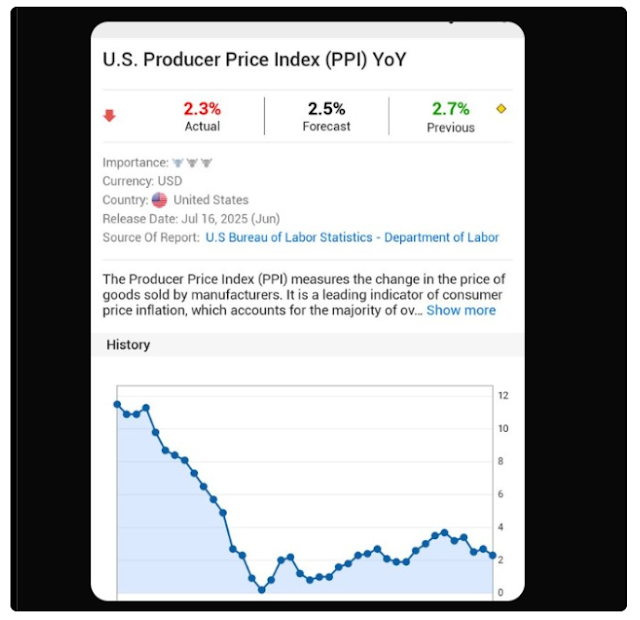

In a welcome surprise for global markets, the price index of the American producer of June (PPI) became fresher than expected, providing a very necessary impulse to cryptocurrencies and feeding speculation about a possible turn of the Federal Reserve in interest rates.

The PPI, a key measure that tracks wholesale inflation, increased only 2.3% year after year, below the 2.5% prognosis and marked the lowest reading since September 2024. Monthly, prices were stagnated by 0.0%, it was also promoted by 0.20% expected. This development has revived optimism among investors, who now believe that facilitating inflation could pave the way for interest rate cuts, providing a backdrop for risk assets, including Bitcoin and Altcoins.

Why the cooling PPI is important for Crypto

Cryptographic markets have endured a turbulent year, dealing with winds against regulations, liquidity limitations and macroeconomic uncertainties. The latest PPI figures suggest that inflationary pressures are finally decreasing, a critical factor for the Federal Reserve, since it evaluates its monetary policy position.

“June PPI data is a sign that the inflation on the supply side is a cooling, which could relieve Fed concerns about persistent price pressures,” said Laura Bennett, Wavefront Analytics chief macro strategist. “For cryptographic markets, this could translate into a softer interest rate environment, feeding the risk appetite and capital flows to digital assets.”

| Source: x |

Investors are observing a lot if the Federal Reserve will adjust its position in the next meetings. For months, the question has been if the Fed will reduce rates to stimulate economic growth without risking a resurgence in inflation. Now, with PPI falling to 2.3%, the case of a rate cut is earning traction.

Bitcoin price today: resistance test in the middle of renewed optimism

After launching the June PPI data, Bitcoin prices have shown a renewed fortress, which is listed between $ 117,000 and $ 118,000, just less than its recent maximums about $ 120,000. Technical indicators indicate a potential breakup:

-

The MACD (Mobile average convergence divergence) has shown a bullish crossing, indicating an impulse up.

-

The relative force index (RSI) is currently at 69.33, near the overcompra zone, suggesting that although the rally has legs, caution is justified.

-

Strong levels of support have been maintained around $ 117,000 to $ 118,000 despite the recent falls, providing a solid base for more rise.

Market observers believe that if Bitcoin can break decisively above the level of $ 120,000, a new advantage could carry the cryptocurrency towards the new maximums of all time.

“The cooling inflation and the potential of a doubt fed pivot provides the perfect conditions for Bitcoin to resume his rally,” said Jonah Kim, a cryptographic analyst of VERTEX MARKETS. “If the return and feeling of institutional buyers remain optimistic, from $ 130,000 to $ 140,000 is available in the short term.”

Altcoins lead the load: Ethereum, XRP and Solana Rally

While Bitcoin is consolidated, Altcoins is taking the center of the stage in the last increase of the cryptography market. Ethereum, XRP and Solana show a remarkable impulse after the launch of June PPI data:

-

Ethereum (eth) It has crossed $ 3,180, driven by optimism around ecosystem updates and renewed investor confidence.

-

XRP It is constantly rising, approaching the $ 3 brand as merchants revolve in Altcoins.

-

Solana (Sol) continues to operate above $ 166, backed by weekly and monthly graphic solids.

Capital rotation in Altcoins reflects the increase in the appetite of risk among merchants, who see opportunities for greater returns as macroeconomic conditions improve.

“The Altcoins often exceed Bitcoin during periods of bullish impulse in cryptographic markets, and we are seeing that it now develops,” said Priya Desai, senior cryptographic researcher at Altify Labs. “Investors seek exposure to higher beta assets, and cooling inflation provides the macro background for this rotation.”

Crypto Week aligns with relaxing inflation: Does a perfect storm for a bull race?

This week also coincides with the Week of Crypt in the United States, where significant legislative developments are being discussed, including the Genius Law and the Clarity Law, whose objective is to provide regulatory clarity for the cryptographic industry.

Former President Donald Trump has described this moment as a “turning point” for digital assets in the United States, indicating a growing bipartisan interest in supporting Blockchain innovation while providing clear regulatory frameworks.

The convergence of cooling inflation and regulatory clarity could prepare the stage for the next execution of Crypto Bull, with analysts that indicate the alignment of macroeconomic and political factors that favor the adoption of digital assets.

“If the United States offers clear and support regulations, while inflation cools and Fed pauses or reduces rates, we could see a structural market in cryptographic up to 2025 and beyond,” said Marcus Lin, a partner of Chainvest Capital.

Institutional interest to increase

Recent data in the chain show an increasing accumulation by the great headlines, indicating institutional confidence in cryptographic assets. The main cryptographic funds and the companies that are quoted in the stock market have resumed strategic purchases, preparing for what many believe it could be a prolonged upward market if macro conditions continue to improve.

ETF tickets in Bitcoin and Ethereum have also recovered, and July already sees more than $ 1.1 billion in net tickets, indicating that institutional and retail investors are positioning ahead of the tail winds of the potential market.

Potential risks remain

Despite optimism, risks remain in cryptographic markets. Regulatory clarity, although it improves, still has uncertainties, and any aggressive signs of the Fed could cushion the feeling of risk.

In addition, Bitcoin’s resistance about $ 120,000 remains a critical level, and lack of interruption above it could lead to short -term setback. Similarly, the Altcoins, while showing a strong impulse, remain susceptible to high volatility.

“Investors must remain cautious and observe the key levels of support and resistance while maintaining a long -term perspective,” Desai advised.

Conclusion: Crypto’s path in 2025

The last reaction of Crypto Market to the PPI data of June US is more than a temporary peak. It means the changing macroeconomic atmosphere that could support a sustainable rally in digital assets.

Bitcoin, although still proves critical resistance, shows strong technical foundations for a continuous rally. Meanwhile, Ethereum, XRP and Solana are capitalizing the improvement improved, surpassing as merchants turn in Altcoins.

With the week of the crypto potentially delivering so long -awaited regulatory clarity and the FED potentially reconsidering its policy position, the scenario is established for what could be one of the most fundamental periods for cryptography markets in recent years.

Investors will closely observe the interaction between macro data, policy signals and market technicians to measure the sustainability of the current demonstration. If the stars align, 2025 could become a historical year for digital assets, redefining the panorama of cryptographic investment and preparing the scenario for the next wave of adoption of blockchain.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.