XRP is negotiated at $ 2.14 with a market capture of $ 124 billion, a 24 -hour negotiation volume of 2.47 billion dollars and a price range between $ 2.103 and $ 2.185, reflecting short -term consolidation as itings for potential escape.

Xrp

The one hour graph of XRP reveals a behavior linked to the beach, the price oscillating between $ 2.13 and $ 2.18. Despite several attempts to exceed $ 2.18, the asset has strong resistance, resulting in temporary withdrawals. The volume has gradually decreased, indicating a winding phase which often precedes a break. Traders can find scalping opportunities with this tight channel, in particular by buying almost $ 2.13 and leaving $ 2.18 to $ 2.20, as long as the upper limit remains a bit.

XRP / USDC via Binance on Tuesday April 15, 2025.1 HOUR.

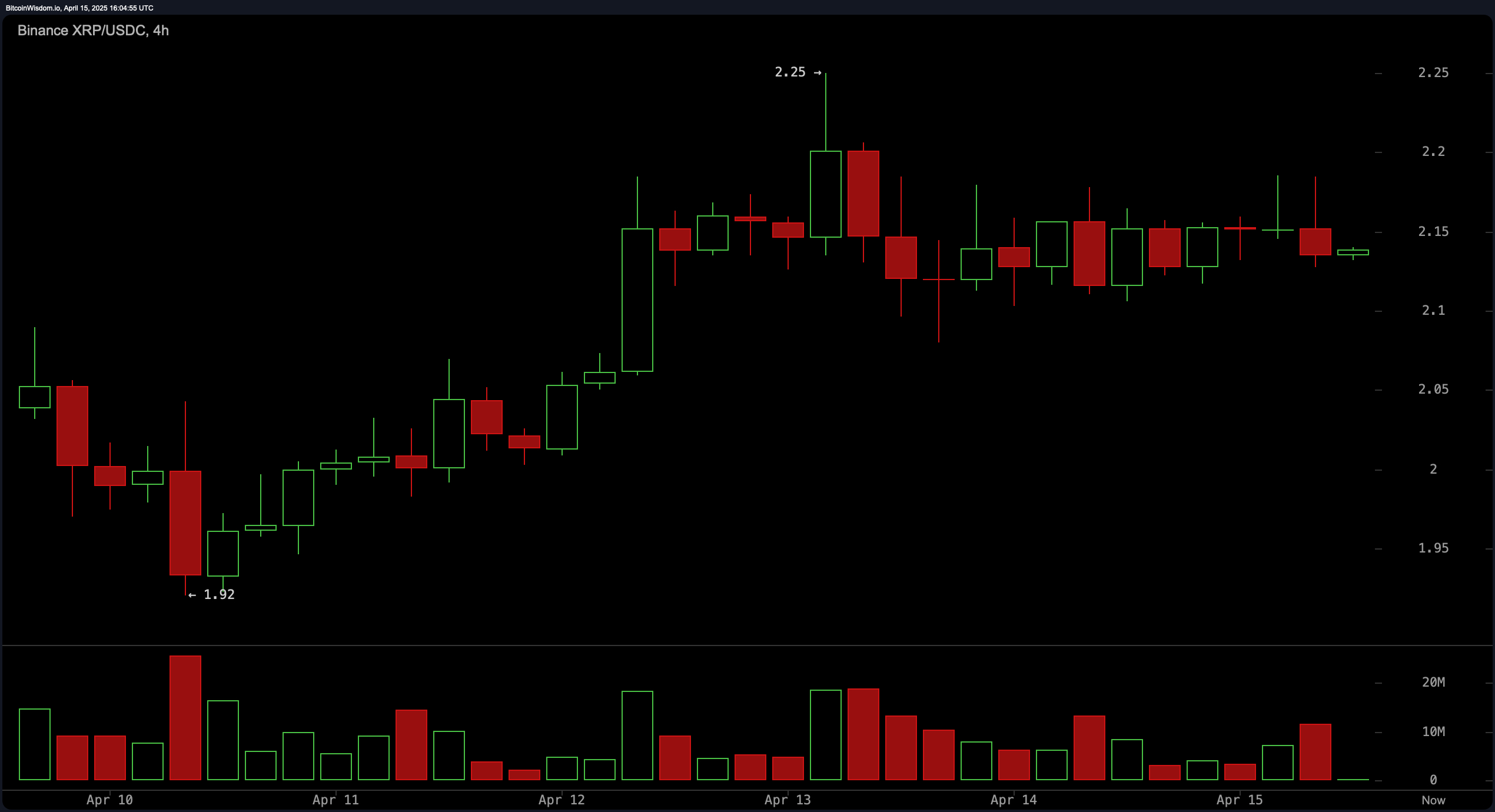

The four -hour graph shows a recent upward escape around $ 2.25, followed by a consolidation phase. The assets failed to maintain the mother upwards beyond this level and has since completely a sideatical model, forming the Appars to be an optimistic flag or a pennant. This training generally suggests control, positive that the break is supported by an increase in volume. With a support level at $ 1.92 and resistance almost $ 2.25, a purchase entry on a neckline exceeds resistance with a coup d’etat with a high negotiation volume leads to gains to the $ 2.40 bar.

XRP / USDC via Binance on Tuesday April 15, 2025. Chart 4 hours.

On the daily graphic, XRP has rebounded from a local bottom of $ 1,611 and is now stabilized around the fork from $ 2.20 to $ 2.20. The preparation of bullish candles in English and doji near recent support levels signals a potential short -term reversal. In particular, the volume of negotiation jumped during the rebound, adding credibility to the Haussier movement. The keys resistance amounts to almost $ 2.59, while the COUELF SERV zone from $ 1.90 to $ 2.00 as a long entrance area, assuming upward confirmation on prices revisited. Merchants considering long -term average positions could target outings between $ 2.30 and $ 2.50.

XRP / USDC via Binance on Tuesday April 15, 2025.1 Day Chart.

