Bitcoin was exchanged on Wednesday September 17 at around $ 115,930, down 0.7% in the last twenty hours, the traders absorbing the first reduction in the interest rate of the Federal Reserve for almost a year.

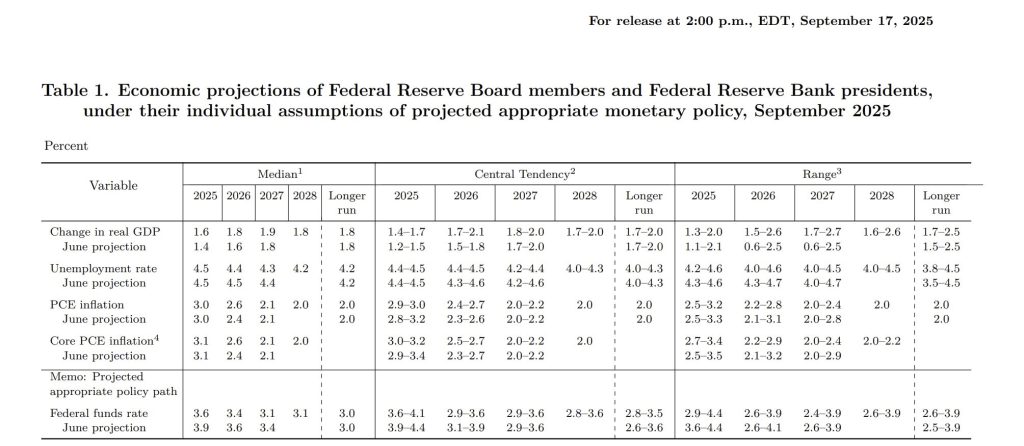

The Federal has reduced the basic interest rate on federal funds of 25 basic points to reach a beach between 4.00% and 4.25%, a decision which was widespread after months of slowdown in the labor market and the survival of inflation is high.

On this subject, Federal President Powell said that the decrease was within the framework of “risk management”, and that is why the federal adopts a data -based approach.

The latest estimates indicate that GDP in the United States will increase by 1.6% in 2025, while unemployment will increase to 4.5%, provided that inflation is gradually decreasing to 2% by 2028. Although Powell declarations have calmed certain investors, the markets have shown remarkable volatility once its press conference has been launched, in a tension. uncertainty.

Rupture: Fed cut rate of 25 SBPS, bringing the 4% target beach – 4.25%.

“F * CK you have. Jerome Powell, FOMC September 17, live. pic.twitter.com/6rh291atds– Carl ₿ Menger

(@Carlbmenger) September 17, 2025

For Bitcoin, which is already with high risks and a means of infection by inflation at the same time, the future way depends on how to reflect the transition to the facilitation of the price movement.

A useful chain model prevents the pressure on buyers

Bitcoin has been formed the elevated artistic chain model, which is a descending model of continuity which generally appears when the increased momentum decreases.

After having failed to resist the resistance level $ 117,300, Bitcoin is currently testing the $ 115,800 support area supported by the simple average movement for 50 periods, in addition to the minimum expansion.

The drop in the RSI index (RSI) below 50 reflects the extent of the drop in the momentum, while the last small candles indicate prudence and market frequency.

#Bitcoin Negotiate nearly $ 115.9,000 after the drop in prices of the Fed 2025.

On the 2 hour graph, a first amount is tight.

$ 115.8K = key support.

Lose it → Slide around $ 114.4K / $ 113.2K. pic.twitter.com/5vjrmvkvcl– Arslan Ali (@Forex_erslan) September 17, 2025

In the event that sellers are checked, TradingView provides for about $ 114,400 with the probability of losses at $ 113,200, where the simple medium movement meets 200 periods with a previous request zone; Confirmation of the emergence of the “three black crows” model is reinforced in terms of continuous support.

However, buyers are still present in the arena, and if Bitcoin maintains $ 115,800 and closed with a growing candle or a hammer in support, this can follow a clear rebound. As for the penetration of $ 117,300, the downward pressure will be invalidated in the short term, and the road opens on the targeting of $ 118,500 and $ 119,350.

Expectations: Can Bitcoin penetrate higher levels?

For merchants, the level of $ 115,800 is a separate limit. If the price is increasing it, the market will start to collect and open new purchase offers around 118 thousand and up to 119,000 dollars. If it is broken down, it is expected that a deeper correction occurs, so that the wider image that shows a higher background during the cycle should take charge of the emerging long -term direction.

RSI <50 shows Momntum discoloration. If BTC defends $ 115.8,000 and breaks $ 117.3K, the path opens $ 130,000 in the coming months.

– Arslan Ali (@Forex_erslan) September 17, 2025

If the interest rate of the federal reserve interests is in accordance with the year 2020, the bitter monetary policy has contributed to triggering one of the most powerful waves of Bitcoin, because the market can attend a new wave of institutional demand.

In such a situation, Bitcoin could succeed in overcoming the level of short -term resistance, heading with a stronger momentum to a region of $ 130,000 in the coming months.

As for investors, daily fluctuations are not linked to short -term noise as much as they aim to prepare for the potential role of Bitcoin in the next phase of expansion of global liquidity.

Bitcoin Hyper-Hyper, which combines Bitcoin and the speed of the Blockchain Solana

Bitcoin hyper seeks to put itself as the first Bitcoin (layer 2) which depends on the Solana Virtual Machine-SVM. On the other hand, the project aims to extend the bitcoin technical system by allowing fast and low -cost intelligent contracts, decentralized applications and even the launch of MC letters.

By bringing together between the safe safety of Bitcoin with a high -performance Solana framework, the project opens the door to completely new use cases, including the fluid connection of Bitcoin and the development of expandable decentralized applications.

For its part, the team focused on the workers of trust and expansion, because the project underwent an audit of Coinsult, which gives investors confidence in its foundations.

In the same context, the momentum increases rapidly, because the first subscription exceeded $ 16.5 million, and only a limited number of digital currencies are available. Bitcoin hyper costs only $ 0.012935 at the current stage, but this number will increase with the subscription procedure.

Finally, you can buy Bitcoin Hyper on the Official Bitcoin Hyper website using digital currencies or bank card.

Click here to participate in the subscription

Does the expectations of Bitcoin-BTC prices: after about a year, does the reduction in federal interest lead to an explosion similar to the year 2020? APPLERDIRST on Arab Cryptonews.