Bitcoin briefly fell below $72,000 Thursday morning in early trading hours in Asia, hitting its lowest level in nearly 16 months. As the sell-off intensifies, market forecast traders on Polymarket are quickly reassessing their expectations – and the data paints a sobering picture in the short term, even as long-term optimism persists.

Polymarket’s real money contracts show a market caught between defending a $70,000 floor and maintaining a $100,000 annual return.

February Outlook: $70,000 is the line in the sand

Polymarket’s February Bitcoin price contract, with 24 days remaining and nearly $1.78 million in volume on the $70,000 target alone, tells a clear story.

The $70,000 contract jumped to a 74% probability, a 65% upside, making it the most traded target of the month. Upside expectations have collapsed: the $85,000 contract has plunged from 61% to just 29%, while the $90,000 contract sits at 12% and the $95,000 contract sits at just 7%.

In contrast, the $65,000 contract fell 13% to 39%, while the $60,000 contract remains at 19%. The odds of a crash below $55,000 are in the single digits. The implied range for February is between $65,000 and $85,000, with $70,000 being the most likely point.

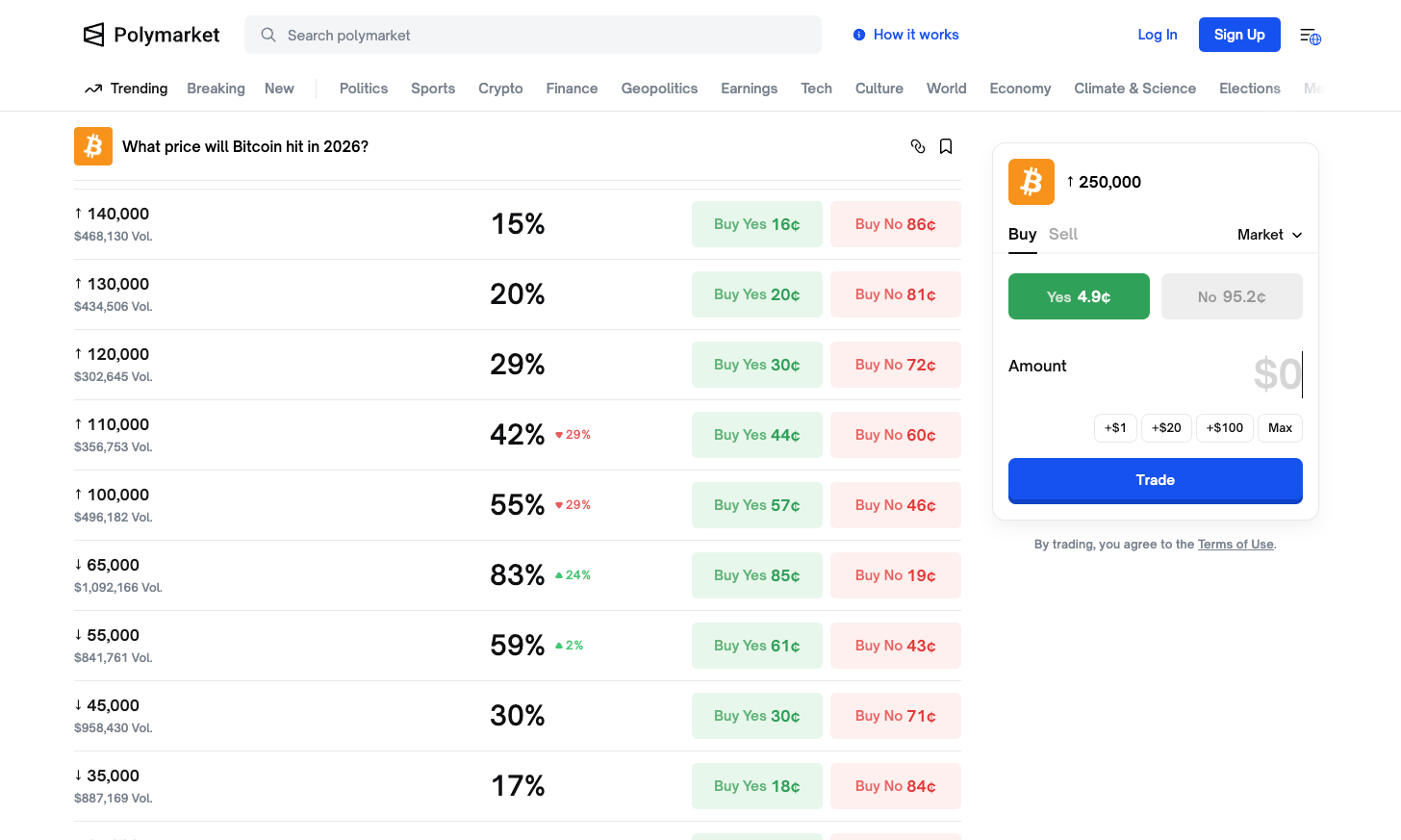

2026 annual contract: still optimistic, but frayed

The longer-term Polymarket contract shows a more nuanced picture. The $100,000 level has a probability of 55% but is down 29%, while $110,000 is at 42% and down 29%. These are significant declines from just a few weeks ago, when traders were banking on the 2025 rally continuing.

The $65,000 contract for 2026 surged 24% to 83% with volume of over $1 million – the highest on the chart – signaling that traders are focused on downside protection rather than upside speculation. The upper curve drops sharply: $130,000 at 20%, $140,000 at 15% and $250,000 at almost 5%.

What drives the sale

Bitcoin was trading at around $73,199 at the time of writing, after briefly falling below $72,000 earlier on Thursday. The token is down 16% year-to-date and around 40% from its October 2025 all-time high of $126,000.

Multiple factors are converging: growing geopolitical tensions, lingering data gaps since last fall’s record 43-day government shutdown, and a hawkish appointment to chair the Federal Reserve, which is strengthening the dollar.

The technical damage was significant. More than $5.4 billion in liquidations have taken place since late January, pushing open interest rates to their lowest level in nine months. US spot Bitcoin ETFs have bled capital for the better part of the past three weeks, with outflows of $817 million on January 29, $509 million on January 30, and $272 million on February 3, punctuated by a single day of inflows of $561 million on February 2. The total net assets of spot Bitcoin ETFs have fallen from over $128 billion in mid-January to $97 billion.

The Crypto Fear and Greed Index plunged to 12 – deep into “extreme fear” and its lowest since November 2025. Gold, meanwhile, rose above $5,000 an ounce, highlighting a broad rotation into safe havens.

The essentials

Polymarket data provides a real-time window into how traders with money on the line are positioned. Expectations for February are between $65,000 and $85,000, with almost no chance of recouping $95,000.

The annual contract is more lenient, with a slim majority still expecting $100,000 in 2026. But even that belief is weakening. Right now, $70,000 is the number everyone is looking at.

The article Polymarket Price in February at $70,000 for Bitcoin appeared first on BeInCrypto.