The Bitcoin-BTC price has recently increased to exceed $ 104,000 and approach a very important level of resistance, while influential voices, such as Robert Kiyosaki-Urged to move away from traditional currencies, where the author of the book “The Rich Father and the poor father” encouraged investors via X (Twitter) to leave “False Money” and the Directorate of Actives such as Bitcoin, Gold and silver.

Kyusaki expected the possibility of Bitcoin to reach a million dollars by 2035, adding momentum to the current emerging movement, which witnessed the Bitcoin price of around 8% in last week. This optimism favorable to the price of Bitcoin is in accordance with the Kyusaki belief farm in digital assets as a means of coverage, because young people and old investors are attracted to bitcoin thanks to its decentralized nature, fixed offer and an accumulation of pressure on the US dollar.

Robert Kiyosaki dit de ditch “ false money ” for bitcoin, gold and silver

#Cryptonews #Bitcoin https://t.co/cdvqvatvhhh– crypto whispers (@crypto_whispers) May 10, 2025

Basic factors affecting the high price of Bitcoin:

- Optimism in American trade and imports circulating on the stock market contribute to the promotion of the increase in momentum.

- Kyusaki’s anti-transitional money position contributes to the promotion of Bitcoin call as a means of covering yourself against inflation.

- The characteristics spread over the price of bitcoin of a million dollars by 2035.

Optimism in American-Chinese trade encourages risks and increases the demand for bitcoin

The high price of bitcoin can also be awarded to the positive developments that take place in American -Chinese trade relations, as President Trump has participated – since May 10 – news for optimism concerning commercial talks between the two economic giants and suggest that an agreement reduces geopolitical pressures; This optimism has extended to global financial markets, including Bitcoin, which generally responds positively to the mood of demand for risk.

Bitcoin increases towards a new record after Trump suggests positive progress with China!

Global tensions reduction + increasing institutional dynamics.

Bulla Run loop-up-up is just beginning.pic.twitter.com/0jpxnd8x8

– Shield (@ShieldMetax) May 11, 2025

These developments indicate the advantage that the price of Bitcoin has grasped following the growing resentment of traditional financial systems and general economic optimism according to which world trade can be recovered.

- The high price of Bitcoin is allocated by the positive developments of American-Chinese business conversations.

- President Trump optimistic on a trade agreement that supports the financial markets, including Bitcoin.

- Bitcoin benefits from an objection to traditional financial systems and general economic optimism.

The participation rate of investment companies provides strong support

The price of Bitcoin of $ 104,000 reflects a solid participation rate by companies, because the Ishares Bitcoin Trust (IBIT) box (BlackRock) recorded a clear net importation of more than a billion dollars indicating the growing interest of adult investors in Bitcoin. This is part of a more extensive movement in which loyalty and 21 Bitcoin ETF shares (affiliated with ARK) is estimated at around a billion dollars last week; These figures suggest the management of major investors towards bitcoin as long -term strategic active.

- The Black Rock Fund negotiated on the Stock Exchange leads to imports by recording $ 1 billion.

- The participation rate of companies contributes to the growth of long -term Bitcoin.

- The circulating boxes on the stock market received approximately a billion dollars in a week.

Blackrock #Bitcoin ETF: 19 days of straight entries#Ibitit Just locked $ 356 million on May 9 – more than $ 1 billion this week

It’s 19 green days and count.$ BTC Above $ 100,000

Accumulation

Ibit crowned “Best New ETF”

$ 1 M $ BTC?? Suddenly not so crazy … pic.twitter.com/uaw25mu4oa

– Blok Topik (@ bok2in) May 10, 2025

Technical analysis of the price of bitcoin: important follow -up levels -Up

Bitcoin is negotiated at $ 104,276 below the Fibonacci Extension level 2.618 to $ 105,250, which is an important obstacle which represents a potential area for merchants to make rapid benefits. The extension of 2.786 will be targeted at $ 106,864 if this resistance exceeds, and therefore the possibility of reaching gains of 2.5%, but the first signs of the MacD intersection suggest the possibility of slowing the momentum with a drop in the short term.

