The Solana -Sol play is put in the spotlight with the growing positive news, in particular the development company – previously known under the name of Janover – investing around $ 12 million in Solana, as well as the impressive success to subscribe to the project of the first second class solution on Solana Bluena (Solx) – which has just exceeded its products. $ 34.5 million.

Recent purchases and assembly of soil add more to the wave of positive developments in the network, which improves long -term confidence in Solana and support has renewed the positive general mood. On the other hand, the official launch of the second layer solution could be one of the largest positive stimuli in the Future way of Solana. This solution should strengthen the balance of the entire Solana technical system – immediately after its launch – by attacking the continuous congestion problems that the network suffers, which can increase its reliability during the enormous periods of activity, which is a decisive step within the framework of its effort to export intelligent contract platforms.

The opportunity for supporters of the first project is always the possibility of acquiring solx currency at a reduced price currently at $ 0.00172, knowing that the price will increase in a few hours when the subscription enters its next step.

DEFI DEVELOPMENT COMPANY passes its ground balance to $ 59 million

DEFI Development – Investment of the AI whose shares are negotiated under the DFDV -Strongly in Solana, where it bought 82,504 additional coins to exceed its total property of the currency 400,000 soil with a value of the company.

1 / The $ Soil Stackin ‘Saga continues!

Defi Dev Corp bought 82,404.50 others $ Soil Is worth ~ $ 11.2 million as part of our Crypto-Forward cash strategy.

Our total assets are now 400,091 $ Soil (Including stokeing awards), or about $ 58.5 M. pic.twitter.com/ev25m5wpk– Defi Dev Corp. (@defidevcor) May 6, 2025

On Monday, the company revealed its purchase of the Solana verification process for $ 3.5 million, and its price was paid via limited DFDV shares at a value of $ 3 million and $ 500,000 in cash.

The infrastructure – which the company has acquired – also includes mortgaged currencies of around 500,000 soil, with a value of around 75 million dollars, which places the company in an excellent location to win transactions verification bonuses and deepen its investment in Solana’s economy. This step is part of the wardrobe strategy for digital assets launched by Defi Development last year in order to collect high-performance chipto assets, similar to a number of other companies.

$ DFDV Just acquire a $ Soil Business Validator with ~ 500K AVG. Delegated soil ($ 75 million).

At 8%, it’s + 40K soil / year = $ 6 million at $ 150.

A strategic movement to deepen $ DFDVPlaybook accumulation floor. pic.twitter.com/gb1s6omcuf– Token Treasury Tracker (@Defi__Tacker) May 5, 2025

The growing institutional interest in Solana has been obvious in the supply of a certain number of companies – the most important of which are Vaneck, 21 shares, Bit and Canari capital requests – for the federal register to create a 90% negotiation box to accept these requests.

Despite the indication of many factors to a brilliant future in Solana, but the expansion of the network and its ability to compete with BlueChen Etheerium forces them to improve its reliability and to extend the problems of continuous overcrowding that disturbed users and developers – both – for a long time, which has prevented the network from benefiting from its complete capacities, and here comes the role of the Solox (Solx).

When the Solana network slows down, the danger of everything; Here, the role of Soillie Sorrection

Reliability is a major element when it comes to any treatment, so imagine Visa or Mastercard when increasing transaction sizes; At that time, billions of dollars could be lost costs and lack of confidence in these companies.

Similarly, this is the case in the world of pancake, for those responsible for the verification of Solana transactions – including the development of DFI – network interruptions can disrupt income sources and destabilize its technical system, and continuous instability and investors to competing blockchain networks can also drive.

Despite the impressive Solana Blactchin, its mono structure – in the sense that all its operations are made only on its own blockchain – makes it vulnerable to disturbances during periods of excessive activity, while the Ethereum Bluecine – in return – relied on the solutions of the second layer of expansion.

Recent reports show that that in intense congestion period, 70% of Solana’s transactions fail, in a clear indication of its urgent need for a solution that helps it develop, and here is only one publication – from other publications – on the X platform by Whale Insider explains that the rate of missed transactions on Solana recorded 75.7% last year, some users recently affirmed this percentage at 90%.

Bresse: 75.7% of Solana’s transpersons are fablel. pic.twitter.com/p1cea4hrmy

– What initiate (@whaleinsider) April 5, 2024

Here, the role of the Solaxy, which presented the first real layer solution to the Solana Balcocin, which is specially designed to mitigate the pressure on it by treating and turning transactions outside the network to finish it, is a solution that will solve network problems in the future.

The Solaxy project carries out important achievements which exceed the functionalities of the main network

Solaxy uses the collection technique of thousands of transactions outside the blockchain and treat it, then turn it over as a single compressed treatment to the main solana network, which would reduce the pressure on integrity and applications (DAPS) without disturbance during pressure periods.

