Bitcoin is currently $ 115,580, while market attention is aimed at increasing institutional participation, because Bito Cripto company has raised a request to make a subscription to the United States in partnership with Citigroup and Goldman Sachs.

Companies have said that income of $ 4.19 billion and profits of $ 12.6 million in the first half of 2025, thanks to their asset management worth $ 90.3 billion and 4,600 agents distributed more than 1.1 million users.

The BitGo Insert on the New York Stock Exchange (NYSE) in the BTGGO symbol is an additional contribution to the caripto care movement after the Federal Interest Rate Reserve has been reduced by 25 basic points, and the value of the circle shares increased by 365% after abandonment, while the value of the part of Gueni decreased by 14%, investors to crypto companies.

Bitgo asked for an IPO in the United States, adding to an active market for digital assets https://t.co/x2keiloygw

– Bloomberg (@bushing) September 19, 2025

Institutional descriptions such as Bitgo also highlight the growth of institutional trust in digital assets and the possibility of Bitcoin.

Liquidity, federal policy and market expectations

Basic liquidity of the next Bitcoin movement is Bitcoin, Bitmex Arthur Hayes’s partner said that liquidity will return to the market and high risk asset prices – including Bitcoin – once the US Treasury Account (TGA) arrives at 850 billion billion dollars per dollar (currently $ 807 billion).

Breakup News: Arthur Hayes sees Bitcoin hit $ 200,000 this year and $ 1 million by 2028, says Ethereum outclass Solana, and the Alt season begins above $ 110,000. pic.twitter.com/l8hms9rcno

– Jason ai. Williams (@goutparabolic) May 20, 2025

On the other hand, optimism increases with the flow of liquidity towards chipto and actions in collaboration with the federal government and the frequency of reduction of interest rates in October, and traders are monitored due to the relief of pressure on liquidity and the possibility of supporting a continuous emerging movement of Bitcoin.

- The objective of the general account of the US Treasury: 850 billion dollars, to which liquidity can be released

- Interest rate reduction: the first since 2024 with the expectations of his rehearsal in October

- Impact: Reduction of interest rates generally leads to a liquidity flow to the origins of the risk

Technical levels of the BTC / USD pair drawing the 2025 course

The expectations of Bitcoin prices tend to be pessimistic in the short term, and this coincides with the transverse movement in the noisy model which generally precedes the declines in the event that buyers do not protect support, and the average movement played for 50 days ($ 116,300) the role of resistance which prevented many emerging movements, while the medium closer to its counter for 200 114,200. $ 113,200.

The decrease explicit below the level of $ 115,100 can allow the follow -up of $ 114,200 and $ 112,100, and the value of the RSI index (RSI) decreased to 41 after reaching the exaggeration zone in the purchase, while commercial candles indicate the compression of the offer near the resistance with a long pasture. $ 114,200 and if it is broken, $ 112,100.

In addition, the mood of the market and the penetration of $ 116,600 can allow the re-test field of $ 117,980 and $ 119,150, and the emerging movement can continue around $ 120,000 and $ 130,000 if the medium-term resistance penetration is penetrated.

This transversal movement will be an opportunity for long -term investors, and the current level could determine the future of Bitcoin currency for 2025 if liquidity and institutional demand increase.

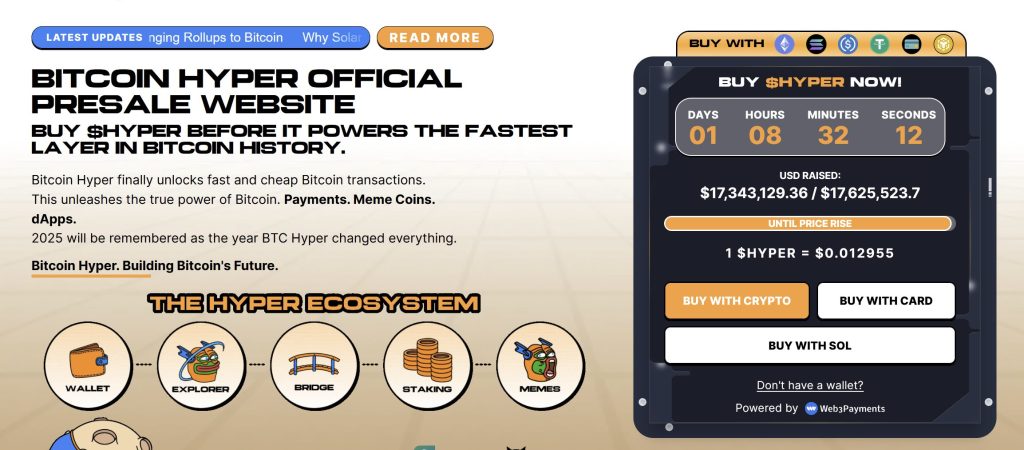

Hyper-hyper bitcoin has a hyper-hyper bitcoin currency. Invest with a currency that combines Bitcoin Blockchain security and the speed of blockchain Solana transactions

The new Bitcoin Hyper network is the first Bitcoin Blocchain on the SVM virtual machine, and to develop to support the Bitcoin Balcacin technological system by providing intelligent contract functionality, decentralization of decentralized applications (DAPP) and the ability to launch MIM parts and circulate it very quickly and low cost.

By combining Bitcoin Blockchain and Solana Blocchain, its second single layer solution provides various practical uses, including a fluid connection with bitcoin and decentralization applications (DAPP) which allows extension capacity.

For its part, the project team pays great attention to the reliability and the ability to develop, and the intelligent contract for its currency has been successfully examined by the Coinsult team to reassure investors in its technical foundations, and taking into account the growing interest of investors in the currency, the result of the subscription was excess to $ 0.012955, and it should increase the succession of subscription steps.

Finally, you can buy Bitcoin Hyper by visiting the official project of the project and paying using your assets from digital currencies, visa and masting.

To participate in the Bitcoin Hyper subscription, click here

Does Bitcoin Bitcoin-Btc Bitcoin-Btc prices expectations: Does this price level attract the remaining path for 2025? APPLERDIRST on Arab Cryptonews.