The price wave Ethereum increases (ETH) reached 40% at its peak at the end of the week, with the first indicators of lowering the purchase pressure which increases the concerns of an expected price correction.

Ethereum Price (ETH) last week has recorded its strongest performance since December 2020, but the slowdown in the $ 2,500 has raised a wave of questions on the positive continuity of the expectations of ETH prices. This increase occurred in the wake of the signing of a trade agreement between the United States and China, and the launch of the “Pectra” network division, which has contributed to the abolition of factors that have hampered the progress of the alternative currency pioneer.

This height ended a relative stability period which lasted a month in a range of $ 1,450 to $ 1,900. After having exceeded this range, Etheeerium had solid foundations to consider it “the best digital currency for the purchase”.

Why does this emerging wave differ from other currencies?

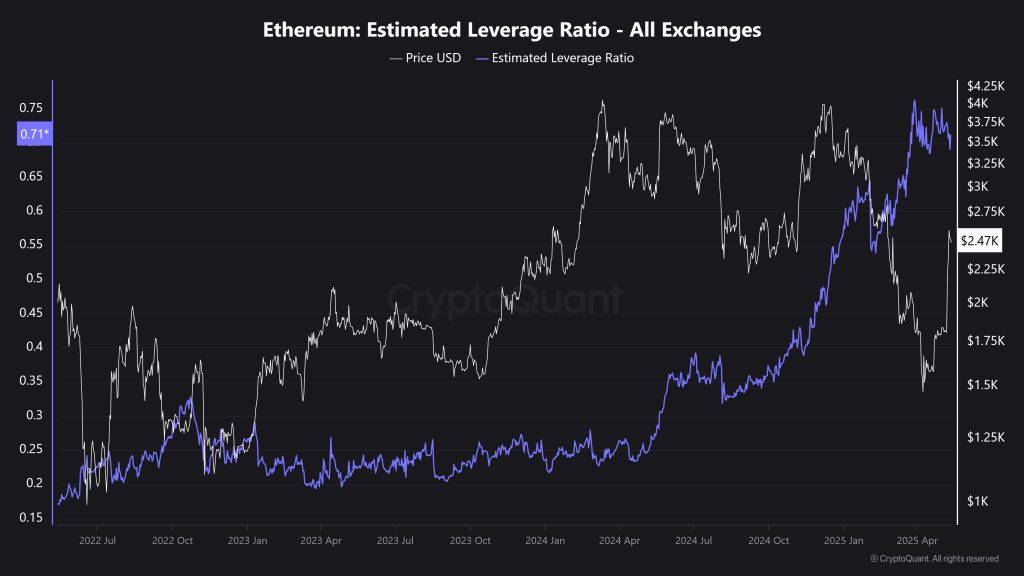

Unlike many other emerging waves on the CRIPTO market, motivated by speculation and the use of a large financial lever, the last movement of the price of the ETH depends mainly on the real demand for the immediate market. During last week, the estimated financial lever (ELR) recorded a remarkable decrease from 0.76 to 0.69 according to data from the cryptocurrency website, because this descending direction indicates that derivative contracts adopt a more moderate approach to the use of the lever effect.

This drop occurs in conjunction with huge withdrawals from Ethereum from commercial platforms, around 323,700 ETH was withdrawn in just 4 days, and the mortgage increased by more than 180,000 ETH in the previous week.

These indicators clearly reflect the orientation of investors to long -term conservation strategies instead of engaging in short -term speculation activities.

Technical analysis of Ethereum: does the upward trend continue?

The current slowdown in prices coincides with descendant technical indicators. The RSI index has exceeded the daily graphic scheme of the excess purchasing area at 80 years old, a clear sign of buyers’ exhaustion. As we know, any height must be followed by a later drop, and it seems that a simple price correction is the logical step alongside the market balance.

It should be noted that the style of the similar triangle – which has been formed since 2021 – returned to the interface after it temporarily, because this recovery derives its strength from the positive indicators of the momentum.

The RSI index (RSI) also exceeded the emerging area on the signal line after a fluctuating period in the 40th area, in an early indication of buyers control instead of the pressure from the sellers. More importantly, the MacD index turned to the emerging trend for the first time from the height wave that followed the inauguration of the American president. The signal line has exceeded an ascending gold intersection, a technical indication that improves the hypothesis of the long -term trend of the trend in this excellent period.

In addition, the 200 -week SMA index (SMA) has returned to solid technical support, and it can be a price correction background and give additional momentum to the possibility of the start of a long -term trend. If the purchase pressure returns, the Ethereum price can turn to the penetration of the previous triangular style to target the resistance level of $ 2,970, which represents an increase of 17%.

In the event of a continuous momentum, the movement can extend to the higher resistance level test at $ 3,750, an increase of around 50%. The “Pectra” update, as well as the improvement of macroeconomic indicators, contributes to supporting prudent optimistic perspectives to carry out the long -term Ethereum price.

A new candidate for second layer solutions can be on a date with a major start with the support of several factors

Investors who preferred to invest in the old Ethereum Bluecine on the alternatives of the other first layer can be forced to reassess their decisions, especially since the Solana technical system recently began to respond to its strongest weaknesses: the ability to develop.

The image has changed with the appearance of the Solaxy project (Solx), which is the first expansion of the second layer of Balcachin Solana, because the network has long suffered from the absence of this decisive characteristic which restricts its uses in decentral financing applications (DEFI) and its interaction with different network of blocking blocks, until this solution appears.

By dealing with transactions on its network on the network, then completing it on the main Solana network, the Solaxy project contributes significantly to the reduction of congestion and reduction of transactions as well as the smooth supply of compatibility between BlueCin networks.

As its current subscription succeeds in collecting more than $ 35 million, investors are already gathered behind this promising project, in the hope that it is the winning horse which harvested the fruits of the new liquidity in the technical system when the demand for Solana Blackchane is intensifying.

In addition, interested persons can follow the Solaxy Project account on X and Telegram platforms, or join the Solx subscription via the project website.

Follow us via Google News

Will the expectations of post-Etheerium prices: will he succeed in hacking the significant level of support at $ 2,500 or will it go through an imminent decreasing wave? APPLERDIRST on Arab Cryptonews.