Ethereum’s price is $ 2,477.12, a decrease of 3.12% in the last 24 hours, with a negotiation volume of $ 12.9 billion. On the anniversary on Monday, the scarcity of liquidity on the Chipo market on Monday raises questions about the potential movements of its price.

Will the drop in post-holiday pay the price of Ethereum-Eth about $ 2,300, or will it find the support necessary to maintain its current levels?

The investments received in the ETF boxes show a renewal of optimism; Does Ethereum support come back again?

On May 23, a special day for digital currency trading funds appeared on the scholarship, because the Bitcoin negotiation funds witnessed investment roses of $ 211 million, and Ethereum funds 58.63 million dollars, and 22,000 Ethereum currencies were purchased, in an indication of continuous attention from investment institutions.

- Bitcoin ETFS: won $ 211.74 million in investments and added 1,900 Bitcoin pieces (BTC).

- Ethereum Etfs: Etf Etf Ethereum: Etftherem Etf: Ethereum Etherem (Ethemem).

ETF activity (May 23):

About 1,900 BTC and 22,000 ETH were purchases.#Bitcoin The ETFs recorded $ 211.74 million in net inforiented. #Ethereum ETFs experienced $ 58.63 million in net influence.– Pushpendra Singh Digital (@pushpendratech) May 24, 2025

These investments show the return of Etheerium to the center of attention; This renewed interest can be attributed to recently arriving and improved the conditions for the macroeconomic economy and network updates.

Technical analysis of the price of Eterium currency: the main levels must be monitored

On the graphics table of the two hours, the Ethereum price penetrated the low trend line without the average momentum for 50 days at $ 2,555, which has become a resistance level now.

With this landing without the upward trend line at around $ 2,500, Ethereum prices expectations are still in a descending direction; The candle models also appear at $ 2,523 of the frequency, and the MacD index indicates a descending momentum.

Main levels to monitor:

- Support: $ 2,378, $ 2,272 and $ 2,171

- Resistance: $ 2,555 and $ 2,626

- AFor indicators: MacD is down, the medium movement (EMA) is a level of resistance, and the steering line is broken down

Patience remains necessary for merchants currently, because a confirmed fracture less than $ 2,378 can mean a new drop to $ 2,300. On the other hand, if the price succeeds by exceeding $ 2,555, we can attend a new increase at $ 2,800.

Will the liquidity of the birthday day cause Ethereum pressure?

In addition to the proliferation of expectations of low commercial volume during the weekend, Ethereum can attend larger movements. And if the investment movement received at the Etterium (ETF) funds continues and the general mood remains positive, we can attend an increase above the level of resistance. If the market hesitates, we can attend the Ethereum price test for the nearest level of support at the start of next week.

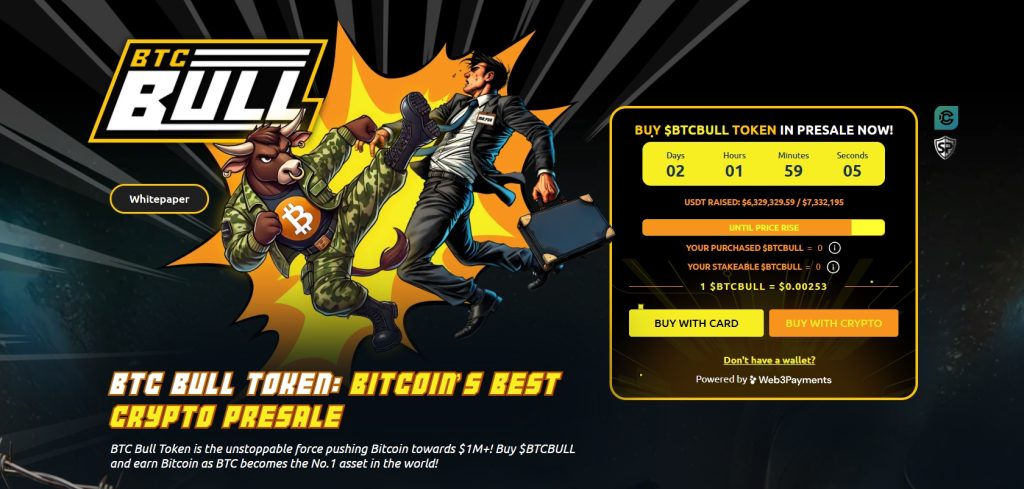

BTC Bull’s subscription is approaching its financing target of $ 7.33 million, and generous mortgage turnover at a rate of 65% triggers demand for it

With the low prices of Ethereum less than $ 2,500, attention is transformed into alternative currencies such as BTC Bull (BTCBLL), which has so far increased $ 6.33 million out of $ 7.33 million, to approach its end, thus entering a new step in which the price increases.

Bitcoin bonus and discounts in the offer

The BTC Bull Project operates according to its own system: the higher the Bitcoin (BTC) price, the higher the BTCBLL parts free, with confirmation that subscribers have priority in rewards. Among some of the regulations also:

- A percentage of project currencies is burned with each $ 50,000 increase at Bitcoin prices, in order to reduce the offer

- The currency price is currently $ 0.00253 before the next height

This approach is balanced between the value of the BTCBull with the Bitcoin price movements while retaining its raid thanks to programmed burns.

Mortgage conditions to obtain easy yields

The BTCBLL mortgage complex currently includes 1.62 billion currencies and offers annual yields of 65%, all with:

- Do not stipulate periods of crisis or withdrawal fees

- Offer the possibility of mortgaged funds at any time

This plan is suitable for foreign exchange owners in search of yields without imposing complex conditions or liquidity risks.

Better before the end of the subscription

Just over a million dollars have remained to reach the entire subscription, its financing objective, and therefore buyers make early purchases, and project work mechanisms also stimulate participation, bonuses related to the price of bitcoin (BTC), and combustion amendments, comfortable mortgage options.

Important numbers:

- The outcome of the subscription (Usdt):: 6,329,314.26 $ on $ 7,332 195

- The current price of money: $ 0.00253

BTCBUL provides an impressive annual return of approximately 65% on the mortgage complex based on Ethereum (which currently includes 1.61 billion BTCBUL), without any compulsory detention period or drawing costs, and this means that the return without problem, and full liquidity is always available.

Follow us on Google News

The expectations of Post-Etheerium prices: the motto between the day of the birthday with little liquidity. Do you like vacation fluctuations at $ 2,300? APPLERDIRST on Arab Cryptonews.