The idea of using Bitcoin -BTC as one of the assets of the strategic reserve was an additional momentum, as a luxury cosmetics company (Evertz Pharma GmbH) – and its head office caught the attention this week after announcing a daring value of $ 10.8 million in BTC (10 million dollars) with a value of around 10 years. Assets at remarkable levels, becoming the first German companies to adopt the strategy to include Bitcoin to the assets of the strategic treasury.

The executive directors of the company underlined their long -term commitment to this approach, because the administrative director Dominic Evertz explained that Bitcoin is compatible with the future objectives of the company, while the main employees of the financial management of Tobias Evertz have confirmed the intention of the company to continue to allocate certain benefits to buy additional Bitcoin balances.

Just inside:

Evertz Pharma Beccomes First Company in Germany to buy Bitcoin for his record

pic.twitter.com/jcpkh2qth2

– Bitcoin Magazine (@bitcoinmagazine) June 11, 2025

This step contributes not only to the strengthening of the company’s financial power, but also indicates the growing interest of European companies in the dramatic of the sector. These developments arise in the midst of a general orientation of companies. The BTC is digital gold and a way to hide from inflation, which makes it possible to continue their price due to the increase in its specialized surveillance of long -term investment.

Trump’s agreement with China opens appetite for investors for risk, and therefore bitcoin possession

The geopolitical conditions have provided an additional favorable atmosphere for the price of Bitcoin with the announcement by American president Donald Trump of the social platform Truth to complete the expected trade agreement with China. The agreement is waiting for the approval of the Chinese president Xi Jinping, and it has been reported that it stipulates the reduction of customs prices for specific material exports, after having reported the approval of trade officials of the two countries.

RUP:

Trump says the commercial agreement with China is done

Markets likely to react strongly! pic.twitter.com/awvibnj3x– Dustybc Crypto (@thedustybc) June 11, 2025

After publishing this news, the price of the BTC / USD pair reached $ 110,300 yesterday, but it quickly decreased to around $ 109,560. These developments occur after months of serious price fluctuations which caused the previous threats of Trump to customs duties, which reduced the price of the BTC to $ 74,434 for a short time.

The completion of the agreement has also led to a reduction in macroeconomics risks and strengthened the positive mood of stock markets and digital currencies. Analysts stressed that the decline in the severity of international trade tensions encourages the price of bitcoin, which can allow it to re -test – or until it exceeds – its highest levels of all time, in particular with the relative stability of the development of macroeconomics.

The price of bitcoin succeeds in maintaining a significant level of support in the context of inflation data anticipation

Although the slight BTC price has decreased by 1.4% in the last 24 hours, the examination of technical analysis indicators improves optimistic expectations of the stable price at the time of writing at $ 108,610. In addition, the two -hour price lesson examination shows the most important indicators compatible with support levels, which are: 50 SIA average days (EMA 50) at $ 108,123, the upward trend line and the Fibonacci correction level approximately $ 108,595.

The negotiation candles suggest the lack of momentum, in particular after the failure of the price by exceeding the barriers of $ 10,355 and $ 110,574, and the management of the MacD index is far from its counterpart to indicate, continuing its decline, in an indication of the weakness of the current path. However, the opportunity is always available for bulls (height speculators) for the initiative. If the price is at the highest level of $ 10,100, the possibility of its size remains very high.

Short -term trading parameters:

- Entrance: By breaking the barrier of $ 10,800 and forming a promising trading candle

- Stop losses: Less than $ 107,950

- The first target: $ 109,355

- The second target: $ 110,574

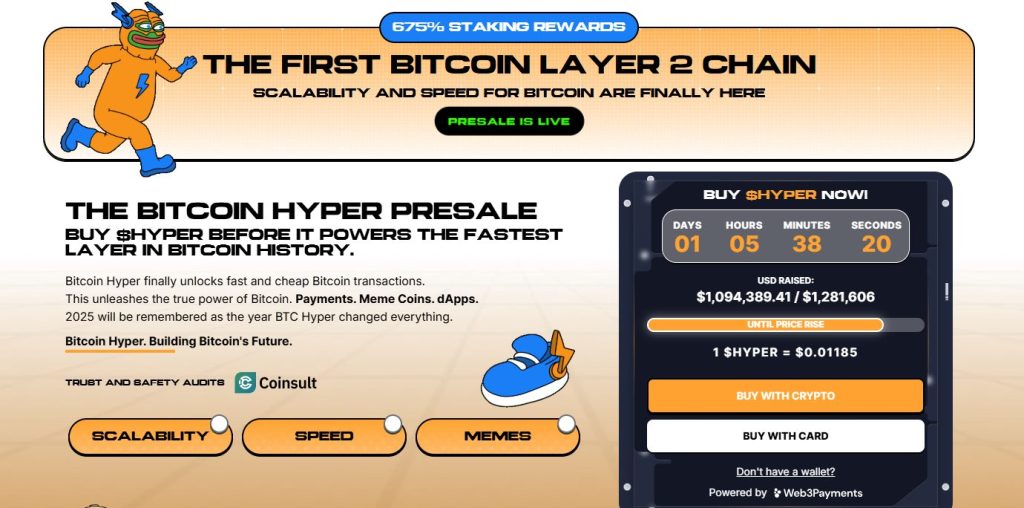

Hyper Bitcoin subscription prospects exceed a panel at a million dollars in the middle of the second layer to resolve a moment equivalent to obsession

Bitcoin Hyper (Hyper) has managed to collect funding exceeding a 10 -dollar panel, which increases its result to $ 1,144,523.66 compared to the current step of $ 1.28 million. And given that a few hours remaining at nothing of the increase provided by the next step, a narrow time window remains for investors to buy its promising currency hyper at its reduced price of $ 0.01185.

The project – which is provided for the first second layer solution to Bitcoin Bluechen and is compatible with the Virtual Machine SEVM (SVM) Assistance of decentralized requests (DAPS), MC currencies and payment activities.

Given the success of the hyper bitcoin by transmitting Coinsult and confirming its reliability, speed and expansion, more than 81 million hyper curls have been mortgaged to receive exciting annual mortgage (APY) of 648% which will be distributed after launch, and its use allows the payment of fees to complete transactions, to use decentralized applications and to participate in the project of the project.

After accepting the subscription, the exchange of digital currencies and the use of a visa and a Maskertard to buy thanks to the third web payment mechanisms (web3), no need to use the cryptographic portfolio. Finally, this project combines the boom of the mines of currencies and various practical uses, naming it to provide the best second layer solutions of all time in 2025.

The expectations of the Bitcoin price with a level of $ 110,000 and has made Evertz and Trump increase positive impetus appeared first on Arab Cryptonews.