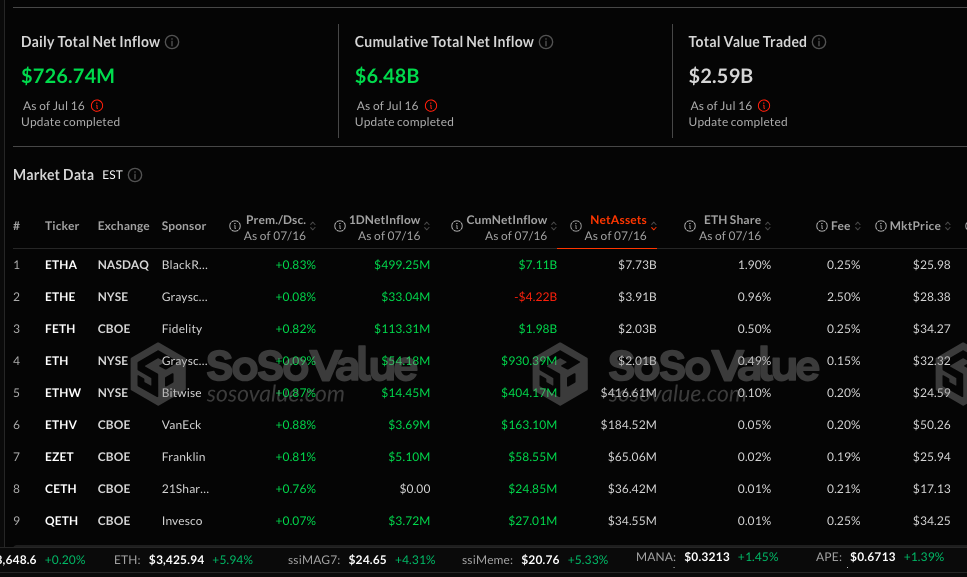

ETFE ETHEREUM ETHERE ETFS boxes have experienced investments of more than $ 5.5 billion since its launch, with more than $ 3.3 billion since April.

The Bloomberg ETF analyst – James Sefart – revealed in an article on the X platform on July 17 that these enormous investments are mainly due to the increase in Ethereum, to exceed 10% for the first time since December 2024, as well as an increase in open assets for the ETH Coin on the Chicago Commercial Stock Exchange (CME).

Part of this is almost in the center of pic.twitter.com/rxaoiglzh

– James Seyfart (@jseyff) July 17, 2025

The price of the Ethereum currency responded positively to this institutional purchase pressure, so it recorded its highest level in six months to $ 3,481.58, before settling at around $ 3,427 at the time of the editorial staff.

The Etha Fund of Black Rock leads the investments received from $ 489 million in a day

The data from the Sosovalue platform indicate that most of the investments came from the Ishares Etareum Trust (ETHA) fund (ETHA) of Black Rock (BlackRock), which made it the strongest daily performance at all by entering investments of $ 489 million on July 17, to attract $ 1.25 billion for the past five days. With this, the value of the current possessions of Ethereum Black Rock is around 6.94 billion dollars.

Blackrock Record Buy: Half USD-Eth-Eth-Eth-Eth

Blackrock has just set a new daily record, buying $ 499.2 million in one day yesterday.

Blackrock currently has $ 6.94 billion from Ethereum. pic.twitter..o1c2mnal6d– Arkham (@arkham) July 17, 2025

The momentum extended beyond the Black Rock product; All ETHERRUM (Ethereum) (Ethereum) (Ethereum) has recorded an unprecedented daily investment of $ 726.74 million, exceeding the previous 430 million dollars record.

Fidelity Fidity Fund contributed $ 113.31 million, while the gray level microcity added $ 54.18 million; It is the strongest performance for them for months.

Offers and request forces: ETFS Control ETFs, 4.02% of the total shopping value of the currency

The boxes in the circulation of ETHERE ETHEREUM boxes are currently operating around 5 million Ethereum currencies, which represents 4.02% of the total market value of the currency of $ 413 billion, and the lockers of Ethereum institutions are evaluated at $ 5.3 billion, and to buy currencies at a rate exceeds 36 times the daily production of ETH.

In a related context, the Ethereum funds investment funds scored the income of 12 consecutive weeks, including $ 996 million in only the last week. In addition, Sharplink Gaming – The largest company bought Ethereum – $ 68.4 million in the currency recently, increasing its total possession to $ 1.10 billion. At the same time, Bit Digital liquidated its full property of Bitcoin-BTC and reaffirmed these funds to buy Ethereum.

Wrap in our first store:

1,000,000 $ ETh pic.twitter.com/hzlwd4x2sp– Sbet (Sharplink Gaming) (@SharpLinkgaming) July 17, 2025

As for World Liberty Financial-Wlfi-associated with President Trump-It recently bought $ 4.99 million from Ethereum, and despite the low currency as a value of value due to its lack of rarity characteristic in the Bitcoin room (Bitcoin), however, its ability to provide mortgage yields makes it particularly attractive for certain institutions.

The new Crypto’s secret advice that has just dropped: certain ARENS SECURITIES PROSPERSET implementation activities – but not everyone on board. https://t.co/igzg1nm7zx – cryptonews.com (@cryptonews) May 30, 2025

The post of the American Committee on Securities and Trade (SEC) appears seems to be easier for mortgage services, which has encouraged more companies to include Ethereum in its treasure strategies without fear of organizational complications.

Analysts call $ 4,000 as a potential price target for Ethereum (Ethereum)

The crapeto and the partner on the OLX-OROWSED OKX platform-that the Ethereum price takes a path similar to the market cycle between 2016 and 2017, after recently exceeded a barrier of $ 3,200, a lawn plans to bounce around $ 4,000 soon, followed by a stronger growing wave.

History is not repeated, but it often rhymes. $ ETh Follows the same path as the 2016-2017 cycle.

Just escape over $ 4,000 and you will see an even greater slowdown. pic.twitter.com/ckwnxo7g19– Ted (@tedpillows) July 17, 2025

The famous Wintermute market manufacturer has indicated that the quantities of Ethereum are available outside the commercial platforms (OTC) have become very limited, which indicates that demand exceeds supply, which often leads to rapid price movements, which consider that many consider additional motivation to target the level of $ 4,000.

Technical analysis: an ascending channel that supports positive expectations

The graphic plan for the price of Ethereum / USD / USD / USD / USD / USD / USD / USD / USD / USD / USD / USD

The price continues to be negotiated over the Ishimoko cloud, which provides technical support around the level of $ 3,200, indicating a strong increase in momentum and clear support. Consequently, the technical analysis indicates two possible scenarios: the first is a slight decrease to the previous penetration zone (almost $ 3,400) followed by an emerging rebound, or the continuous height of the test of resistance between 3,519-3 664 $ $ $.

Ethereum at 9.65% of the massive gap at 4 years targeting $ 3,500 Beekend while BlackRock is 5 billion dollars and Sharplink explodes to $ 974 million in ETH portfolio.#Ethereum #Ethhttps://t.co/2eitkiqchw – cryptonews.com (@cryptonews) July 16, 2025

And as long as the price remains in the emerging channel and above the Ishimoko cloud style, the positive view remains, with potential targets in a predictable range between $ 3,650-3,664, but if the price drops below $ 3,300, this can cancel the emerging channel and reactivate the previous level of support at $ 3,300.

Shop investments exceeding $ 5.5 billion in Ethereum-Eth, can the price of money soon be $ 4,000? APPLERDIRST on Arab Cryptonews.