Global cryptography markets react when Trump’s tariff threat increases commercial war tensions

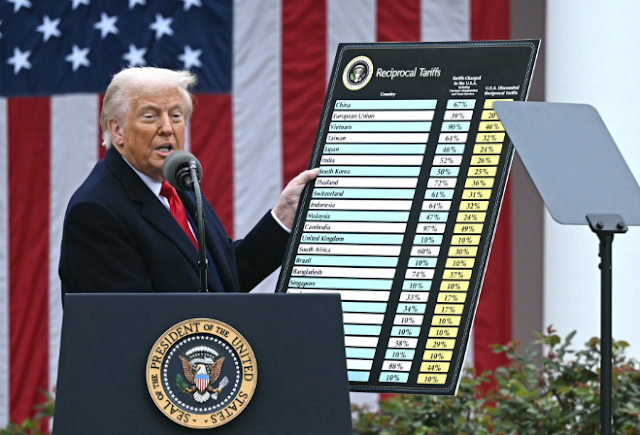

The global economic panorama is nervous as the United States is close to imposing a 10% reciprocal rate in 10% of approximately 100 countries, a movement that could fundamentally remodel global commercial flows and sacrifice financial markets. The Secretary of the United States Treasury, Besent, confirmed the plan, aligning with the aggressive economic position of President Donald Trump as the 90 -day tax pause of his administration approaches the expiration on July 9.

The announcement, first highlighted by Kobeissi’s letter, arrives at a sensitive moment, with many international trade negotiations still unsolved. As the deadline approaches, companies and investors prepare for unpredictable policy decisions that could interrupt supply chains, increase operating costs and alter capital flows worldwide.

|

| Source: x |

How will this rate affect cryptographic markets?

The 10% proposed Trump rate is not simply another policy adjustment in the field of international trade; It has significant implications for cryptocurrency markets. Historically, economic uncertainty and geopolitical tensions have brought investors to seek refuge in alternative assets, and cryptocurrencies such as Bitcoin and Stablecoins are considered increasingly as hedges against potential depreciation of the fiduciary currency.

As commercial tensions increase, experts believe that interruptions in traditional markets could push capital to cryptographic assets, with Bitcoin often emerging as a preferred safe refuge. However, the cryptographic sector is not immune to winds against potentials that this rate could introduce. Governments that face greater economic pressure could harden financial regulations, particularly in relation to transactions of cross -border digital assets, in efforts to maintain the stability of the currency and avoid capital flight.

In addition, blockchain companies that depend on global hardware supply chains or international developer talent can find the increase in operating costs. Any delay or interruption in hardware shipments due to new tariffs could slow down the development of infrastructure, affecting the deadlines for project releases and impacting the growth path of the broader cryptographic ecosystem.

While there is the potential of a greater adoption of cryptographic, the performance of the sector will be closely linked to how these rates are implemented and the broader macroeconomic environment that they create in the coming weeks.

Expert views: limited progress and legal uncertainty

Coin Gabbar analysts point out that with the imminent deadline, only limited progress in commercial negotiations is expected before tariffs enter into force. They suggest that while the United States can ensure some minor agreements to mitigate the immediate reaction, the general rigidity in global negotiations will persist.

In a recent note, Coin Gabbar analysts declared: “The most realistic scenario implies partial agreements that allow the United States to extend certain deadlines without seeming to compromise their position. However, given Trump’s unpredictable approach to trade, markets must prepare for steep changes that could redefine global commercial dynamics.”

To further complicate the situation are continuous legal challenges for Trump’s tariff strategy. In May, the United States International Trade Court ruled that the majority of the previous tariffs of the Administration were illegal, a decision that has been temporarily annulled by a Federal Court of Appeals. These legal battles have added new layers of uncertainty for companies, which now face a dilemma: prepare for new rates or anticipate a judicial reversal that could alter the results of the policy.

The European Union remains firm

One of the most critical players in this developing exchange saga is the European Union, which has not indicated that there is no intention to give in to the pressure of the United States or adjusted deadlines. Representing almost 25% of US exports, EU’s firm position underlines a broader change in global commercial dynamics, where nations prioritize long -term policy considerations on reactive measures.

By maintaining its position, the EU can influence other nations to adopt a similar position, which further complicates any quick resolution to the ongoing confrontation. This resistance is emblematic of a world where countries increasingly affirm their sovereignty in commercial negotiations, even in the face of economic pressures.

Cryptographic industry trapped in crossfire

For the cryptocurrency sector, Trump’s rate strategy creates a complex environment. On the one hand, economic instability often increases the demand for decentralized financial systems and non -sovereign digital currencies. Bitcoin, Ethereum and Stablecoins could see a renewed interest of investors seeking to diversify away from the fiduciary exposure amid the volatility of the potential currency.

However, the same tensions could also lead to regulatory repressions, particularly in relation to anti-launching measures and capital flow monitoring. Mining encryption operations, many of which depend on the hardware of global origin, could face higher costs, tighten margins and delay expansion plans.

In addition, blockchain projects with international development teams may experience talent shortage or greater compensation demands if cross -border movements become more expensive or restricted. These challenges could hinder the speed at which cryptographic projects develop and implement, which affect the rhythm of innovation within the ecosystem.

Agreement between the United States and Vietnam and additional rates

Adding greater complexity to the global commercial environment, President Trump recently announced an agreement with Vietnam that will introduce tariffs ranging from 20% to 40% in goods sent through other countries before reaching the United States. This measure, aimed at curbing transford practices to avoid existing tariffs, has added another layer to the tariff panorama, affecting multinational supply chains.

| Source: x |

For companies with intricate global logistics networks, this development requires a reevaluation of shipping strategies and relations with suppliers, increasing operating costs and delaying deliveries.

Companies and investors enter the “wait and see” mode

With the deadline of July 9, companies in all industries are adopting a cautious approach. Importers, exporters and manufacturers are delaying investment decisions, the reevaluation of supply chains and reinforcement for higher costs associated with possible tariffs.

In the cryptographic sector, companies are equally vigilant. From hardware -dependent mining operations to software development projects that depend on global talent, companies are evaluating potential risks and the formulation of contingency plans. For new companies and projects that operate in developing markets, challenges are even more pronounced, since limited resources make rapid adaptation to policy changes difficult.

Conclusion: A crucial moment for global trade and cryptography

As the global market prepares for the imposition of the Trump 10% rate in almost 100 nations, uncertainty permeates financial markets, supply chains and cryptocurrency ecosystem. While there is the potential that cryptocurrencies benefit from economic instability and fiduciary concerns, the industry must also navigate regulatory risks and operational challenges that may arise when changing commercial policies.

The latest developments mark a critical phase in global commercial relations, with the potential to influence the feeling of investors, corporate strategies and policy frameworks worldwide. It remains to be seen if these tariffs will mark the beginning of a new era of economic realignment or will trigger new commercial tensions.

For the cryptographic sector, this is a moment of cautious optimism, balancing the potential of greater adoption against winds against operations and regulatory that could arise from a changing global commercial environment.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.