The price of the Ethereum currency has recorded the level of $ 4,500, recording an increase of 0.54% in the last 24 hours with a market value equivalent to $ 543.9 billion, and its renewal of the dynamics is renewed after the reduction in monetary mood, which can support the prices of digital shares as a currency frame.

Lorie Logan, head of the Federal Reserve in Dallas, said today that the Central Bank’s decision reduced interest rates of a quarter of percentage (0.25%) in September, it was therefore justified to support the silent labor market, but decision -makers must be cautious to avoid excessive economic motivation, inflation rates are therefore always higher than targets, high can increase the prices of the end of the term.

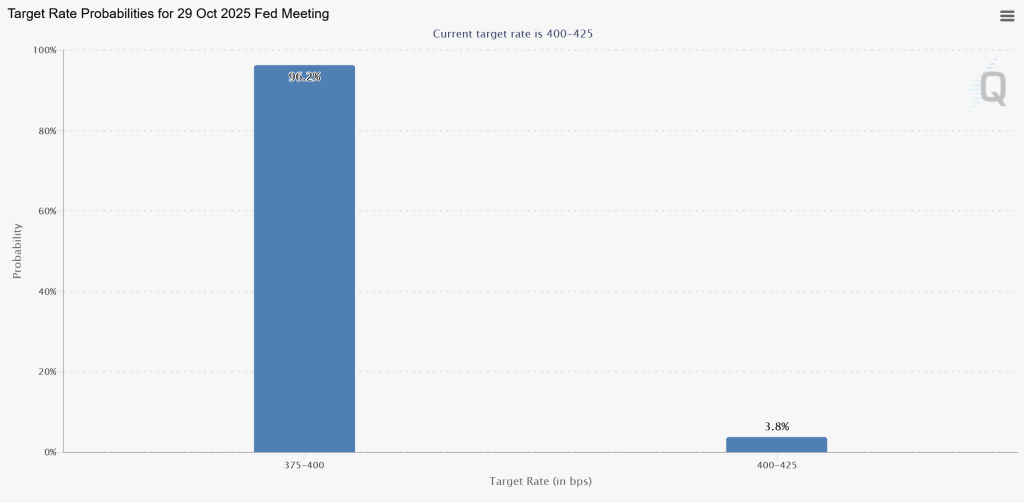

The market remains confident in the continuation of the federal reserve, the reduction in interest rates, because the Fedwatch tool of the CME group currently expects the interest rates to 25 basis points in October by 97% with a later reduction in December by 85%.

Although the postponement of the non -agricultural employment report due to the government’s closure on traders because of their dependence on data indicating that the labor market continues to express twice.

Why the challenges to reduce interest rates ignite Ethereum ignition (Ethereum)

One of the most powerful macroeconomic savings supporting the price of Ethereum; When borrowing costs decrease, investors generally tend to pass assets provided for stable yields to the highest and most risky assets, and the actions of the technological sector and digital currencies. As for Ethereum, this transformation means additional liquidity into a currency itself and to the pillars of its technical system, the most of which is defined.

The advantages of Ethereum blockchain in particular because it is the pillar of the infrastructure of most blockchain requests, including stable currency sectors, NFT and mortgage protocols. With traditional financial market revenues, the Ethereum part, which currently provides an annual return, is 3 to 4%, a relatively more attractive option, which contributes to explaining the superiority of Ethereum to its counterpart in the lowest alternative currencies in recent weeks.

In addition, the increase in institutional participation supports this trend. Often, the funds that expect to facilitate monetary policies balance their governor towards long -term innovative assets, and if interest rates are soon reduced, investments received in the funds exchanged (ETF), mortgage products and decentralized financing systems (DEFI) on the basis of Etheerium blockchaine will increase (Ethereum Blockchaine) Sectors.

Ethereum Attentions prices: artistic look

Technically, and by examining the graphic graphic of two hours, the price of the Ethereum price remains promising, because the continuous price of cohesion greater than $ 4,500, now its stability in a price channel emerging since the end of September. Here, the graphic graphic shows the formation of vertices and gradients with a support for the importer of medium-sized airlines (MAS), where the average average measurement line was installed with a range of 50 SMA-50 trading at $ 4,372, the highest counterpart (SMA-100), which is placed at $ 4,294.

Likewise, momentum indicators remain favorable to the direction of the increase, because the relative power index (RSI) approaches 58 after having retracted the excess purchase while maintaining a positive dynamic, while the formation of short negotiation candles and another of Duji recently suggests a phase of temporary stability after a high wave of height.

Ethereum is stable above $ 4,500, leading a strong upward trend in an ascending channel. RSI cooling nearly 58 indices in healthy consolidation – a limit of $ 4,440 to $ 4,420 could feed the next leg around $ 4,675 – $ 4,765. #Ethereum #Eth #Crypto pic.twitter.com/jxjwcnraal

– Arslan Ali (@Forex_erslan) October 4, 2025

In any case, the price will be linked to the upward trend line of $ 4,440 to $ 4,420, an opportunity to buy to take advantage of the decline with the targeting of resistance levels at $ 4,675 and $ 4,765, respectively. To kiss any imminent drop, you can end losses less than $ 4,375 in accordance with the short -term support level.

If it is broken and stable below, the correction wave can extend to $ 4,200. However, expectations remain high as long as the price maintains its position in the channel.

Maxi Doge-Maxi

The maximum currency depends on the culture of M., and it is designed for investors who like the risks interested in doubling the value of their investment at around 1000 times and that researchers are expelled to success, the maximum currency is only MIM currency, but a community culture which combines the ferocity of negotiation, the energy of gymnasiums, stimulants and collective competitors.

Currency owners will receive mortgage bonuses and will benefit from trading competitions and reach games that look like games. On the other hand, the intelligent currency contract has successfully passed the solid and corporate teams successfully, giving investors an additional confidence in the project foundations.

The currency has a strong dynamic indicated by the success of the subscription by collecting more than $ 2.75 million, and the currency is currently sold for $ 0,000,2605 and is expected to increase with the progress of the subscription stages, which increases the attractiveness of early investment.

Maxi Doge will also appreciate access to:

- Degles mortgaged with variable yields.

- Ecpentant commercial competitions with prices for the lists of winners.

- Partners’ activities paid in society and future expansion activities.

Finally, you can buy currency for Ethereum, Binance-Bnb and Tether-USDT or by Visa and Mastercard by visiting the official site of Maxi Doge.

لزيارة الموقع الرسمي لاكتتاب عملة ماكسي دوج (Maxi Doge) اضغط هنا

The position of expectations of Ethereum-Eth prices: here is the reason for paying interest rates reduction rates to increase the momentum of the currency after restoring the level of $ 4,500 appeared first on Arab Cryptonews.