Chainbase, once promoted as the next Big Datafi revolution, has seen its long -awaited Airdrop and $ C Token list in the main exchanges followed by a rapid and acute decrease of 34% at a few hours after the release. The rapid fall has lit debates in cryptographic communities: is this a typical sale of the sale of subsequent air data, or indicates deeper challenges for the Chainbase ecosystem and its promises for the web3 data economy?

The launch that became a free fall

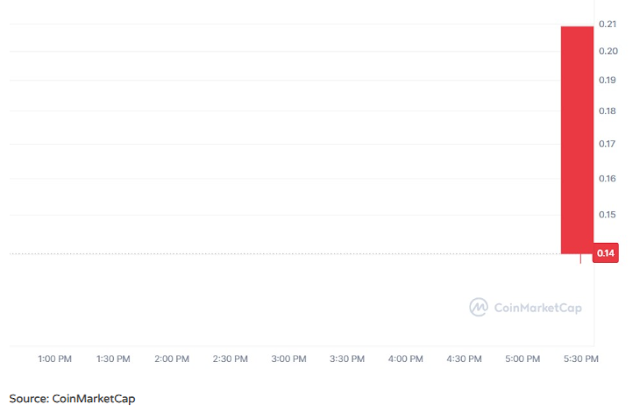

The token of $ C was launched at $ 0.20, backed by listings in Binance, Kucoin, Mexc and Bitget. The expectations were high, and the chain base was promoted as a fundamental player in the AI and Datafi sector, promoting the hyperdate network that promises to monetize data and democratize its use on web3.

A few hours after negotiation, the price fell to around $ 0.14, eliminating more than a third of its initial value. Despite an amazing 24 -hour negotiation volume of $ 525,500, which reflects a 19,833% increase in the activity, the sales pressure was implacable.

Industry analysts point out the structure of the Airdrop and the initial tokenomics as key drivers of the decrease. Chainbase allocated 3.5% of its total supply, equivalent to 35 million tokens $ C, to its Airdrop of season 1, distributed using a contribution score system aimed at rewarding shocking users instead of a mere wallet activity.

However, with 16% of the tokens supply unlocked in the launch and 750 tokens of $ C claimable by users through the alpha points of Binance, the sudden entrance of the free tokens in the wallets of the users translated into an immediate earning Price

| Source: x |

Why did Chainbase opt for this strategy?

The logic behind the Chainbase Airdrop was to start its ecosystem distributing tokens to active and committed community members while creating liquidity simultaneously in the main exchanges.

The Binance, Kucoin, Mexc and Bitget list provided global exposure and deep liquidity, essential for any project looking for significant adoption. However, with free claim events, the user’s incentives were misaligned with long-term possession, which caused the typical airdrop-to dump cycle that many tokens experience.

| Source: x |

According to the official statement after the launch of Chainbase, the team expected volatility, but continues to trust the fundamentals of the project, stating that “current price movements are driven by the market and do not reflect the long -term vision that we are building within the hyperdate network.”

General description of tokenomics: built for sustainability?

The token of $ C Chainbase has a total supply of one billion, with strategically designed assignments to support the growth and sustainability of the ecosystem:

-

40% for the ecosystem and community initiatives

-

13% for free reward incentives

-

12% for workers’ rewards

-

17% for the first sponsors

-

15% for central taxpayers

-

3% for liquidity provisions

While only 16% of tokens were unlocked in the launch, free tokens distributed to thousands of users created a significant sales pressure in the absence of immediate demand promoted by public services.

The real utility question: can Chainbase deliver?

The central question that Chainbase now faces is whether it can deliver utility that supports the sustainable demand of tokens of $ C. The Hyperdata network aims to allow users to monetize their data safely while allowing companies and models of AI to access decentralized data foods.

In a market that focuses more and more in cases of use of the AI block chain and the real world, Chainbase’s vision is timely. However, without active incorporation projects and real transactions that occur within its ecosystem, the Token runs the risk of being relegated to speculative trade without tangible backrest.

The first users who received Airdrop assignments will need to see incentives beyond speculative profits to consider or reinvest in the ecosystem. Whether they are rewards, governance participation or rates discounts within the hyperdata network, Chainbase will need to demonstrate a clear use of the real world to counteract the pressure of the downward prices.

Community feeling and market reaction

In social platforms such as X (previously Twitter) and telegram groups, community feeling is divided. Some early supporters express their disappointment due to the rapid decrease in the price, feeling that their air gains have devalued too fast. Others remain optimistic, seeing the lowest entry point as an opportunity to accumulate before the network matches.

In particular, several analysts in the chain argue that the decrease in prices was predictable, citing similar patterns in the recent Airdrop -based token releases where liquidity events eclipse the progress of the ecosystem. The success of $ C will depend on Chainbase’s capacity to go quickly beyond the initial distribution towards the real adoption of the user.

Price prediction for $ C: What follows?

Short -term perspective:

The $ C token is expected to remain volatile, fluctuating between $ 0.12 to $ 0.16 as users continue to claim and sell their airdrop assignments. Any other sale of users of users who have purely hunting profits can boost the token to test lower support levels.

Half -period perspective:

If Chainbase demonstrates an early traction with associations and utility in its Hyperdata network, a gradual recovery to the range of $ 0.18– $ 0.20 could occur in the coming months, particularly if the feeling of the cryptographic market remains stable.

Long -term perspective:

If Chainbase successfully forges a significant niche in the Datafi and AI space and the real companies on board or decentralized applications, $ C has the potential to claim $ 0.25– $ 0.30 in the fourth quarter of 2025. However, this would require Chainbase to demonstrate that its vision can translate into tangible network activity and user value.

The great lesson: Airdrops needs usefulness to succeed

The case of Chainbase is a clear reminder that, although Airdrops can generate immediate interest and liquidity, they can also create significant volatility without the established utility to anchor the demand.

The Chainbase Airdrop was legitimate, and its objective of democratizing the exchange of data on web3 aligns with higher industry trends. However, the market is demonstrating that exaggeration alone is not enough to keep Token prices after launch.

Final thoughts: should you buy, hold or wait?

For holders, it may be advisable to establish realistic gains objectives or maintain only if they believe in the long -term potential of the Chainbase hyperdata network. For potential buyers, prices after the fall can offer a better entry, but this comes with the warning that future performance will depend completely on Chainbase’s ability to offer real cases for use to your token.

The cryptographic industry has matured to the point where the utility increasingly dictates the value, and the next steps of Chainbase will determine whether it becomes another fleet airdrop project or evolves to a significant player in the AI + Datafi sector.

For now, Chainbase remains a project to observe closely, offering lessons about the balance between the growth driven by exaggeration and the need for a real world application in the evolutionary web 3 panorama.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.