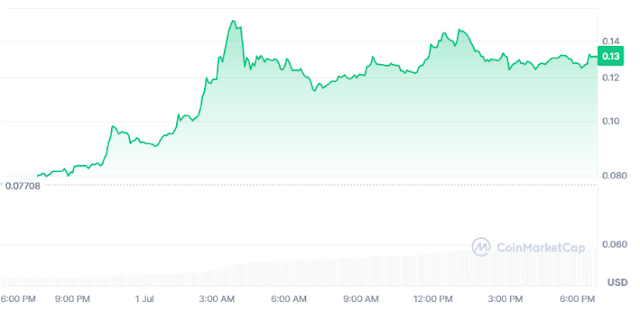

Hashflow (HFT) has captured the attention of cryptographic investors worldwide after a dramatic price increase of 66% within 24 hours, which takes its value to approximately $ 0.13 and records a striking $ 612 million in negotiation volume. This sudden increase has placed the hashflow in the center of cryptographic discussions, raising the fundamental question: what is feeding this rapid increase and indicates a sustainable upward trend for HFT in the coming months?

|

| Source: Coinmarketcap |

A closer look at Hashflow’s rupture

HASHFLOW, a decentralized financing protocol for allowing cross -chain trade without sliding, has become a remarkable player in the ecosystem of multiple chains evolving. This week, it has become one of the most seen tokens in the main commercial forums, with analysts and merchants due to dissecting the factors that contribute to their explosive growth.

|

| Source: x |

Next, we explore four key reasons that promote the increase in hashflow and what merchants and long -term investors should expect from Token, since it gains traction in a competitive cryptography market.

1. Solana Integration: A critical step for multiple chain expansion

On June 11, 2025, Hashflow’s team officially announced the integration of the Token HFT with the Solana block chain, marking a significant milestone in its multiple road map. Integration also comes with associations that involve Jupiter, Kamino and Titan, expanding the operational panorama of the hashflow cross chain commercial capabilities.

Solana integration offers reduced transaction rates and faster settlement times, improving Hashflow’s attractiveness to retail merchants and institutional participants looking for high -speed defi solutions. This strategic movement is particularly remarkable in an environment where the interoperability and efficiency of the transaction are becoming decisive factors for the DEFI protocols.

Market analysts point out that the announcement caused immediate purchase pressure on HFT since merchants positioned themselves for a possible additional adoption, seeing Solana’s expansion as an indicator of Hashflow’s long -term commitment with a scalable and multiple future.

2. Tokenomics Transparency increases investor confidence

A critical concern in the cryptographic space is the clarity of the tokenomics of a project, particularly with respect to the supplies unlock schedules that could lead to important sales and price volatility. Hashflow has approached these concerns by providing transparent and detailed revelations about its Token Liberation Mechanisms.

The team clarified that HFT tokens are unlock linearly every day, without large cliffs or sudden massive unlock events that can trigger a market overturning. This transparency has played a crucial role in improving investor confidence, reducing uncertainty about future supply clashes and encouraging holders to maintain their positions or increase their bets.

For many investors, the confidence in the tokenomics of a project can be the decisive factor to support the appreciation of long -term prices, which makes the hashflow approach a clear differentiator in a defi landscape full of people.

3. List in DYDX increases the utility and negotiation volume

Another catalyst that drives the HFT price increase is its recent list in DyDX, a leading decentralized derivative derivatives trade platform. This list allows advanced merchants and Defi enthusiasts access to trade and coverage strategies leverage with HFT, expanding the cases of use of the token beyond traditional spot trade.

The DyDX list also improves HFT liquidity, which makes it more accessible to a broader commercial community and contributes to the significant increase in its commercial volume. The growing demand for HFT on decentralized derivatives platforms indicates the greatest interest among merchants seeking to capitalize on the impulse of the Token, potentially maintaining their upward trajectory.

4. Technical Breakout confirms the impulse of bullish trend

The technical analysis provides more evidence that supports the current hashflow. HFT recently broke out of its prolonged negotiation range between $ 0.05 and $ 0.07, exceeding the resistance level of $ 0.10 in high volume, as confirmed by the daily lists of TrainingView.

The indicators such as the relative force index (RSI) show readings greater than 85, highlighting the strong bullish impulse of the Token. In addition, the divergence of the convergence of the mobile average (MACD) has shown an upward crossing, indicating the possibility of a more upward movement if the current purchase pressure continues.

Market observers also point out that HFT’s price action is aligned with patterns commonly associated with the accumulation of whales and possible short slices, which increases the probability of continuous volatility and ascending impulse in the short term.

Key price levels to monitor

Merchants are closely observing several critical levels of support and resistance to guide their entry and exit strategies. On the support side, $ 0.10 serves as a vital base after the recent rupture, with $ 0.08 as a secondary level linked to previous resistance areas. On the resistance side, $ 0.15 represents the maximum Intradía, followed by $ 0.18 (the maximum of February 2025) and $ 0.22, a significant rejection zone in 2024.

These levels could serve as reference points for merchants who navigate against potential setbacks or who seek to confirm the continuations of the break in the next few days and weeks.

Hashflow pricing prediction: What’s ahead?

According to the combination of solid fundamentals, technical indicators and the market expansion, hashflow pricing prediction for the near and medium term remains optimistic.

In the short term (2–3 weeks): HFT can test the range of $ 0.15– $ 0.18 if the current negotiation volume persists. Any setback at $ 0.10 could find a strong purchase interest, serving as an opportunity for accumulation for merchants anticipating a continuous bullish impulse.

Half term (2–3 months): If the broader Altcoin rally maintains and additional integrations or main listings are produced, HFT could point to the range of $ 0.20- $ 0.24, backed by the increase in utility and network growth.

In the long term (end of 2025): If Hashflow obtains listings on platforms such as coinbase or expands more in the Binance ecosystem, a movement towards $ 0.35– $ 0.40 becomes a realistic objective. Taking into account the historical maximum of $ 2.58 of the tokens in November 2022, there is a significant space for long -term recovery, particularly if HASHFLOW can continue to deliver its road map and its construction of community support.

Is now the right time to buy hashflow (HFT)?

Although the cryptographic market remains inherently volatile, the recent increase in hashflow is backed by tangible developments: solar integration, transparent tokenomic, expanded commercial opportunities in DYDX and a clear technical rupture. These factors collectively indicate a project that gains impulse, positioning HFT as a potential candidate for merchants and investors seeking exposure to emerging protocols with multiple ambitions.

However, investors must remain cautious, especially given the high levels of RSI that often precede short -term setbacks. Exhaustive research, risk management and a clear investment thesis remain essential before entering any cryptographic position.

Final thoughts

The dramatic increase of 66% hashflow is not simply a speculative peak, but the result of the strategic expansion of the ecosystem, operational transparency and the increase in market recognition. As the defi space continues to mature and the functionality of multiple chains becomes the standard of the industry, HASHFLOW seems to be ready to benefit from these evolutionary trends.

The next few weeks will be fundamental to determine if HASHFlow can maintain their ascending impulse and solidify its place in the defi landscape. Both merchants and long -term investors will observe closely as HFT continues their trip, with the potential of a greater increase if the current impulse is aligned with the continuous growth of the ecosystem.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.