An oscillators ventilation highlights a new market position. The relative resistance index (RSI) reads 49,74954, the stochastic oscillator is 81,27979, the freight channel index (CCI) puts 48,11322, the average directional index (ADX) is located at 21.79912, and the impressive oscillator shows −0,09439, the whole index oscillator. How, the Momntum indicator flashes a lowering signal at -0.00622, while the level of converted divergence (MacD) of the Mobile Average (MacD) can be read this mixed conimen supports the vision of consolidation with a slight upward inclination.

With regard to mobile averages, short voltage indeakators remain optimistic, with the exponential mobile average of 10 periods (EMA) at $ 2,08231 and the simple mobile average (SMA) at $ 2,01954, both, signaling positivity. EMA from 20 periods to $ 2,11123 and SMA at $ 2,07,974 also reflect positive signals. How, prudence is justified as EMA and SMA of 30 periods at $ 2,15666 and $ 2,18777, indicate the lowering signals respectively. This divergence has longer long-term signals where EMA and SMA 50 and 100-Peyod suggest a lower feeling, while EMA and SMA of 200 periods at $ 1,95638 and $ 1.90439 return to high long-term uncertainty.

Taurus verdict:

The current technical posture of XRP reflects a consolidation market with a bullish nuance, supported by short -term purchase signals of the mobile averages of 10 and 20 periods and a rebound in a well -cooled support area. If XRP can perceive the resistance of $ 2.25 on a strong volume, the Haussier flag formations on the graph at 4 hours can catalyze a race around $ 2.40 and beyond, strengthening the potential of the shorter increase.

Bear verdict:

Despite some early signs of force, XRP faces several opposite winds with mobile mid -range means flashing up sales signals and largely neutral or showing weakness, such as the Momntum indicator. The non -violation of the resistance zone of $ 2.18 – $ 2.25 COUELF leads to a renewed sale pressure, bringing the price back to the level of $ 2.00 or lower, in particular if the continuous volume to withdraw and that the optimistic continuation models cannot confirm.