Spot Bitcoin ETF merging the barrier of $ 5 billion on October 1, with Bitco-BTC, penetrated the $ 120,000 barrier, recorded a weekly increase of 10% of its lowest levels at the end of September, which amounted to around $ 109,000.

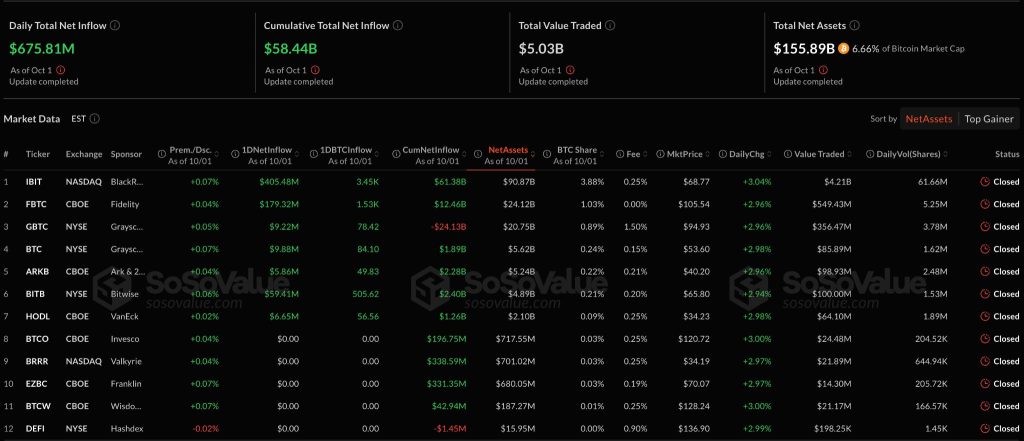

Institutional investors led this increase with clear investments of $ 676 million on October 1, where the Bitcoin Ishares trustee fund for BlackRock recorded $ 405 million in investments, while Fidelity has 1,570 bitcoin with a value of $ 179 million per day.

The Bitcoin price exceeded $ 120,500 and the negotiation volume exceeded $ 50 billion in all markets.

In detail, the BlackRock Ibit Fund now holds 773,000 Bitcoin currencies estimated at around 93 billion dollars, which improves its position with the greater institutional conservation authority with a share of 3.88% of bitcoin.

The Bitcoin ETF spot in immediate negotiations has increased net investments of $ 58.44 billion since its launch in January 2024, bringing total net assets to 155.89 billion dollars, which represents 6.66% of the value of the Bitcoin market (Bitcoin).

Vanguard adjusts its investment orientation with the launch of Black Rock for a new ETF box for distinctive gains

VANGUARD – The second largest asset management company in the world worth 11 dollars – restores its position on the boxes circulating on the stock market after having removed it for a basic position in which it had reduced bitcoin, considering it “He has no fundamental economic value».

It is reported that the company is studying the possibility of granting its 50 million customers worldwide – access to boxes circulating on the stock market linked to Bitcoin ETF and Ethereum ETFE via its platform. This possible change is the direction of the new CEO Salim Ramji who previously worked in Blackrock, who spoke of the promising potential of digital currencies.

Here, Vanguard finds himself in an embarrassing position as the largest owner of the strategy company (strategy) through funds related to the NASDAQ 100 index despite its conservative position towards Bitcoin. A company spokesperson told Bloomberg:We constantly assess our mediation offer, investor preferences and the evolution of the organization“Without confirmation of a possible date for the launch of the crapeto boxes circulating on the stock market.

Even if only 1% of Vanjard’s customers are decided to invest in Bitcoin FNB, this means that 500,000 new investors enter the market.

In the blink of an eye of Anye, 50 million customers Vanguard coun SA BE AKLE to invest in Bitcoin ETF for the first time#Cryptohttps://t.co/dlqeqmjg0t

– cryptonews.com (@cryptonews) October 1, 2025

Black Rock has expanded its product range with a distinctive gains strategy

Black Rock applied to launch the Etf Bitcoin Premium Income box, a product that adopts the covered call to provide additional yields on Bitcoin.

Eric Balchunas’ analyst said the company had recorded the name of Ishares Bitcoin Premium ETF.Product subject to law 33 (33 ACT SPOT Product), Making it an extension of its famous Ibit box, which costs $ 87 billion.

In addition, ETF Bitcoin and Ethers Ethereum – affiliated with asset management of 12.5 billions of dollars – are made annual income of more than $ 260 million, including $ 218 million in Bitcoin and 42 million dollars in a room of Ethereum. By calculating the small digital active ingredients, the total balance of digital currencies of the black rock increased to more than $ 101 billion.

