The firm of Michael Saylor, strategy (previously Microstrategy), is about to achieve an important mile June.

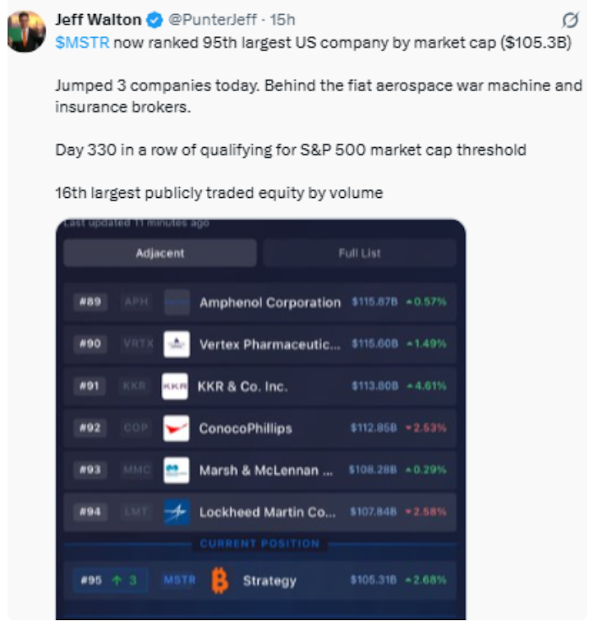

With a market capitalization of $ 102.5 billion, currently qualifying as the 98th largest company that is listed on the stock market in the United States, the strategy has already satisfied most of the eligibility requirements of S&P. However, there is a crucial reference point: demonstrate profitability in the last four consecutive quarters.

|

| Source: x |

Why could the strategy qualify for the S&P 500

The S&P 500 includes the 500 largest companies based in the United States for market capitalization, liquidity and other financial criteria. A key requirement for inclusion are positive profits in the four most recent quarters.

As of June 22, the strategy has 592,345 BTC. If the Bitcoin price remains above $ 95,240 until June 30, the company can close the second quarter with strong enough profits to approve the profit test. But a significant fall in the price of Bitcoin before the end of the quarter could endanger the opportunity.

Market performance and current state

When writing this article, Bitcoin is quoted at approximately $ 107,209, 1.88% more in the last 24 hours. This gives the strategy a safety shock absorber over the risk threshold. However, the encryption market is still volatile. Only a few days ago, geopolitical tensions between Iran and Israel pushed Bitcoin below $ 100,000, which goes back to investors as quickly as the market can change.

Despite volatility, the strategy has maintained its market limit above the S&P eligibility level for 329 consecutive days, which reflects a constant force in terms of size.

The heavy negotiation volume indicates a strong interest of investors

Beyond market capitalization requirements, the strategy is also one of the most actively negotiated actions in the market. He currently occupies the 13th place in negotiation volume, indicating a sustained interest of investors. Last week, the company acquired additional 245 BTC for $ 26 million, with an average purchase price of around $ 105,856 per currency.

|

| Source: Coinmarketcap |

In mid -2025, the Bitcoin strategy portfolio has delivered a gain of 19.2% in the year to date, an impressive figure given the fluctuating cryptographic panorama.

What could mean S&P 500 inclusion for $ Mstr shares?

If the strategy is added to the S&P 500, it would become the second company focused on cryptographic to join the index this year, after the inclusion of coinbase in May. This would be widely seen as another innovative moment for the cryptographic industry.

For strategy actions ($ Mstr), inclusion could trigger a price increase. Historically, the shares recently added to the S&P 500 benefit of greater visibility, greater institutional investment and greater confidence in investors. The possible domain effects for the assessment of the strategy are significant.

Michael Saylor’s Bitcoin vision is close to realization

Michael Saylor has long been one of Bitcoin’s most open corporate defenders. His bold strategy of making BTC the central asset in the balance sheet of the strategy was once controversial, causing criticism of traditional financial circles.

|

| Source: x |

Today, that strategy seems to be paying off. The long -term long -term accumulation of the strategy is to position the company for inclusion in the most elite actions index in the United States. Many in the cryptographic community now consider Saylor as a pioneer of the institutional adoption of Bitcoins.

Final countdown to June 30

With only remaining days in the second quarter, all eyes are in Bitcoin’s price trajectory. If BTC maintains its position above $ 95,000 until June 30, the strategy is expected to meet all the necessary grades for S&P 500 inclusion.

This milestone would not only raise the public profile of the strategy, but also serve as a symbolic victory for the broader digital assets ecosystem. A place in the S&P 500 offers greater legitimacy, attention of the media and possible inputs of investors both for the strategy and for the cryptographic sector in general.

Broader implications for cryptographic industry

The possible entry of the strategy in the S&P 500 represents more than a milestone of the company: it points out the growing conventional acceptance of cryptography as part of traditional finances. If a strategy is added, it would validate the belief that companies with aggressive digital assets strategies can achieve prominence in inherited markets.

Bitcoin, the centerpiece of strategy holdings, is increasingly seen as a speculative asset, but as a strategic financial instrument capable of remodeling corporate assessment and capital structure.

Conclusion: Crypto edges closer to the Wall Street nucleus

The almost true inclusion of the strategy in the S&P 500 is a strong sign that cryptography is no longer a marginal element of finance. The combination of visionary leadership of Michael Saylor, a substantial investment in Coin BTC and favorable market conditions are converging to create a historical moment for both the company and the broader digital asset community.

If everything is aligned as predicted, on June 30 it could mark a decisive moment, not only for the strategy, but for the role of cryptography in global finances.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.