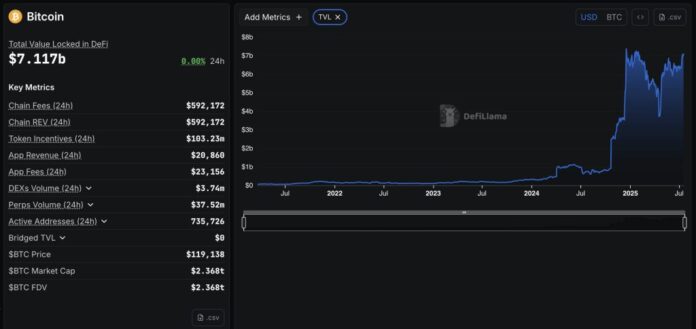

The high price of Bitcoin-BTC considerably affects the decentral financing sector (DEFI) on Bitcoin Blockchain. Defillama data showed that the total value entered (TVL) in decentralized financing protocols on Bitcoin Bluechen increased from $ 304.66 million on January 1, 2024 to $ 7.117 billion when writing these news.

It is likely that this last growth in the decentralized financing sector is likely to be on Bitcoin BlueChen- which is generally called BTCFI- due to the flow of institutional investments, the launch of new protocols, the re-flexible mortgage, bitcoin, etc.

Institutions seek to develop a decentralized financing strategy on Bitcoin Bluex (BTCFI)

Rena Shah, Director of Operations at Trust Machines – Technician for decentralized BTCFI funding – told Cryptonews that institutions have started to realize that Bitcoin is faster than expected.

Consequently, the Stacks network – a second layer of Bitcoin blockchain – recently announced the connection of 5,000 SBTC currencies (a bitcoin -1: 1: 1: 1: 1: 1:

SBTC CAP-3: FULL.

We deleted the cap of 5,000 SBTC in less than 2.5 hours.

BTCFI is inevitation. pic.twitter.com/iz08kx4lta– stacks.btc (@stacks) May 22, 2025

Shah added that the total value of loans in the battery system increased with the high price of Bitcoin.

While recognizing Bitcoin as the origin which can be used as guarantee, Shah believes that institutions will also begin to seek decentralized financing strategies on BTCFI, and many will be followed this year. She said: “When ordinary users see that the price of bitcoin continues to record unprecedented levels, they will start looking for new ways to benefit from them, and this is what BTCFI offers them. He will give the opportunity to develop for this moment to work to introduce new users to benefit from the full Bitcoin potential.”

For his part, Ben Sanders -the head of official growth in Rootstocklabs -that is what will happen, as he said of Cryptonews, saying that the coming months will often attend the demand of trading platforms and consumer financing applications to include Bitcoin Bitcoin layers (Bitcoin) (BTCFI).

Sanders added: “With the increase in Bitcoin part institutions, it is natural that these entities are starting to look for ways to use bitcoin parts in blockchain networks that are compatible with Bitcoin BlueChen as the rootstock network,” added Sanders.

Stable currencies contribute to the growth of decentralized financing on Bitcoin Bluevi (BTCFI)

Sanders said that the use of the rootstock network as a decentralized financing layer on Bitcoin Bluevi (BTCFI) saw a boom in the activity. He added: “This is reflected in the recording of the unprecedented level rootstock network in terms of total entered value (TVL) and the number of active addresses.” In addition, other major protocols such as UST0, Solv, Midas and Layerzero have recently started supporting the Rords network, which led to the acceleration of current change towards decentralized financing on the blockchain. Bitcoin (BTCFI).

It’s time. BTCFI, for real. https://t.co/mgazo28xme

– Rootstock (@rotstock_io) July 16, 2025

In addition, Rich Evans – Administrative Director of CEX.IO – Platform for the negotiation of administrative currencies for cryptonews that the introduction of stable currencies in the world of decentralized funding on Bitcoin blockchain is considered one of the most promising developments.

