Bitcoin-BTC decreased by 1.4% to $ 108,000 during the European negotiation session, to return below the level of support formed from the lower line of the emerging canal; Despite the daily negotiation volume of $ 57.7 billion, the price has decreased below $ 112,000 caused a short -term wave of profits. This decrease coincides with the conditions of uncertainty in the macroeconomic economy, and a swallowed candle is formed on the graphic scheme within two hours, indicating the possibility of a price change.

However, the institutional interest is still solid, the high value of Options of Options open in Bitcoin Trust Ibit (Blackrock) (BlackRock) at $ 20 billion; This indicates a great interest in traditional financial institutions. On the other hand, the total value of open option contracts increased to $ 65 billion, according to Amberdata, traders specifying to an increase in the BTC price at $ 116,000 and $ 120,000 in succession in the coming weeks.

The most important points:

- Bitcoin Price: $ 108,000

- The nearest level of resistance: $ 112,000

- The value of Options Open Options in the Ibit for Black Rock: $ 20 billion

- The total value of open options contracts: $ 65 billion

Optional contracts indicate the possibility of a bitcoin price high at $ 120,000

Optional contract data indicates optimism in the medium term, because orders record on the drunken platform show that the volume of purchase option contracts (calls) is $ 23 billion, compared to $ 13.9 billion for contract sales (PUT), which indicates an increase in the number of speculators on high prices. In particular, attention is focused on exposing major contracts in June to implementation rates from $ 110,000 and $ 130,000.

The block school platform has confirmed the existence of a significant increase in the number of profitability purchase contracts (that is to say which assumes a significant price in the future), indicating generalized optimism among investors. In addition, the rate of purchase sales contracts (put / call ratio) has reached approximately 0.61, which is a clear positive indicator, where trading activities are currently concentrated at implementation rates from a distance, and there are nominal values of $ 420 million at a price of $ 200,000 and $ 620 million at a price of $ 300,000 Bitcoin.

- The value of purchase contracts compared to sales contracts: $ 23 billion / $ 13.9 billion

- Best implementation prices: ranging from $ 116,000 and $ 130,000 in the short term

- Long -term contracts: purchasing contracts greater than $ 200,000 at a value of approximately $ 1 billion

The end of many options of options in June increases risks with serious bitcoin price fluctuations

Today completes 25,000 Bitcoin option contract contracts worth 2.81 billion dollars, which can lead to an increase in short -term price fluctuations with the rate of sales contracts to the purchase today 1.22, and this requires non -optimistic in the short term. The maximum point of pain occurs at the price which ends with most of the options of without value, which is $ 104,000, which is likely to further reduce the price in the event of uninviting momentum.

25,000 BTC options should expire with a put / call ratio of 1.22, a maximum point of pain at $ 104,000 and a notional value of $ 2.81 billion. Meanwhile, 202,000 ETH options will also expire with a put / call ratio of 1.26, a maximum pain point at $ 2,450 and a notional value of $ 570 …

– Wu Blockchain (@wublockchain) May 23, 2025

However, the majority of traders have transformed into contracts which will end on June 27, which currently contributes to more than 30% of the total value of open contracts. Analysts, like Peter Yan, indicated that this indicates the increase in institutions centers, with the possibility of larger fluctuations.

Technical analysis of the price of bitcoin

The expectations of Bitcoin prices seem very optimistic, but at the price of the height again at $ 108,400 and $ 108,650 to enter the purchase zone again. If it fails, this may decrease to the following support levels at $ 107,077 and $ 105,905 respectively. On the other hand, the MacD index continues its decrease below the signal line, so it is worthy of being careful.

- Optional contracts that will end today: 25,000 contracts worth 2.81 billion dollars

- Maximum pain point: $ 104,000

- Contracts that will end in June: 30% of the total value of the open contract

- Relay levels: price height at $ 10,650 again or decrease at the bottom of the level of support at $ 107,000

In conclusion:

The value of Ibit Options contracts in an unprecedented manner indicates $ 20 billion to the possibility of a long -term bitcoin price; But given the indicators of the technical analysis and the end of options of options with great value, a period of caution can prevail before the start of a new emerging wave.

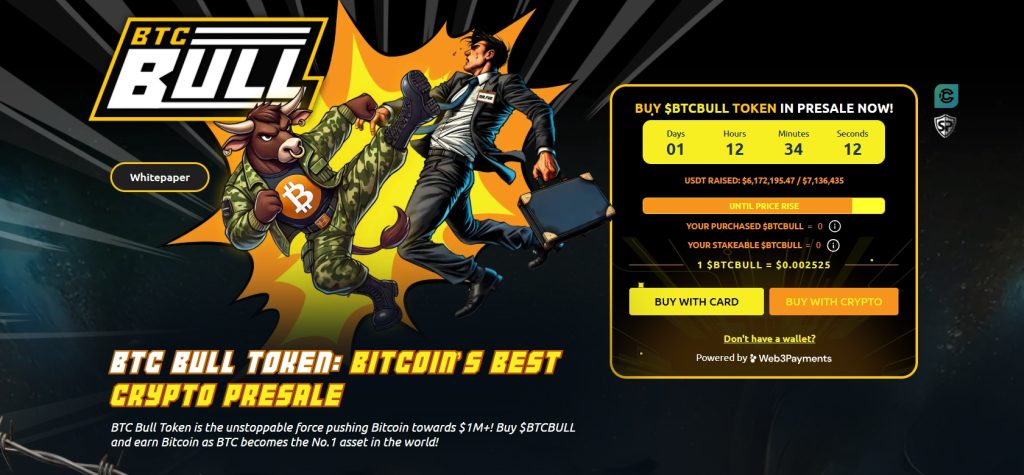

BTCBLL’s subscription is approaching its financing target of $ 7.3 million, and the yield of the fascinating currency of 65% is afraid of the opportunity to miss the opportunity

With the slight price of the BTC / USD pair swing around the level of $ 108,000, the investor’s attention quickly turned into alternative currencies with the most powerful elements of success, the largest number of which is BTC Bull (BTCBUL), which has managed to collect the frequency of the frequency of the financing objective with the approach to the development of the increase. The next price.

The BTCBLL project is characterized by its unique yields, and its owners will receive free BTC distributions each time the price of Bitcoin is a new monument. The higher the price, the higher the number of free BTC distributions, with priority to the supporters of the project during its currency subscription more than its investors after appearing on decentralized trading platforms.

Subscription data:

- The current result: 6,335,731.42 $ 7,332 195

- The current price: $ 0.00253

- Mortgage currencies: 1.62 billion currencies

- Annual mortgage feedback (APY): 65%

In conclusion, it is likely that the deflationary currency mechanism constantly increases its price. The higher the price of the BTC, the more a specific amount of BTCBull currencies will be burned, which reduces the offer and offers significant growth capacities for its long -term investors.

In addition, the BTCBLL currency offers annual mortgage (APY) mortgage (APY) currently balanced by 65% by the mortgage in the mortgage complex on Ethereum, knowing that 1.62 billion currencies have been mortgaged so far without seizure or early withdrawal costs, which allows you to gain income without problem, with the possibility of withdrawing your assets each time you wish.

Follow us via Google News

Will the Bitcoin prize for Bitcoin’s prize for Black Rock soon be exceeded the brand of $ 110,000? APPLERDIRST on Arab Cryptonews.