Analysts believe that “the price of the price to stay above the average cost of short-term currency owners during this volatile and unconfirmed period is a constructive signal, indicating that the bulls (rackets on the height) are always in control and that the basic momentum can remain biased towards the ascending direction”.

The price of Bitcoin currency increased to exceed $ 107,000, which puts the vast majority of investors to the possibility of reaching profits, because total unreasonable gains amounted to $ 1.2 billion, according to the BlueCinode data platform.

Bitcoin is currently negotiated at $ 109,716, after its price has increased by 2% in the last 24 hours, because the market is witnessing a slight increase in general, with almost all the currencies recorded positively when writing these news.

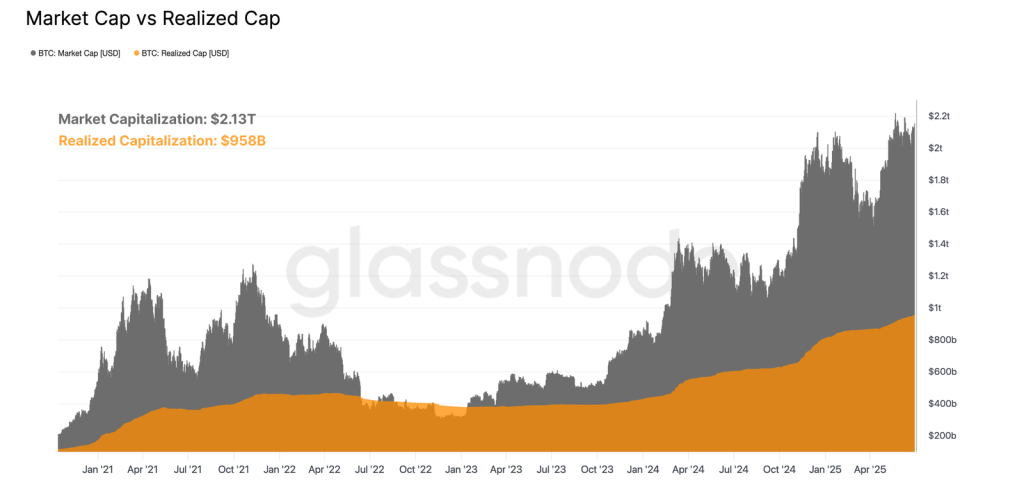

Given marketing value and precious value, Glassnode monitored “great growth” during this session. The market value increased from $ 304 billion to $ 2.13 billions of dollars, while the value achieved increased from $ 400 billion to $ 955 billion. Glassnode says that “these two tensions together confirm not only the enormous capital invested in Bitcoin, but also maturation as a digital actor whose market value exceeds several dollars’ billions”.

AS $ BTC Rebounds at $ 107,000, most holders are back in profit. But distribution remains the mode – investors hold. The profits made decrease, the LTH of the supply strikes ATH, and the ETF entries are strong. Learn what to do with it in the last week to the channel: pic.twitter.com/g5oivhk8ld

– Glassnode (@glassnode) July 2, 2025

In addition, the total unreasonable profits are currently 1.2 billion of dollars, which indicates “the great increase in the value of bitcoin” whose investors have witnessed, as well as “the possibility of selling a sale in the event of a general mood of the market”.

On the other hand, the average unreasonable benefit is greater than 125%, and the report indicates that Bitcoin investors “can make great profits”. However, this number remains below the profit rate of 180% in March 2024 when the price recorded its highest level at $ 73,000 and in December 2024 when it reached $ 107,000.

As for the daily benefits made, it currently represents around $ 872 million, which represents less a number compared to the benefit previously achieved at 2.8 billion dollars and $ 3.2 billion during the mentioned increase.

It should be noted that the report indicates that recent declines have not “considerably affected investors’ profitability” and that evaluation forms show the possibility of profit for profits for Bitcoin owners, regardless of the duration of their possession.

This market increase comes several days after successive decreases – and if it was relatively light – the Israeli attack on Iran, which caused the victims and the agitation of the conflict in the region.

The Glassnode platform believes that the effect of geopolitical events on the pancake market maintains the risk of decline. Nevertheless, the decline in tensions between the two countries has helped stabilize the general mood of the market and support the resumption of prices.

In addition, analysts believe that “the price capacity to remain above the average cost of short-term currency owners during this volatile and unical period is a constructive indication, which indicates that the bulls (height speculators) are always in control and that the basic momentum can remain an bias towards the upward direction.”

The expected increase in market fluctuations pushes investors to maintain Bitcoin currency (Bitcoin)

Gadi Chait – Head of the Investment Department in Xapo -Bank of Glassnode Platform Data, saying: “Bitcoin indicators continue on Bluecchin by showing the strength of its current position on the market.” He added in an email that the high percentage of bitcoin, profit, reflects “the extent of the force of the last rising momentum”.

But it is warned at the same time that the high levels of profit are generally followed by an increase in market fluctuations, and it explained: “Historically, the higher the proportion of the supply of profit, the higher the possibility of profit, which leads to short -term price movements even in the light of a general positive vision of the market.”

On the other hand, the Glassnode report has revealed that the behavior of investors – despite the high profit rate – clearly tends to follow the long -term conservation policy, and the report declared that the current price level does not seem sufficient to stimulate significant profits, which is confirmed by several indicators, in particular: the decrease in the unprecedented levels.

The drop in sales pressure is clearly obvious in data related to the total long -term category supply, which has recorded a new record of 14.7 million Bitcoin currencies. “This indicates that long-term conservation is always dominant behavior on the market, because assembly operations and assets are remarkably exceeding sales pressures”, the Glassnode platform has declared that long-term retention is always the dominant behavior on the market, because assembly operations and assets are considerably marked on temporary pressure, “and the behavior of this category supports this argument; This category has again reduced the frequency.

Finally, reading the level of activity (lionlelines) recorded a remarkable increase when training the two highest previous price levels in Bitcoin, in an indication of the sale and increasing profits on the market. However, the index has decreased during the highest price levels, which supports the hypothesis that long -term retention (TAS) is always the dominant behavior of investors, and that stimulation of a new sales movement may require a greater increase in prices.

The Bitcoin-BTC recovery position returns the price of the profit zone, appeared first on Cryptonews Arabic.