Trading parameters suggested:

- Buy above the level: $ 10,250

- Great benefits: At $ 106,864

- Stop losses: $ 103,681

Commercial strategy: You can buy BTC currencies after penetrating the barrier of $ 10,250, and the lens is the extension of $ 2,786 to $ 106,864, with an order to stop losses less than $ 103,681 to cover the extension of the decline wave, so that recovery under this level can increase a stronger correction wave.

Summary

Bitcoin has the ingredients necessary to obtain more gains in the light of solid institutional support, the demand for well -known bodies and growing hostility to traditional funds, and traders must be cautious as Bitcoin addresses significant levels of resistance; Attempts to carry out profits can cause short -term volatility, and the road remains $ 200,000, according to the demand of major investors and the general mood of the market.

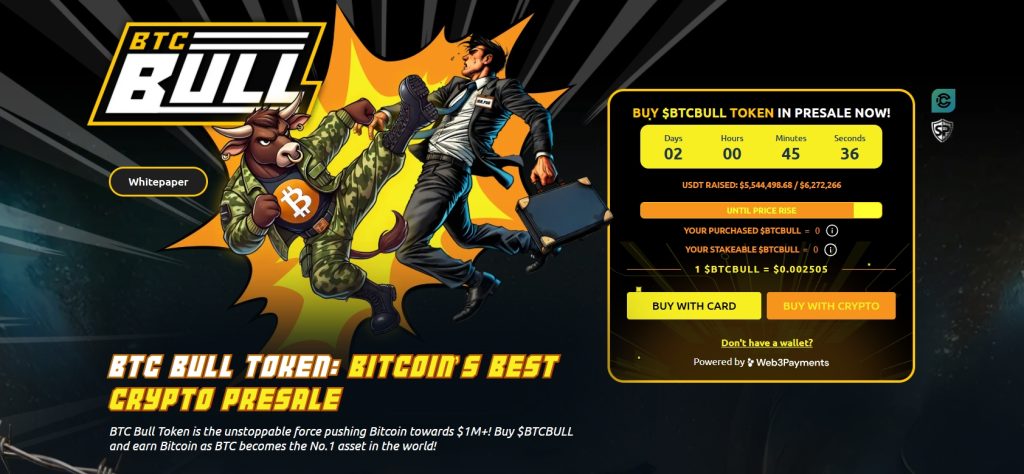

A flexible mortgage with a yield of 73% which attracts new investors and pays the results of BTC Bull to exceed 5.6 million dollars

BTC Bull (BTCBull) continues to take momentum, which has so far surmounted $ 5.6 million and approach its target of $ 6.27 million. BTCBull has proven more than MIM despite its low prices of $ 0.002505, because it offers real advantages thanks to the awards for the flexible mortgage.

Economic data derived from practical uses increase the demand for money

Unlike traditional MIM currencies, BTCBull has managed to combine the attractiveness of chipto cultivation with the revenues of the mortgage, because it allows its investors to currently win an annual return (APY) of the mortgage at a specified rate, to receive these unique mechanisms, in particular the approval of investors who seek a return to a stable sacrifice.

Current subscription data:

- The result: 5,581 603.93 USDT on 6,272,266 USDT

- The current BTCBull Prize: $ 0.002505

- Total mortgage complex: 1,429 405.316 BTCBull

- Expected return: 73% per year

The time remaining to participate quickly is about to stay with less than $ 700,000 to collect it only to recover it before the date of the end of the subscription, because the BTCBLL currency is an ideal option for investors who seek to obtain high yields while benefiting from the flexibility of the withdrawal during the Crapeto cycle for the year 2025.

Follow us via Google News

The expectations of the Bitcoin price: Kiyosaki urges investors to replace BTC currencies “false silver” in the light of its price historically approaching its highest level – can it reach $ 200,0000? APPLERDIRST on Arab Cryptonews.