According to Farside Investors, the Black Rock Ethereum signed up for $ 512 million in investments in last week. In its profit report for the second quarter, the company revealed that investments amounting to $ 14.1 billion in the digital asset sector, making it one of its fastest growth sectors, although it represents only 1% of its total oriental assets.

Technical analysis indicates the targeting of $ 128,000 with the risk of relative stability

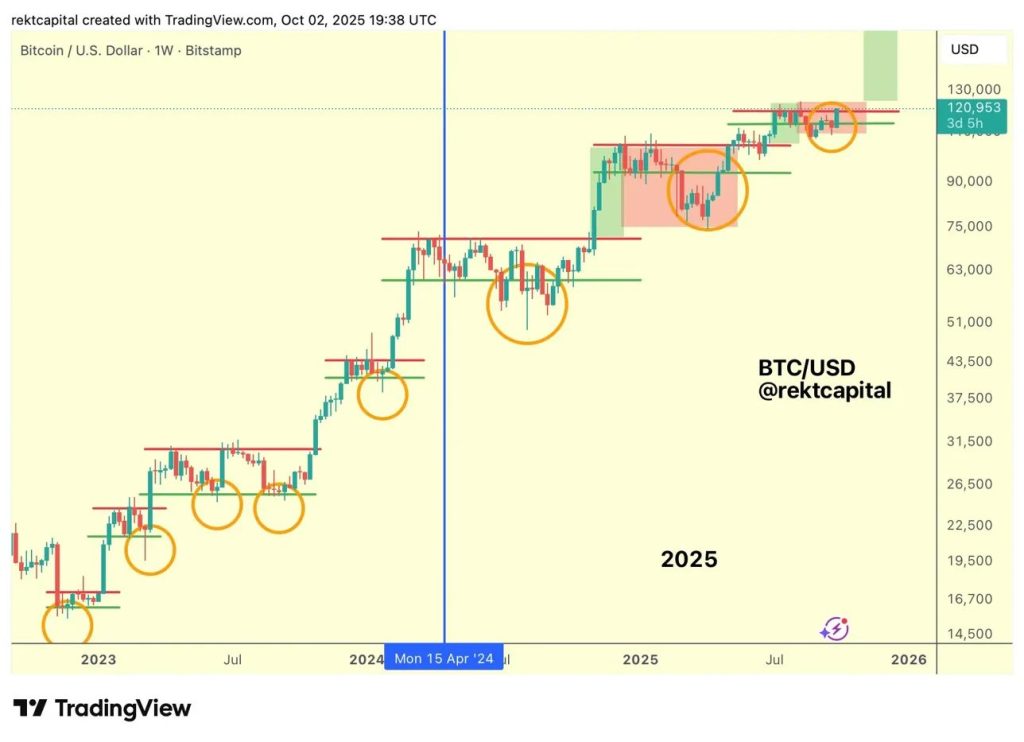

The weekly Bitcoin (Bitcoin) graphic table shows relative stability areas, followed by strong heights during the period 2023-2025, where the current price of $ 120,953 is located at the upper limit of what analysts call “the rising trend to discover the price 3”.

Here, each stage of relative stability continued for several weeks and even months before ending with breakthroughs, because the model reveals a constant behavior of the adoption by bitcoin of the price bases in horizontal ranges before starting by going up to new stages of discovery of the price.

However, the decrease in earning rates between each emerging step and another can indicate the slowdown in the amount of movement, as transfers represent $ 70,000 to $ 120,000 from around 71% compared to 75% at the previous level, and the simplified price model displays a major break and test and the most test around the level of $ 110,000.

It seems that the price of bitcoin has exceeded the level of resistance and a decrease in the re -evaluation of this level as support, which qualifies it for a possible continuation of the increase, while technical evidence indicates the possibility of progress towards a scale of 128,000 to $ 135,000. However, the extension of the movement suggests higher fluctuations and deeper drops.

On the other hand, the decisive level of support to maintain the upward trend is 110,000 to $ 112,000, and the previous resistance should transform into support. And if you do not resist this region, you can lead to the chain support at $ 103,000 to $ 105,000, while price cohesion greater than $ 128,000 will open the road from around $ 135,000 to $ 140,000 before testing the resistance of the upper canal nearly $ 173,000.

Does the position of the size of the immediate trading boxes of Pitcoin ETF exceeds $ 5 billion with a price penetration of $ 120,000, will the price soon be recorded an unprecedented summit? APPLERDIRST on Arab Cryptonews.