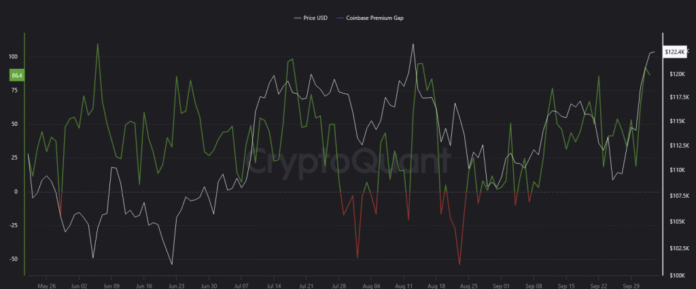

Bitcoin is currently negotiating around $ 123,000 with a signal from the latest blockchain data to American institutions has again requested money; According to the cryptocurrency platform, the price of the price purchase of the premium Coinbase gap-which follows the difference in the cost of buying Bitcoin between the most important cornerbase and the world platform-to more than $ 86.4.

The positive purchase cost difference means that Bitcoin is sold at a higher price through the Coinbase – known to be attracted by investment establishments and the entities subject to organizational supervision – compared to the rest of the platforms, which generally means stronger American demand with the movement of investment funds and active managers to buy.

In a simpler sentence, this means that senior buyers are ready to wear a higher cost to buy bitcoin, which suggests their growing confidence in the long -term horizons of money.

Historically, these notable differences in the price difference are played on the Quebis platform because its role of introduction to strong launches, because institutional investments are flowing towards the rest of the platforms are becoming rare, which open the way to imminent inhabitants, and the data coinciding this time with the stability of the entry of Bitcoin market institutions at the highest level of $ 120,000 market institutions for possible preparation.

- Coinbase premium price difference exceeded 86.4, indicating the increase in purchase activities using the American dollar currency (USD).

- Bitcoin exchanges recently set around $ 123,000 after a major resistance barrier entered.

- Institutional investment is in accordance with the momentum of October “Uptuber”, the month of altitudes, which generally lifts the last quarter.

Technical perspectives for the expectations of bitcoin prices

Technically, the expectations of Bitcoin prices remain a strong increase after its recent success by hacking the barrier of $ 119,500, continuing to maintain the top of the pair of the simple means movement of 50 and 100 days (DMA-50 and 100) at $ 115,013 and $ 114,523, respectively, in the middle of the signal of the signal to the continuous acquisition of the moment.

However, the plans also show the formation of the motive of the horizontal and consensual butterfly, which often indicates the drain of purchasing power near the target of the launch.

If the price of bitcoin continues to increase, the next resistance barrier will face $ 12,600, with a PRZ reflection area in a range of $ 128,000 to $ 130,000. As the price is approaching, currency passes can lead with a more purchase – due to the relative reading of the reading of the power index (RSI) 73 – a wave of temporary sales to make profits.

While the latest trading candle models suggest caution, in particular with the appearance of lower-size candles and an extending the tail to the top, which can indicate a frequency with the approach of the target of the height, and perhaps it will decrease below $ 12,1140 or re-tester the level of pressure of $ 118,500 with the possibility of contacting $ 115,000 with the increase in sales pressure.

Market prospects: institutional investments strengthen confidence

Despite potential correction waves in the predictable term, the general mood remains positive; The continuation of the institutions to be purchased and the increase in volumes of ETF Pitcoin Spot, and the improvement of incoming liquidity is considered a long -term bitcoin part (Bitcoin) in the long term, and the gap of fiftes – which is often considered as a major indication – improves the idea that professional investors continue to collect assets of currency quietly in the preparation of their next start.

If the price of Bitcoin stabilizes more than $ 120,000 and institutional demand increases, it could push to test $ 128,000 -1330,000 $ at the end of the year, while success in the hacking of this range will allow it to reach new higher levels, and perhaps obtaining other remarkable achievements in terms of institutions.

Maxi Doge-Maxi

Maxi Doge is an MG currency specially designed for persistent investors looking for a tool that allows them to double their earnings by approximately 1,000 times; It is more than another motto MM, but also represents a societal culture which combines commercial density, the athlete, the stimulants and the competitive spirit.

Once Doge Maxi are purchased and kept, investors include exciting mortgage yields, participation in commercial competitions and access to exciting activities through partners, and to strengthen confidence in project foundations, the intelligent contract has been successfully subjected to the careful examination of solid and coinsults.

Currently, the project has a strong dynamic, proof that the result of its subscription – which is currently sold for only $ 0,000260 – is more than $ 2.7 million, knowing that the price should increase with the progress of subscription stages, which makes early participation the best choice to harvest the strongest gains.

Maxi Doge will get:

- Mortgage bonus in the form of annual yield change.

- Commerce of competitions with prices against exporters.

- Societal events with partners and a future accommodation of exciting events.

You can buy Maxi Doge by visiting the official site of the Maxi Doge project and the use of Ethereum-Eth or Binance-Bnb or Tether-USDT or USD Coin-USDC to buy, or even by Visa and Mastercard.

لزيارة الموقع الرسمي لاكتتاب ماكسي دوج (Maxi Doge) اضغط هنا

The expectations of Bitcoin-BTC Bitcoin-BTC prices: the $ 113 Coinbase price suggests a solid institutional collection in preparation for the penetration of the highest levels recorded appeared first on Arab Cryptonews.