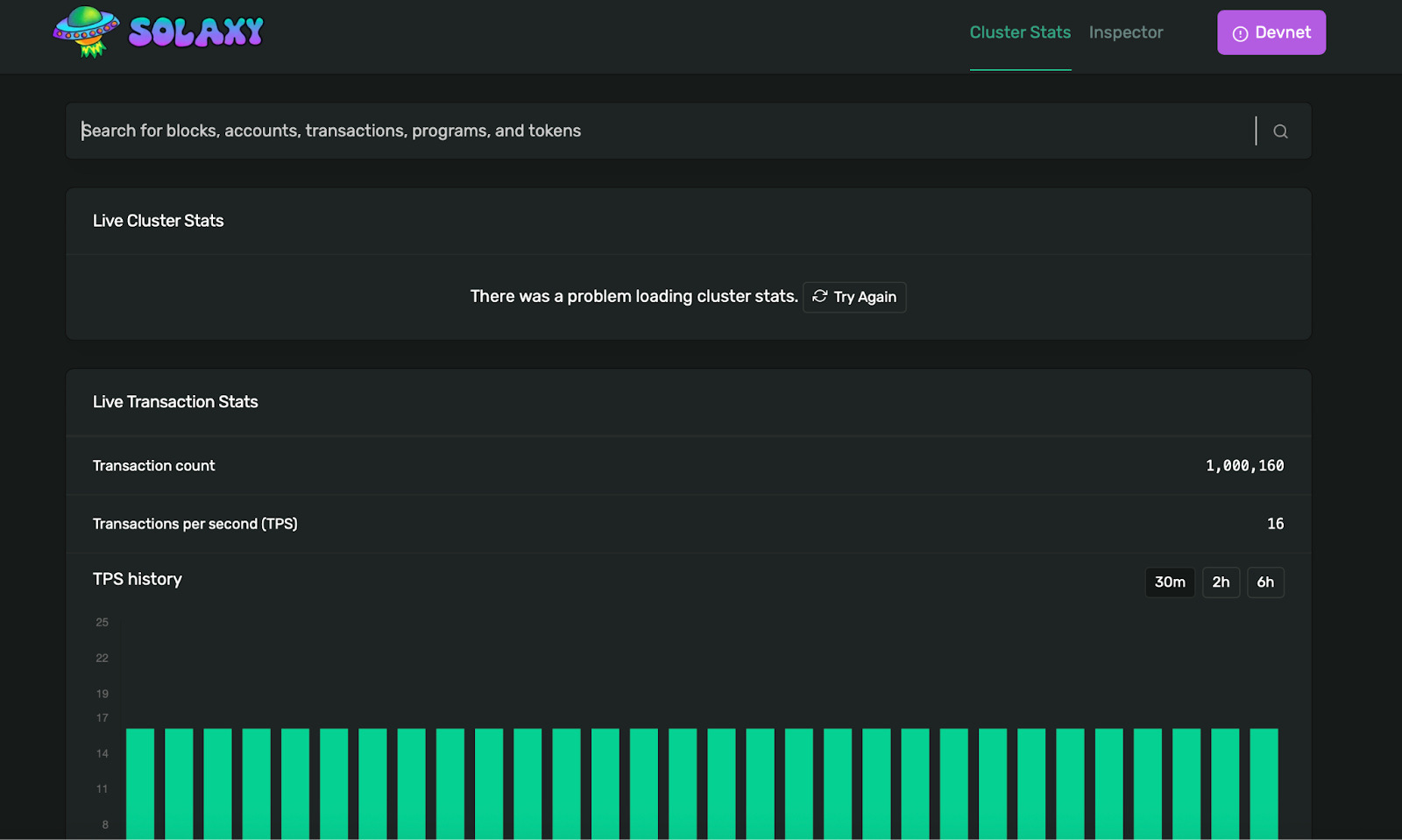

It is not considered as theoretical words, because the experimental network of Solaxy works now, offering developers an environment to test the pressure and the desire to launch the main network. In short, you can consider a test tool for the Solana II engine.

On the other hand, the project also launched its Blukachin browser in order to review the activity of the experimental network in a way that would provide transparency rarely presented by a currency project at its subscription stage, which emphasizes the course of things as it should.

In conclusion, these achievements show that the project is not only under development, but has also started to operate.

Have you missed the opportunity to invest in Sol when it was $ 0.50? Here is the solution of the second layer, which can grow 1,000 times

According to Vaneck, the ground price can reach $ 520 this year. And compared to its price today, its investors can obtain yields for 3.5 times, but for those who bought it at $ 0.50, they made incredible profits of 1,040 times.

Source: tradingView

Of course, the days of early investment in Solana came, so how can you repeat these huge yields? The solution may not invest in Solana itself, but in the infrastructure based on its expansion. With more Solaxy transactions, functional uses of its solx work that supports Solana’s growth can increase; Researchers can find earnings with a thousand times they have lost.

The present time is perfect for joining Solx and maximizing your gains in the future

If you want to obtain yields of a thousand times, the element of time is of great importance for you, in particular with the possibility of buying a solx at the lowest price for this now thanks to its current subscription. Therefore, it may be worth visiting the Solaxy website and linking your governor to its interface; You can also mortgage your currencies – the news – immediately for an annual yield (APY) of 116%, knowing that this yield will change according to the size of the mortgage complex.

For the best experience, you can find the use of the best wallet that allows you to offer your solx assets even before its launch, as well as its ability to work via Etheerium and Solana networks. Finally, you can also join the Solaxy community on Telegram and X to see the most important developments in the project.

Follow us via Google News

The position is one of the decentralized financing giants invests $ 12 million to buy 82,000 floor currencies, and the second layer solution is calmed for more than $ 34.5 million.