Vitalik Buterin expressed his desire to provide a more stable and lasting growth basis for the prosperity of the Ethereum system, since risk -free risk can provide a sustainable income for Ethereum Blockchain similar, it is represented by the Google search engine for its parent company, and believes that this trend will allow its pursuit to support experimental and cultural applications without exposing its financial allocation to RISK.

Potterin stressed that decentralized funding protocols are not obliged to follow a unique or revolutionary approach to become influential, but it is rather sufficient to guarantee stable resources for income without increasing moral problems, or contradicting the fundamental values of blockchain, invoking developers to resolve new forms of digital prices, such as compiled currency and stable currencies (stable) Role in improving the status of Bluecoin ethereum (Ethereum) as a pillar of global financial innovation.

If you want to educate yourself on Ethereum and the future of $ EThGo read Vitalik’s new blog.

The low -risk DEFI shroud is certainly part of Ethereum. We are now noar when we want to be, and it is only another showcase where we are ready. pic.twitter.com/os2rfxqpkr– Djani (@djaniwhaleskul) September 20, 2025

This discussion occurs at a time when the Ethereum technical system for decentralization has exceeded the level of $ 100 billion in the total value of the assets entered (TVL) for the first time since the beginning of 2022, which is an achievement which reflects the descending market and confirms the continuous monitoring of Ethereum blockage in this regard; According to Defillalama data, blockchain and extension solutions for the second layer have 64.5% of the total value of the assets entered, compared to less than 9% in its counterpart blockchain blockchain blockchain.

Balcochen activity suggests the acquisition of the momentum

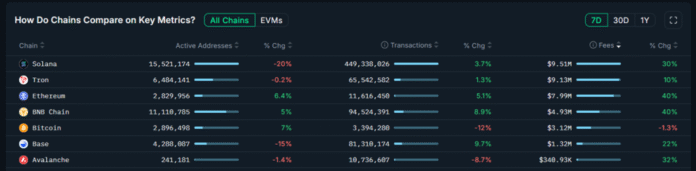

The essential foundations of Ethereum continue to develop significantly with the resumption of requests for decentralized financing which operating them; Last week, the product of transaction costs on the blockchain increased by 40%, while the number of active addresses increased by 10%. Since all Ethereum block transactions require payment of costs using Ethereum, the acceleration of its use is directly translated by the growing demand for the currency.

The increase in the costs of costs is also in the interest of listeners and helps to improve blockchain safety and to stimulate the automatic combustion mechanism of the balance of Ethereum currency in a way that contributes to reducing its food in circulation, to support the mixture of growing activity and the lower structural mechanism of the supply of the attractive currency as a long investment option.

Bluechen networks are organized according to the result of the costs in 7 days (US dollar), Source: Nansen

Currently, trading volumes on decentralized platforms exceeded 3.5 billions of dollars, demonstrating the superiority of Ethereum blocks in terms of decentralized applications. Despite the strength of this data, Ethereum suffered during the recent negotiation sessions, as it came back to 4.15% in a week to settle approximately $ 4,468, in the middle of the decrease in its daily negotiation volumes over 30%, recording $ 18 billion, reflecting a quieter market but in the cohesion process.

Ethereum price astendations and technical proports

The expectations of the Ethereum prices seem to be balanced, in particular with the swing of prices in a range gradually, so that its movements remain confined to a similar style of triangle which began to form in mid-September, and that the average of 50 days (EMA 50) is stable at $ 4,519 as a barrier which prevents the height, while its counter holds a period of 200 days (EMA-200) at 4,394. Fluctuations, but these models are often a decisive penetration in one of the two directions.

Enimony indicators reveal a prudent market; The relative power index (RSI) of 40 twice shows the momentum, while the repetition of the negotiation candles extended by the tail to the summit almost $ 4,587 reflects the exposure of the currency to the sale pressure, but the gradient base for the model suggests that the buyers defend the support range from 4,418 to $ 4.394.

If the price is broken, $ 4,394, the road will be paved to be tested later at $ 4,350 and possibly $ 4,280. On the other hand, it can allow the recovery level of $ 4,520 to start at $ 4,587 and $ 4,670, with a launch that could push it to $ 4,760 and up to $ 5,000 depending on the arithmetic target to penetrate the model.

For merchants, monitoring the training of ascending commercial candles close to the support levels remains a priority. For investors, current cohesion can be a solid base for a sustainable start for Ethereum, which can extend until 2026.

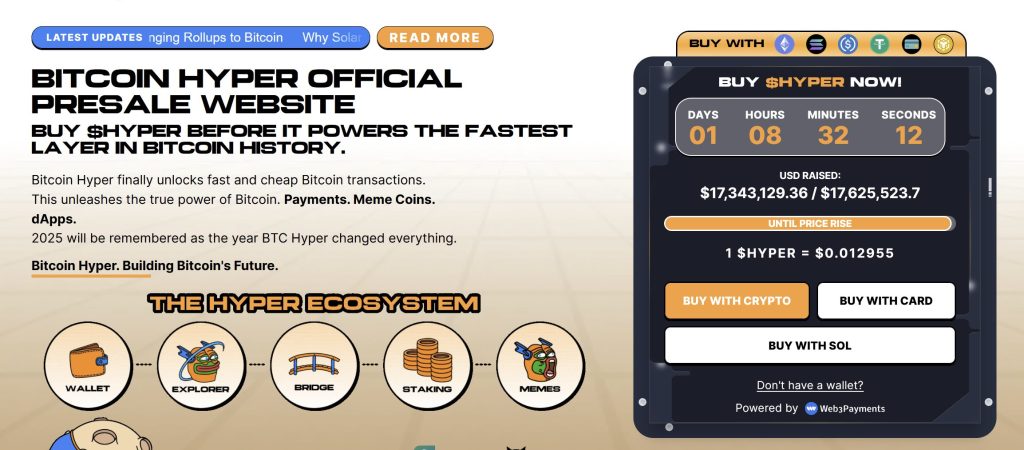

Hyper-hyper bitcoin has a hyper-hyper bitcoin currency. Invest with a currency that combines Bitcoin Blockchain security and the speed of blockchain Solana transactions

The new Bitcoin Hyper network is the first Bitcoin Blocchain on the SVM virtual machine, and to develop to support the Bitcoin Balcacin technological system by providing intelligent contract functionality, decentralization of decentralized applications (DAPP) and the ability to launch MIM parts and circulate it very quickly and low cost.

By combining Bitcoin Bluechen safety and Solana Bluechen speed, its unique solution offers a variety of practical uses that include a fluid connection with Bitcoin Bitcoin balances and the development of decentralized applications (DAP) which allows you to develop.

For its part, the project team pays great attention to the reliability and the ability to develop, as evidenced by the success of the intelligent contract with its currency successfully to check the Coinsult (Bitcoin Hyper) is currently at $ 0.012955, and it should increase the succession of subscription stages.

Finally, you can buy Bitcoin hyper by visiting the official project site and paying the use of digital currencies or by Visa and Maskertard.

To participate in the Bitcoin Hyper subscription, click here

The position The expectations of Ethereum-Eth prices: Coinbase, see the downward price of the opportunity to buy first on Arab Cryptonews.