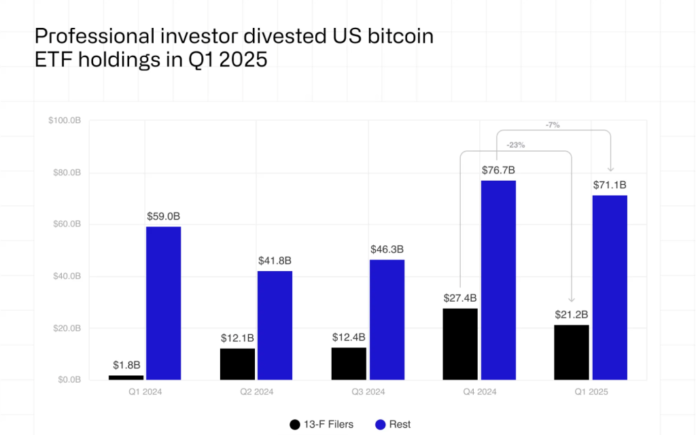

Bitcoin has witnessed a volatile start for June, while investment funds circulated for Bitcoin (ETF) recorded its first quarterly decline since its appearance on the American market. According to a report published by Coinshares, Bitcoins de Bitcoin went from $ 27.4 billion in the last quarter of 2024 to only $ 21.2 billion in the first quarter of 2025, a drop of 23%.

Although the price of Bitcoin decreased by 11% was a major reason for this drop, the report also indicated a significant activity in sales by major managers of the governor.

It should be noted that despite this drop in the trend, some financial advisers have slightly increased the size of their investments in Bitcoin, indicating the presence of a certain firmness and confidence in a certain group of investors. But the general trend between institutions now tends to move away from rapid speculation and focus on Bitcoin long -term retention as a strategic origin, especially among large companies.

The drop in pressure has increased after huge flows of the Ishares Bitcoin Trust (IBIT) box came out of the 430 million Dollars BlackRock Company in just one day (May 30), which is the biggest negative daily flow since the launch of the box. This ended a series of positive flows that lasted 31 consecutive days, which raised fears of the wave of sales on the market.

The mask and Trump dispute explodes a wave of sales on the digital currency market

Fears on the market have worsened after the public dispute between US President Donald Trump and Elon Musk turned into a crisis that affected high -risk assets. History began with a controversial bill of expenses in the congress, but things degenerated when Musk called for Trump’s resignation and agitated to seek his isolation, while Trump responded, considering the bill as a historical success to reduce taxes.

Trump prices will cause a recession in the second half of this year https://t.co/rbc11iyne

– Elon Musk (@elonmusk) June 5, 2025

This public dispute has increased investor tension, in particular with previous rumors about the possibility that Musk joins the Trump team to formulate technological policies for 2025. Due to this political tension, the digital currency markets have experienced a wave of reluctance to risk quickly.

This was followed by more than $ 831 million in digital currencies, and sales centers were responsible for $ 765 million in this total amount.

More than $ 800 million liquidated in crypto in the last 24 hours

More.

The increase in liquidations reflects extreme volatility of the market and relaxation of rise.

Source: Coringlass pic.twitter.com/hmofvtr7lw– Crypto Town Hall (@crypto_townhall) June 5, 2025

The “fear and greed” index of Bitcoin also decreased from 62 to 57, which reflects the transformation of the market into caution. The price of Bitcoin has decreased below the level of $ 102,000 and is currently exchanged nearly $ 101,500, with a loss of around 3.16% in just 24 hours. Ethereum and alternative currencies have followed the same path, which increased the size of losses on the market in general.

Can Bitcoin recover in the middle of the opposite winds?

Despite the panic wave, some analysts believe that this decrease can be a strong opportunity to buy in the long term, especially if Bitcoin repeats the performance of gold in times of economic recession.

This comes in conjunction with musk warnings that the customs functions imposed by Trump can push the American economy to stagnate in the second half of 2025, which could again open the door to the origins of Safe Haven as Bitcoin.

Main technical levels:

- Resistance: $ 102,178 → $ 103,127 → $ 104,561

- Support: $ 100,766 → $ 99,807 → $ 98,772

Prepare an agreement for new traders:

- Stripping scenarioClosing the price of more than $ 102,178 can pay a test of $ 103,127.

- The downstream scenario: Break the level of $ 100,766 can open the way to a drop of approximately 98,772 dollars.

Until fluctuations calm down, it is recommended to be careful. However, the increased use of Bitcoin can be provided as an asset of the Treasury by companies a long -term support base, even in the light of the outfits of institutionalized investment funds.

BTC Bull pre-reference approaches its target of $ 7.91 million with attractive annual storage awards of 61%

With the stability of bitcoin around the level of $ 102,000, many investors began to turn their attention to alternative currencies, in particular the BTC Bull ($ BTCBLL). The project has so far raised around $ 6.85 million on a funding target of $ 7.91 million, which means that less than a million dollars separate us from the high price of the code in the next step. The current price of $ 0.00255 is expected will increase as soon as the coverage is finished.

The BTC Taurus value is directly associated with Bitcoin via two basic mechanisms:

- Free Bitcoin distributions for pre-salers participants.

- Automatic combustion mechanism for symbols at each height of $ 50,000 at Bitcoin price, which reduces the $ BTCBLL negotiation offer.

The code is also characterized by an annual yield of 61% and contains more than 1.73 billion icons, and provides the following:

- There is no seizure or costs

- Complete liquidity

- Stable negative yields, even on volatile markets

This storage model attracts the two decentralized financing professionals (DEFI) and beginners looking for a negative income without problem.

With only a few hours of remains and access to maximum financing, the momentum increases rapidly. BTCBull mixes the value associated with Bitcoin currency, rarity mechanisms and elastic storage, which contributes to a sharp increase in demand. In front of the first buyers, a limited time to enter before activating the next level of pricing.

The expectations of the Bitcoin price: liquidation of $ 831 million due to the mask and Trump dispute that shook the markets appeared first on Arab cryptonews.