The market has remained stuck between a frantic desire to invest and an innate instinct to preserve capital, in a scene that warns against a potential battle which will impose its hegemony at the next wave of height.

The blockchain active movement has witnessed a remarkable change that fell into market attention, while about $ 900 million in stable currencies entered the Binance platform this week, at a time when Bitco-BTC owners are quietly withdrawing their active ingredients. These measures reflect a possible change in the directions of institutional investors in collaboration with increasing political ambiguity in the United States.

The frequency of investment rotation in digital currencies is accelerating with the climbing of the crisis of Trump and Powell and the mood growth of the risk of the risk

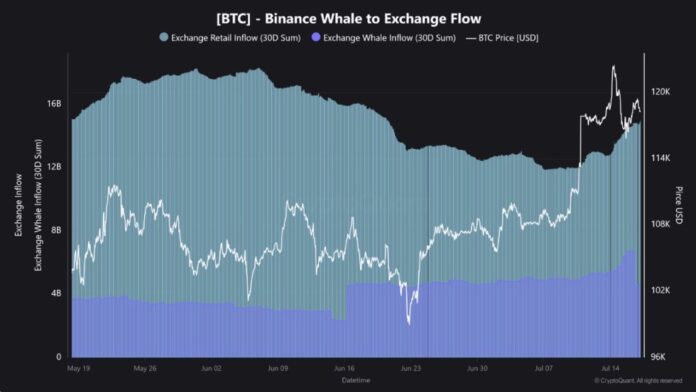

According to the cryptocurrency platform report, blockchain data show that Bitcoin Bitcoin whales have started to reduce their presence on the most important platforms. In the past 30 days, their deposits on the Bennes platform increased from $ 6.75 billion to 4.5 billion, a drop of $ 2.25 billion. This decrease represents a possible indication of a reduction in pressure pressure, as the whales transferred their assets from the BTC to trading platforms in preparation for a huge sale. Now this drop can reflect the desire to calm the market and reduce the chances of serious corrections.

At the same time, investments flock to an accelerated pace. On July 16, the Binance platform received more than $ 895 million in stable currencies, followed directly from the HTX platform with 819 million. These are not the movements of small investors, but rather commercial volumes and the coincidence of operations coincides with the assembly of a coordinator led by institutions.

With the drop in whales and advanced buyers offered, conditions are trained in the occurrence of blockchain analysts as a “liquidity coup”, as incoming investments are increasing while traditional sellers are upset. The last time the markets have experienced a similar structure, prices have increased.

However, this fragile emerging structure began to be shaken by political ambiguity. This week, rumors have spread that Donald Trump discussed at a closed -door meeting with republican legislators the opportunity to reject the president of the federal reserve Jerome Powell, but Trump then denied his intention to withdraw him.

He confused the possibility of Powell – known for his strict monetary policy and increasing interest rates – investor accounts; Bond yields have increased, the money in dollars has decreased and investments began by turning to risky assets, in particular digital currencies.

The price of bitcoin on a heating plate with an inactive currency of $ 4.7 billion and the company Tayhar issued a value of 3 billion dollars in TETHER-USDT currencies

In the midst of market fluctuations, Bitcoin Blockchain attended an unusual movement that caused the concerns of followers, while one of the oldest whales of Bitcoin returned to activity more than ten years after immobility. This title – which has collected 80,000 BTC currencies since 2011 – has converted more than 40,000 currencies of around 4.77 billion dollars, into a new address.

A dormant, which sent $ 2.1 billion in BTC to Galaxy Digital, returning Bitco from $ 123,000 to $ 117,000 and fueling the designers of adult discharges.#Whalewallet #Galaxidigital https://t.co/7lmgsj2xvo

– cryptonews.com (@cryptonews) July 15, 2025

Earlier this week, the same address converted 9,000 Bitcoin into a Galaxy digital portfolio, followed by another period of 7,800 other currencies. For its part, the company has transferred 6,000 bitcoin to trading platforms, notably Binance and Bybit.

Although it is not clear if these movements have been paved for sale or simply a reorganization of the governor, they triggered the fears of a wave of imminent liquidation which can afflict the market.

A portfolio transferred 1 042 $ BTC(122.54 million dollars) to a new portfolio 20 minutes ago after being dormant for 6 years.

This portfolio received 1,042 $ BTC($ 9.12 million at the time) of Brains Mining and Xapo Bank 6 years ago, when the price of $ BTC Was $ 8,746. pic.twitter.com/1rmajtzzyq– Lookonchain (@lookonchain) July 16, 2025

In an additional climbing of tensions, an inactive carbeto portfolio containing 1,042 bitcoin – a value of around $ 122 million – returned to activity after six years of development. It is not known whether these movements redistribute the currencies reserved in cold storage (not connected to the Internet) or in preparation for sale, but its surprising activity has confused traders.

As for stable currencies, Tithar recently took one of his most daring movements. On July 16, the company issued a value of three billion dollars in the attachment in less than 24 hours, at two billion dollars first, then an additional dollars after a short period.

PSA: 1B USDT inventory repleenish on Ethereum Network. Note This is an authorized transaction but not Ising, which means that this amount will be used as an inventory for the Isuance requests for the next period and channel exchanges.

– Paolo Ardoino

(@Paoloardoino) July 16, 2025

Although these factors interact and produce new conditions, the price of Bitcoin maintains its stability at $ 118,200, with a slight decrease compared to its highest level ever recorded at $ 123,000 recorded at the start of the week. Despite stability, internal market indicators indicate the possibility of entering a slowdown stage; The transferred assets increase to trading platforms, which is a traditional indication of the start of operations for profit.

It should be noted that small investors accelerate the pace of transferring their money to platforms, while the rhythm of deposit of whales decreases. Nevertheless, the conviction of new investors remains unusional; Glassnode data show that the number of bitcoin parts kept by new buyers of 4.91 million currencies against 4.77 million currencies two weeks ago, an difference of around 140,000 currencies (equivalent to more than $ 23 billion) purchased at levels close to the summit.

For the first time in the history of Bitcoin, the average purchase cost of short -term owners exceeds $ 100,000, which shows their impetus to exploit the last drop when the price decreased below $ 116,000.

In the past two weeks, the offer held by the first time $ BTC Buyers increased by + 2.86%, from 4.77 m to 4.91 m #BTC. Fresh Capital continues to enter the market, supporting the last price escape. pic.twitter.com/w95hsamahi

– Glassnode (@glassnode) July 17, 2025

The extent of the gap between the enthusiasm of small investors and the warning of whales puts analysts in a state of maximum levy; The qualification activity is intensified by the former governor can dismantle the dominant structure on the market and push towards a sudden reflection of the general mood. However, the price of bitcoin continues to show a degree of hardness supported by stable currencies, a decrease in the sale and the transformation of macroeconomic data in a way that stimulates the appetite for the risk for investors.

The stable currency position worth $ 895 million heading towards the Bings platform with the withdrawal of whales and fear of a huge wave of sale appeared first on Arab Cryptonews.