Billlet Bitget and Mastercard partner to launch a zero tariff crypto card, which makes daily cryptography spending easier than ever than ever

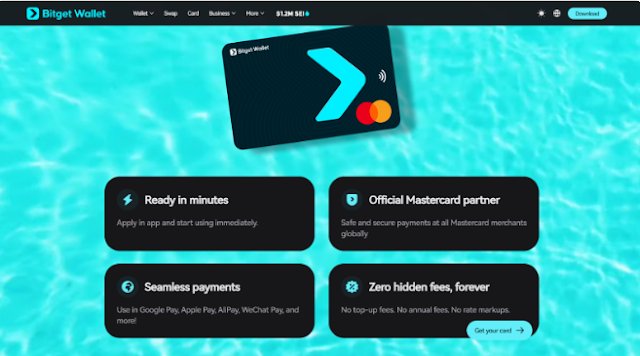

In a historical movement that indicates how fast the cryptocurrency, Bitget Wallet has been associated with the Mastercard and Blockchain service provider of global payments to launch a Zero rate crypto payment card. The initiative aims to transform digital assets into a practical payment tool that can be used without problems in more than 150 million merchants worldwide that accept mastercard.

This movement not only expands the usefulness of cryptography beyond investment and speculation, but also demonstrates how the main players in the cryptographic and traditional finance sectors are working together to close the gap between virtual assets and real world expense.

Spend crypto instantly using bitget ballet

Through the Bitget wallet application, users can now spend their crypt instantly through the new card. The Integra Swaps and Deposits card in the chain in real time, ensuring that users can convert and use their cryptography for payments without waiting periods or complex processes.

Thanks to Mastercard Digital Digital Technology, users can request the card online and start using it in minutes by adding it to their mobile wallets such as Apple Pay or Google Pay. Once activated, the card can be used in physical stores and online platforms, working as well as a traditional debit or credit card while obtaining funds directly from user cryptography holdings.

|

| Source: Bitget |

The ease of this process is designed to demystify cryptographic payments and position them as a viable alternative to fiduciary transactions in everyday life, from coffee shopping to online purchases and travel reserves.

A quick expansion cryptographic ecosystem

Bitget Wallet has been growing as a prominent player in the cryptographic ecosystem, which now serves more than 80 million users worldwide. It supports more than 130 blockchains and more than 20,000 decentralized applications (DAPPS), offering features such as encryption swaps, bet, rewards and now, global cryptographic payments without problems.

Security remains at the forefront of Bitget operations, with a user protection fund of $ 300 million to safeguard user assets against unforeseen events. This security network aims to provide tranquility for users who make the transition to the use of cryptography for daily expenses.

Safe and fulfilled cryptographic payments

The cryptographic card is issued by Immersve, a MasterCard partner with a license, ensuring that all transactions legally comply. Payments made with the card become virtual currencies to local currencies in the chain, strictly adhering to knowing the regulations of their client (KYC) and anti-launch of money (AML).

This guarantees that cryptographic transactions used by the card are safe, traceable and meet international financial standards, which facilitates both regulators and consumers, trusting cryptography as a legitimate means of payment.

The initial launch of the card will take place in the United Kingdom and the European Union, with plans to expand to Latin America, Australia and New Zealand in the following phases, thus supporting a truly global cryptographic payment solution.

Added benefits for card holders

Beyond the ease of spending cryptography, Bitget wallet card holders will get access to additional advantages, which include:

-

Reims and rewards based on transactions volumes

-

Inactive cryptography gains stored inside the wallet

-

Welcome bonds after completing the KYC verification

-

Global usability, make trips and purchases abroad without problems

These characteristics are designed to encourage cryptographic spending and ensure that card holders receive tangible benefits to use their cryptography in daily transactions.

Perspective of leaders about the association

Jamie Elkaleh, Marketing Director at Bitget Wallet, highlighted the simplicity and security objectives of the association, stating: “Encryption payments should feel as simple and safe as regular.”

Scott Abrahams, Executive Vice President of Mastercard Global Associations, said: “We are working with the main currency companies such as currency companies such as Bitget Wallet to make digital payments more accessible and practical for all.”

Jerome Faury, Immersve CEO, emphasized the useful use of the new initiative, saying: “We are creating real tools that connect virtual currency with everyday life. This card is a great step in that direction.”

Mastercard’s commitment to financial inclusion

Mastercard has constantly defended the role of digital payments to boost financial inclusion and economic growth worldwide. When collaborating with cryptographic platforms such as Bitget Wallet and Immersve, Mastercard is taking active measures to ensure that the future of payments includes cryptography, which offers accessibility and security both to consumers and companies.

Its technology and services have helped companies and individuals for a long time to the transition to the digital economy, and this new association is aligned with the broader Mastercard strategy to support the integration of emerging financial technologies in the main systems.

Bring crypt to daily life

This initiative demonstrates how the virtual currency moves more and more towards daily life, which makes the process once complex of spending cryptography is as simple as using effective cash or payment cards.

By combining the Bitget, Mastercard and Immers -wallet strengths, this zero tariff crypto payment card offers consumers the ability to use their digital assets for daily purchases while maintaining control and transparency over their funds.

In addition, this movement underlines the rapid convergence of traditional finances and the digital asset ecosystem, indicating a significant step towards the normalization of cryptographic payments in the global economy.

The future of cryptographic payments

The introduction of the Bitget wallet crypto payment card can pave the way for a broader adoption of cryptography as a legitimate currency for daily spending, reducing dependence on fiduciary currencies while training users to take advantage of the complete usefulness of their digital assets.

As the global interest in cryptocurrencies and stablcoins continues to grow, initiatives such as this highlight the role Crypto will play in future financial systems, offering a safe, flexible and globally accepted payment alternative.

Consumers who seek to diversify how they use their cryptographic assets will find that this card is a practical solution, reinforcing the idea that cryptography is not simply for long -term trade or investment, but can also function effectively as a means of exchange.

Conclusion

The collaboration between Bitget Wallet, Mastercard and Immersve shows a future thinking approach for cryptographic payments, demonstrating how digital currencies can be integrated without problems in daily spending. This zero rate cryptographic card is not just a product launch; It is a significant milestone in the trip to the global adoption of cryptography, falling the gap between traditional financial systems and the future of digital finances.

As consumers require greater utility of their cryptographic assets and regulators, they press for compliance, solutions such as this will play a fundamental role in the configuration of how cryptographic are transformed from speculative investments to daily tools for financial empowerment.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.