CoinGecko CEO Bobby Ong confirms he is reviewing “strategic opportunities” amid reports the cryptocurrency data platform is considering tender offers valued at around $500 million.

CoinGecko CEO Bobby Ong acknowledged Thursday that the company is exploring “ Strategic Opportunities “Following media reports indicating that the company is seeking acquisition offers worth approximately $500 million.

“After nearly 12 years of building CoinGecko as a self-funded company, the most frequently asked question is: where do we go next?

“What I can reveal today is that CoinGecko is growing and maintaining profitability, while also seeing growing institutional interest as traditional financial sectors increasingly adopt cryptocurrencies.” » said Ong on LinkedIn.

Media reports, attributed to sources familiar with the matter, revealed that CoinGecko was considering a potential sale worth an estimated $500 million.

JUST IN: According to crypto market data platform CoinDesk @coingecko is exploring a potential sale for a valuation of around $500 million and has hired investment bank Moelis to advise it on the process. pic.twitter.com/D4IkyJ1jw0

– SolanaFloor (@SolanaFloor) January 13, 2026

Moelis advises while CoinGecko considers put options

Informed sources indicated that the company had engaged Moelis to provide consulting services as part of this process, although one source stressed that it was too early to determine an exact value as negotiations did not begin until late 2024.

Moelis is a well-established Wall Street investment banking firm specializing in strategic financial guidance on mergers, acquisitions and IPOs, and has facilitated more than $5 trillion in transactions spanning diverse industries.

In an article on X, Ong acknowledged receiving numerous inquiries following the recent media coverage and expressed his appreciation for the interest.

We have had many questions following recent media reports, and we are honored by the interest.@tmlee and I have been running CoinGecko for almost 12 years, and like any growing and profitable company, we regularly evaluate strategic opportunities to strengthen our business and…

– Bobby Ong (@bobbyong) January 15, 2026

He noted that after leading CoinGecko alongside co-founder and chairman TM Lee for over a decade, “Like any profitable and growing company, we regularly evaluate strategic opportunities to strengthen our business and accelerate our mission. »

This statement indicates that CoinGecko is seriously considering put options, targeting Wall Street institutional buyers rather than venture capital funds.

Although Ong declined to go into details of the negotiations, he expressed enthusiasm about “ Features that allow us to better serve users and facilitate business adoption of cryptocurrencies “.

It is worth noting that CoinMarketCap, another cryptocurrency market data platform, was purchased by cryptocurrency exchange Binance in 2020 for an estimated $400 million.

When announcing the acquisition, Binance explained that although the trading platform and its BNB token are offered on the platform, “ CoinMarketCap and Binance remain separate entities adhering to a strict independence policy “.

More than five years later, cryptocurrency industry observers say CoinGecko’s $500 million valuation is reasonable, given that cryptocurrency data has become increasingly valuable and Wall Street data intelligence firms command much higher valuations.

For example, Bloomberg LP, although a private company, is valued in the tens of billions, and recent calculations indicate over $120 billion based on a 2008 equity deal, with current annual revenues exceeding $13 billion by early 2025.

$8.6 billion in cryptocurrency deals: Polygon and Fireblocks lead M&A boom in 2026

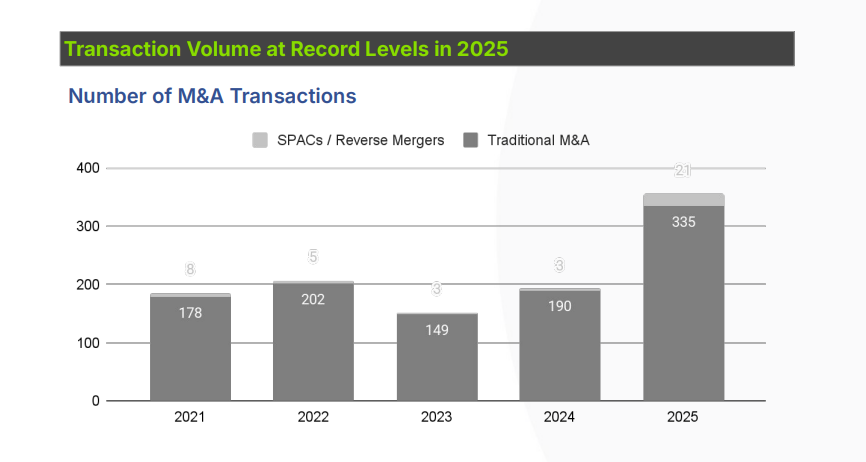

The quantity and value of cryptocurrency M&A and IPOs soared throughout 2025, with transaction values reaching a record $8.6 billion, thanks to looser regulation in the United States that encouraged investors and financial institutions to re-enter the sector.

According to a report published by the Financial Times, 267 transactions related to cryptocurrencies were carried out in 2025, which represents an increase of 18% compared to 2024.

The total transaction value increased by almost 300% from last year’s $2.17 billion.

Market participants expect this momentum to continue through 2026 as regulatory clarity improves across all major jurisdictions.

Polygon Labs recently revealed plans to acquire cryptocurrency trading platform Coinme and cryptocurrency wallet infrastructure provider Sequence for over $250 million in 2026.

Additionally, FireBlocks, a blockchain infrastructure company, announced on Wednesday that it has acquired Trace Finance, a cryptocurrency accounting and financial reporting platform, for over $130 million to meet the growing demand for financial records. Audit ready and tax compliant “For businesses based on blockchain technology.

On January 12, Bakkt Holdings, Inc. announced its agreement to acquire Distributed Technologies Research Ltd. (DTR), continuing its strategy to develop stable settlement and programmable payment capabilities through an all-stock transaction comprising shares representing 31.5% of a designated “Bakkt Stock Number”.

The post from CoinGecko CEO responds to reports of $500 million acquisition appeared first on Cryptonews Arabic.