“Tom Lee” expects the price of Ethereum to soon reach $ 5,500 and $ 12,000 at the end of the year, after Bitmin managed to receive a firm of this change of $ 7.65 billion after the approval of the Engineering Law on Stable Stores.

Tom Lee – The Fundstrat chief investment manager – plans the high price of Ethereum at $ 5,500 at the foreseeable duration, with an ambitious objective of $ 12,000 at the end of the year. On August 26, for me, on Actis Investing, revealed that the instructions of the institutions of Wall Street towards Ethereum were radically modified after the American Senate approved the genius law associated with stable currencies and stressed that the Ethereum blockchain provides the appropriate infrastructure of traditional financial systems (traffic) due to its support for stable currencies, currently exceeding 145 billions of dollars.

Tom Lee made his debut open on the market in the series and we discussed a variety of subjects, in particular Ethereum & Bitmine:

– For what $ ETh Coulf be the biggest macro trade in the next decade

How $ Bmnr Growing

– Ethereum end of … pic.twitter.com/yqww4je5y4– Amit (@amitisinovise) August 26, 2025

Its strong domination over the sector is one of the most important of what prompted Lee to consider Ethereum, one of the most important investment opportunities linked to infrastructure during the next decade.

Tom Lee’s expectations concerning Ethereum Coin followed by the approach of Bitmine subscribers to collect cash flows of $ 7.65 billion

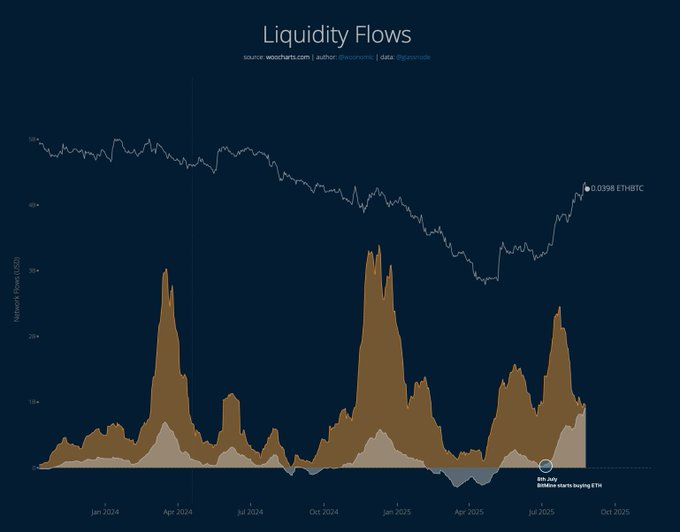

After the launch of the company Bitmine specializing in the creation of a balance of the Ethereum wardrobe, strong investments flocked in the currency, the managers of investment institutions and small investors began to convert their systematically Bitcoin-BTC investment destination to Ethereum, and the average daily transfers have reached around $ 900 million.

Sale Bitmine Launched its Strategy to Collect Ethereum -June 30, The Market Value of the Currency has increased by more than $ 255 Billion, and Jeff Kendrick – A Standard Charged – Recently Indicated That The Total Investments (Standard Charted) – Recently that the Total Investments to the Institutions Interestred in the inclusion of Ethereum to the assets of its treasury, its counters have been crosted by the bitcoin currency of their cabinets, and he sees that the institutions of Ethereum placard have greater opportunities for organizational expansion compared to their Paris on Bitcoin counterpart.

Bitmine’s internal analyst presented new forecasts for the administration, after he expected Ethereum’s price last week to $ 4,075, then he then increased to record his new standard at $ 4,900.

On August 26, Lee expected the price of Ethereum to record its lowest level in hours, jointly with Bitmin Immersion Technologies, buying additional balances of $ 21.28 million, which increased its total possession to 1.72 million currencies and 7.65 billion dollars.

It is reported that his expectations are in line with the technical assessment of enlightened analyst Mark Newton, who is likely to start the price of Ethereum currency, a new recorded record recorded at $ 5,100 before targeting $ 5,500.

Brand@MarkNeWtoncMtAgain.

Call Eth Bottom in Happy in the coming hours

@fs_insight @Fundstratcap

TICKERS: $ Bmnr $ Grny pic.twitter.com/blmfqggs– Peaky (@peakyparody) August 26, 2025

In a later interview with the CNBC network, Lee confirmed its forecasts on Ethereum, authorized by Bold price targets in the $ 12,000 to $ 16,000, indicating that “Ethereum is preparing for a high wave similar to the start of Bitcoin in 2017”.

Lee acquired a great reputation in 2017 when he appeared on CNBC Channel and expected the price of Bitcoin (Bitcoin) to be a brand of $ 55,000 at a time when he was only $ 2000, and it was planned that many Wall Street experts were ridiculed. Today, Lee applies the same conviction towards Ethereum, which has prompted many investors to closely follow his analyzes.

For his part, Ryan Adams – The Investor and Analyst at Bankless – Lee Prévision on Ethereum is very exceptional, pointing to the Lee Assembly for sales of around $ 10 billion in 50 days, or almost 1.4% of its total offer.

Absolutely unprecedented.

Tom Lee has acquired nearly $ 10 billion in ETH in the last 50 days.

More than 1.7 m ETH.

1.4% of all ETH Super.

If Tom reaches its objective by 5% and that ETH exceeds $ 12,000, Wald is larger than Microstrategy. pic.twitter.com/dpizv5dbc– Ryan sξan Adams – RSA.eth

(@Ryansadams) August 25, 2025

Adams believes that if Lee is able to achieve its objective by holding 5% of the total supply of Ethereum and that the price is more likely at a level of $ 12,000, Bitmin can exceed the strategy to become the main CRIPTO wardrobe companies in the world.

At the same time, the senior owners of the Ethereum part strive to exploit the strong dynamic and the liquidity flow towards the currency in order to reach unprecedented levels, and the blockchain data of the Arkham platform reveal that 9 whale titles (the biggest investors) recently bought quantities of digital trading (OTC).

Technical analysis: the $ 4,800 barrier can lead to a high start of price of the Ethereum currency

In terms of technical analysis, the graphic plan appears within the framework of the watch in the predictable term with a clear definition of the main areas of support. The price recently brought the scope of demand by $ 4,200, 4,460, the increase in height centers of more than $ 4,500, reflecting the investor’s confidence in the operation of the drop in purchase.

Technical analyzes indicate that the penetration of the resistance range of $ 4,950 to $ 5,000 can trigger a solid start-up which complies with the harmonic model that has started to train.

Currently, Ethereum is traded surround $ 4.580 after a slight decline, while momentum indicators indicate an upward intersection that formed recently that enhances the chances of continuing recovery, and if the request area maintains its durability During possible correction waves, Upward Path will remain at the Range of Resistance of $ 4,950-5,000, and if the cohesion fails Higher $ 4,600, the price may Witness a Deperation Correction before trying to go up.

The Tom Lee position should start the Ethereum-Eth price at $ 5,500 soon and $ 12,000 at the end of the year: is it considered to be realistic? APPLERDIRST on Arab Cryptonews.