Pepe fails to break the 50 -day EMA, restoring a key trend line. Will it be linked or will crash at $ 0.00,00050?

As Bitcoin drops by $ 84,000, the supply pressure on coins increases sharply. Among

Pepe, the frog-theme same corner, is downloaded at $ 0.0000070, losing Momntum Haussier in the middle of the mounting sales pressure. With an imminent potential download, is Pepe about to dive at $ 0.00,00050?

The price of pepe is approaching the retest of the broken corner fall

By not thinking of the upward rupture of a first fall model, Pepe took a downstream turn. The price has not climbed above the 50-day EMA, which has been a dynamic resistance since the end of March.

The recent bullish attempt is under a 7 -day summit of 0.0000077 before rejecting a strong rejection. While the 50 -day EMA has a strong supply pressure, the action of pepe prices has formed lonely bick candles.

Currently, the drop in the dynamic resistance line suggests a possible retest of the broken resistance line from the corner of the fall. This presents an opportunity for potential reversal for optimistic merchants and investors, if the retest is held.

With the discoloration of a bullish mom, the MacD and signal lines approach a negative crossroads. If confirmed, this number of technical signals suggests another lower extension.

The pirates accumulating pepe?

Five new portfolios have recently acquired 611 billion PEPE WORK $ 4.28 million tokens in current Pricens, all with the last 24 hours.

How, the source of financing of these portfolios raises the eyebrows. Everyone was funded with Tornado Cash Eth withrawn, a decentralized cryptocurrency mixer 15 days ago.

Do these lives have a question of presentation: do the pirates buy Pepe?

5 portfolios spent $ 4.28 million to buy $ 611B PEPE in the last 8 hours.

The 5 portfolios with ETH $ from #Tornado ago 15 days ago – linked to a pirate.

Do pirates buy $ pepe?

Address:

0x5D058264E3E27EE1B4F852216DC4AFC7C320E25

0x53ba3f792d6c8097a7169c8916b1c3f7975f5ed … pic.twitter.com/8yudfsubva– Lookonchain (@lookonchain) April 16, 2025

Long liquidations will the Pepe download $ 0.00,000,5050?

In the midst of increased volatility, Pepe experienced a -5.37% drop in open interest, now at 281.25 million dollars. It is interesting to note that the funded funding rate by the volume overturned positive, reaching 0.0063%.

One of the main engines of the positive financing rate is the increase in long positions. On

Graphic of the Longshort Pepe ratio

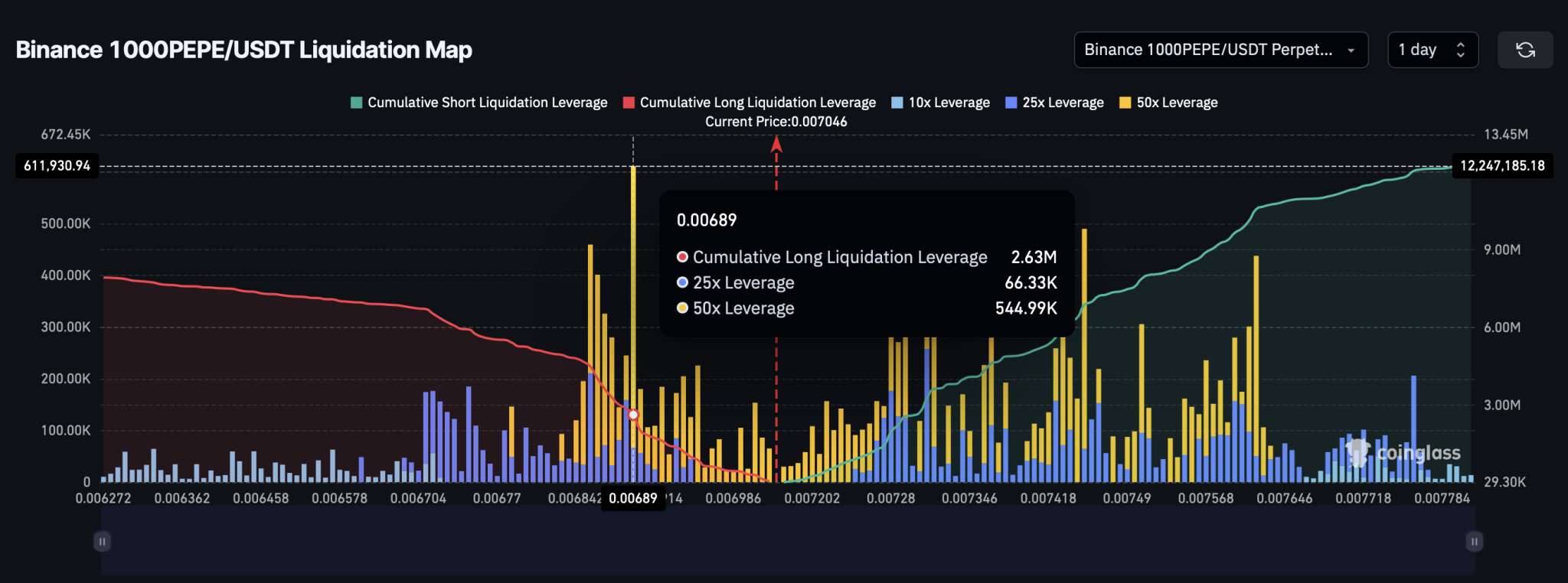

Long positions are currently dominating at 55.9%, reflecting growing upward security for Pepe. Howver, if the download continues and the price reaches $ 0.00,000689, a massive glance of $ 2.63 million in long liquidation shakes many buyers.

Pepe liquidation card

PEPE PRICE TARGTS

With the increase in the Volaticla prices and a large decline in the market, the prices of the meter part can continue to slip. In the short term, PEPE will probably relate the braid resistance trend line nearly $ 0.00,00062.

If this happy, a peak in long liquidations, it slides the price download at $ 0.00,00050. Howver, from an optimistic point of view, a successful post-retest rebound could repaint ÉMA of 50 days, nearly $ 0.0000078321.