The gain of $ 1 billion binance adds weight to the bitcoin price prediction of $ 1 million CZ

Changpeng Zhao, known worldwide as CZ, has once again captured the attention of the cryptographic industry. In a recent interview with Anthony Pompliano, Binance co -founder boldly reaffirmed his belief that Bitcoin will eventually reach the $ 1 million mark, a statement that reverbes in the markets in the midst of renewed institutional interests and solid market foundations.

But what makes the prediction of the price of Bitcoin of CZ particularly convincing at this time? The response lies in a combination of explosive profitability of Binance, the cryptographic ecosystem in maturation and the evolving macro panorama that is increasingly favorable for digital assets.

|

| Source: x |

The explosive first year gain of Binance prepares the stage

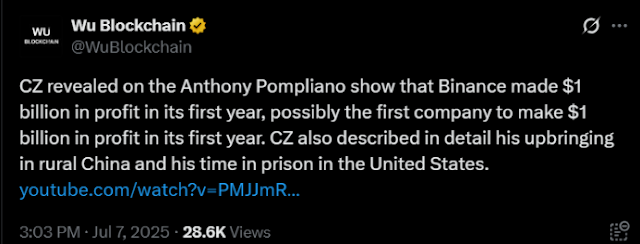

“We obtained more than $ 1 billion in our first year,” said CZ, as stood out in a Wu Blockchain publication in X. This unique statement has gone viral, sending waves in the Bitcoin news ecosystem and highlighting how quickly Binance amounted after its launch in 2017.

In an era in which most startups spend years trying to reach the equilibrium point, the achievement of Binance stands out. To put this in perspective, it took Google for five years to reach one billion in profits, while the early goal of the finish line also pales compared to the speed and efficiency of Binance. The rapid expansion of the platform during ICO’s boom, combined with its aggressive listing strategy and user inlaid, Binance positioned as the reference platform for cryptography trade, providing deep liquidity in a wide range of tokens.

Binance’s profitability history is not simply corporate flexion; It underlines the operational excellence and demand that supports the exchange, which provides credibility to the ideas of the CZ market and long -term predictions, including its Bitcoin prices prognosis.

CZ’s trip: from rural China to cryptographic leadership

The personal history of CZ is added to the intrigue, which has captivated both cryptography and conventional public enthusiasts. In his conversation with Pompliano, CZ revealed that time spent time in a cell in the United States prison, describing the experience as “emotionally intense and reflective.” While the details are still scarce, the revelation adds another layer to its historic rural China trip to become one of the most influential figures of cryptography.

His personal resistance and ability to navigate the legal and operational challenges position it uniquely as a leader capable of seeing through market cycles, which makes Bitcoin prices prediction even more notable.

CZ’s trip: from rural China to cryptographic leadership

The personal history of CZ is added to the intrigue, which has captivated both cryptography and conventional public enthusiasts. In his conversation with Pompliano, CZ revealed that time spent time in a cell in the United States prison, describing the experience as “emotionally intense and reflective.” While the details are still scarce, the revelation adds another layer to its historic rural China trip to become one of the most influential figures of cryptography.

|

| Source: x |

His personal resistance and ability to navigate the legal and operational challenges position it uniquely as a leader capable of seeing through market cycles, which makes Bitcoin prices prediction even more notable.

Why CZ believes that Bitcoin will reach $ 1 million

Several factors support CZ’s upward perspective:

-

Institutional adoption: CZ pointed out the growing institutional flows, emphasizing that traditional variable rental markets have moved more and more to cryptography, particularly in the last nine months. This change has been promoted by the launch of regulated cryptographic investment vehicles and a greater acceptance of Bitcoin as a legitimate asset class.

-

Spot Bitcoin ETF and corporate holdings: The approval of the ETF Spot Bitcoin in the key markets, together with the corporate treasury assignments of companies such as Tesla, has created a constant portfolio of demand for Bitcoin. Blackrock, Gamestop, Fidelity and Ark Invest are among the main players that build cryptography positions.

-

Global regulatory clarity: The improved regulatory frameworks, including the Mica in the EU, are creating a safer environment for institutional participation, eliminating previous barriers that kept large investors outside cryptographic markets.

-

Scarcity and half -sight cycles: Bitcoin’s fixed supply and periodic reducing events naturally limit their issuance, creating an environment in which demand clashes can lead to significant price increases, aligning with structural drivers behind a possible recovery towards the $ 1 million mark.

Bitcoin Price Today: A base for the next Toro race?

As of today, Bitcoin is traded approximately $ 108,763.15reflecting a 0.66% gain in the last 24 hoursAccording to Coinmarketcap. In particular, the negotiation volume increased by 33%, reaching $ 40.25 billion, indicating the increase in investors’ interests.

|

| Source: Coinmarketcap |

Institutional players, often called “whales”, seem to accumulate in silence Bitcoin, even when retail investors are still cautious after past volatility. This accumulation phase may be preparing the stage for a possible rally in the second half of 2025, aligning with CZ predictions.

Binance role in the ecosystem

The operational resilience and the global scope of Binance are key factors to understand the optimism of CZ. Despite the regulatory challenges in multiple jurisdictions, Binance has continued to expand, launching new services and maintaining its position as the main exchange of cryptography of the world by volume.

The exchange capacity to innovate and remain agile against the change of regulatory and market dynamics positions it as a glass for broader cryptographic trends. As Binance Prospera reflects the underlying force within the cryptographic ecosystem, even more validating the bullish forecasts.

Institutional flows: a tectonic change

One of the most important drivers behind the Bitcoin prediction of $ 1 million CZ is the growing institutional participation in cryptography markets. Traditional financial institutions are not only exploring cryptographic investment, but actively integrate blockchain technology in their operations.

Fidelity, Ark Invest and Blackrock have launched cryptographic investment products, while pension funds and family offices are exploring Bitcoins assignments as coverage against inflation and geopolitical uncertainty. This influx of institutional capital is fundamentally different from the retail demonstrations of the previous Alcist markets, providing a more stable basis for the appreciation of long -term prices.

Final thoughts: Is Bitcoin’s prediction of CZ becoming a reality?

While no one can predict the exact timeline for Bitcoin to reach $ 1 million, the CZ history, combined with the operational success of Binance and the broader trends in the cryptographic ecosystem, lend a significant weight to their prognosis.

Whether it is building an exchange of billions of dollars within a year, navigating complex legal landscapes or defending the adoption of cryptography worldwide, CZ has constantly demonstrated the capacity to shape the market.

As the institutional interest in Bitcoin grows and the macroeconomic environment continues to evolve, the possibility that Bitcoin reaches $ 1 million does not feel like a crazy dream but a potential milestone in the horizon.

However, investors must remain cautious and informed. Cryptographic markets remain volatile, and although long -term perspectives can be optimistic, it is essential to conduct thorough investigations and consider individual risk tolerance before making investment decisions.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.