The Bitcoin price is experiencing a change in dynamics with increasing institutional investment flows, corporate adoption, and the emergence of favorable technical indicators. Spot Bitcoin ETFs attracted $1.42 billion last week, marking their biggest rise since October, while companies like Steak & Shake added $10 million to their holdings.

As the price holds near $95,000 in a bull flag pattern, traders expect a breakout towards $100,500 as market confidence increases.

Inflows of $1.42 billion into exchange-traded funds (ETFs) mark strongest week since October

Bitcoin is seeing growing momentum thanks to a strong wave of institutional demand. Spot Bitcoin ETFs saw net inflows of $1.42 billion last week, their strongest performance since October. Midweek trading was particularly eye-catching, at $844 million on Wednesday and $754 million on Tuesday, according to SoSoValue data.

Bitcoin ETFs bought $1.42 TRILLION worth of BTC last week.

The highest influx week since October pic.twitter.com/Pt9eN01g6D– Maestro (@GoMaestroOrg) January 17, 2026

Ethereum ETFs also joined the rally, attracting nearly $479 million in weekly inflows. Analysts believe this trend reflects the return of institutional investors adopting a buy-only strategy in the market via regulated financial instruments.

Blockchain data supports this narrative, showing a reduction in selling pressure from whales, thereby tightening the supply of Bitcoin.

- Spot Bitcoin ETF: $1.42 Billion in Cash Flow

- Ethereum ETF: $479M in Cash Flow

- Commercial pressure on whales: low supply

This combination of demand for ETFs and low selling pressure creates a favorable market structure. Even as short-term volatility persists, fundamental demand from institutions is boosting Bitcoin’s long-term outlook.

Restaurant chain Steak ‘n Shake has added $10 million in Bitcoin to its investment strategy.

Outside of Wall Street, major companies are ramping up their Bitcoin strategies. Fast food chain Steak & Shake purchased $10 million worth of Bitcoin a few months after accepting Lightning Network payments at all of its US branches. This approach is self-reinforcing for the company: Bitcoin payments drive sales, cryptocurrency profits flow into its strategic Bitcoin reserve, and those funds are then reinvested in restaurant development.

ALL YOUR TAX REDUCTIONS BELONG TO US – AYB. pic.twitter.com/JVnxbsFY03

– All your bases belong to you (@AllYourBase_AYB) January 17, 2026

Since Bitcoin’s adoption in May 2025, sales at existing branches increased 10% in the second quarter, while payment processing costs fell 50%. The company also added Bitcoin-inspired items to its menu, highlighting how major companies are integrating digital currencies into their daily operations.

US government holds 328,000 bitcoins worth $31 billion

Speculation about Bitcoin sales by the US government ended when the Department of Justice confirmed that it had not liquidated Samurai Wallet’s assets. Instead, the confiscated bitcoin remains held in the Strategic Bitcoin Reserve, in accordance with President Trump’s executive order requiring its preservation.

NEW:

DOJ confirms Samourai wallet $BTC was not sold by the US government.

The executive director of the President’s Council of Advisors on Digital Assets says the assets will remain on the federal balance sheet as part of the strategic plan. #Bitcoin Reserve. pic.twitter.com/kzGdUsOdMA– Bitcoin.com News (@BitcoinNews) January 16, 2026

The United States currently owns more than 328,000 bitcoins worth $31 billion, making it the largest sovereign holder in the world. This assurance reduces fears of government selling pressure and reinforces the idea of Bitcoin’s scarcity, a key factor in building institutional trust.

Bitcoin Price Forecast: Flag Pattern Indicates Breakout of $100.5K Level

Forecasts on the charts indicate an upward trend in Bitcoin price as the price stabilizes in a flagging pattern after rising from $90,000. The price is currently trading near $95,030, just above the support level at $94,357. The Spinning Top candle indicates a state of hesitation and not weakness. The RSI at 54.11 remains positive and the short-term EMA is above the long-term EMA, which is a bullish signal.

A break above $95,204 could lead to a move towards $97,700, then $99,000, up to $100,500. Ethereum and Solana are also showing bullish signs, indicating overall market strength.

As ETF flows increase, corporate adoption grows, and technical indicators align, Bitcoin’s trajectory toward price levels above $100,000 appears more credible. For traders and investors, this may be a good time to invest before the next bullish wave.

Bitcoin Hyper: Is this the next evolution of Bitcoin on the Solana platform?

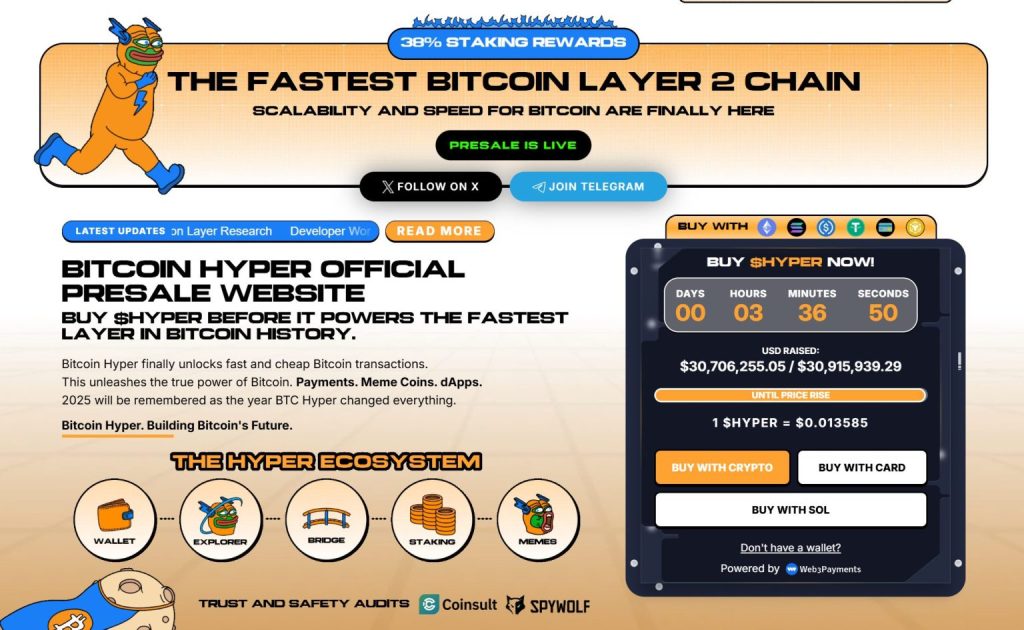

Bitcoin Hyper ($HYPER) brings a new phase to the Bitcoin ecosystem. While Bitcoin remains the benchmark for security, Bitcoin Hyper adds what it has always lacked: Solana-like speed. The result: super-fast and inexpensive smart contracts, decentralized applications, and even the creation of meme-specific cryptocurrencies, all secured by Bitcoin.

The project, which was audited by Consult, focuses on trust and scalability as demand increases. The project has already achieved strong momentum, with the presale value exceeding $30.7 million and the token price standing at just $0.013585 before the next increase.

With the increase in Bitcoin activity and the high demand for powerful applications based on it, Bitcoin Hyper is emerging as a bridge between two of the largest cryptocurrency ecosystems. If Bitcoin laid the foundation, Bitcoin Hyper can make it fast, flexible and fun again.

Click here to participate in the presale

The article Bitcoin Price Expectations: Exchange Traded Fund (ETF) Value Rises to $1.42 Billion, Pushing It Toward $100.5 Thousand appeared first on Cryptonews Arabic.