Arimagining Stablecoins on Bitcoin: the future of Defi@coinbase I just published their quarter report. One of the main conclusions? The power of respect for stablescoins.

The Stablecoins broke out in 2024, with chain volumes which increased to record heights.

And that eth a … pic.twitter.com/gjqpf2ywnArch Network (@Archntwrk) February 24, 2025

He explained: “Tithar seeks to launch his stable currency -Thetet -usdt on the Lightning network (lighting network) via tapot assets, while the UST0 (UST0) is added to rootstock al -Mulamazi through other networks, and Bitcoin Bluechen always has a decorative point. Therefore. Decentralized financing of this blockchain.

This change seems to have already started; Sanders indicated that two of the most important uses in the rootstock network lend and borrow using Bitcoin-BTC, and added: “We are witnessing the participation of young and institutional users in the Rootstoc network to obtain a return to their property from Bitcoin, or to borrow stable currencies by guaranteeing new markets.

Willem Schroé – Executive Director and one of the founders of Botanix Labs, who developed a second Bitcoin layer solution – told Cryptonews that the Botanix network had also witnessed sustainable growth due to these factors.

“With the return of the capital flow to the technical system, we note the increase in interest in decentralized financing on the BTCFI, in particular in the areas of the loan, the reissue and the generation of the BTC yield.” He also pointed out that the Botanix network is witnessing continuous growth in the number of new users and applications launched to provide loan services and decentralized trading platform activities and obtain bitcoin yields.

What is the next step for decentralized BTCFI funding?

While the BTCFI sector is currently increasing accelerated growth, it will soon enter a new growth phase. According to Shah, work on several blockchain networks is considered to be the great opportunity for decentralized financing on Bitcoin Bluecine (BTCFI).

She said: “Even if you have the origins of another first layer blockchain, the Stack network must offer opportunities to link blockchain networks via bridges, so that users can access the best benefits of decentralized financing without the need to sell their Bitcoin pieces.”

Evans also pointed out that technical innovations – like BitVM2 and the new BitvM3 proposal – open the way to provide more flexible and flexible and expanding intelligent contracts (Bitcoin Blockchain), and said: “Bitvm3 – is particularly – is in particular – by providing bridges on Bluecin Bitcoin to offer greater efficiency and lower cost and can reduce dependence on the Bluec Networks.

Challenges that must be taken into account

Despite the enormous potential enjoyed the decentralized financing sector on Bitcoin Bluevi (BTCFI), the pace of its growth is even slower than expected, according to Rich Evans, where it said: “Although the Bitcoin price has recorded unprecedented levels this year, reaching around 28% since the start of the year, the growth of the sector is the growth of the Sector. It has not exceeded 8% and is still without its previous highest point.

Consequently, Evans indicated that the last height of the price of Bitcoin has caught attention to money, but it has not yet assigned the same form on activity in the BTCFI sector, and this can be attributed to a certain number of challenges. For example, Shero believes that the development of this sector requires that the owners of the long -term Bitcoin currency redefine their relationship with it.

He talked about it, saying: “The dominant strategy for several years was to buy and keep the currency. Although this mentality has succeeded in the first stages, but if we want Bitcoin to reach its maximum capacity, it must be used.

In addition, Sherou has stressed that security and education are always a problem with the BTCFI sector, and said: “Many Bitcoin owners are prudent to use new tools, which is quite understandable.”

In confirmation of this, Sanders stressed the importance of strengthening security to ensure the expansion of the sector, commenting: “It is necessary that the Bitcoin Treasury will enjoy the provisions of infrastructure, tutelage and development teams of decentralized protocol in the dangers and appropriate measures and guarantees to protect its users in the future.”

The position Why the Decentralized Financing Protocols (DEFI) on the incredible growth of Bitcoin Blockchain after the high price of money? APPLERDIRST on Arab Cryptonews.