Ribel Coin returned to the Circle of Lights after a whale (senior investors) transferred 29.5 million XRP currencies with a total value of more than $ 64 million to the Coinbase platform, in a possible indication of the return of momentum. The alert platform, which specializes in the follow-up of the Blockeen, confirmed this process to increase the enthusiasm surrounding the future of Ribel in the short term.

This optimistic vision is based on health data indicating that the governor of whales which maintains between 10 and 100 million XRP collected more than 200 million of them in a week, because this assembly model often preaches, especially before the next market catalyst with strong ascending movements.

The positive atmosphere of the market is the expected announcement of the launch of the Proshares box circulating on the stock market of the Ribel part (XRP ETF) on May 14, where data from the Polymarket platform indicate that the approval possibilities of the above-mentioned fund are 80%, which increases institutional interest in this digital asset. It should be noted that 23% of CRIPTO investors in the United States have XRP, which supports its growing popularity.

Main axes:

- He was allocated to a whale transfering XRP dollars to the Québis platform.

- Whale wallets add more than 200 million XRP currencies in the last 7 days.

- The risk of approval of the ETF XRP fund increased to 80% before the decision on May 14.

The price of XRP sets up at a significant level of support and awaits the possibility of starting

Ribel Currency is currently exchanged nearly $ 2.19 after its temporary price increased to $ 2.15 last week, which led to the liquidation of speculative transactions at a value of around $ 14 million, in what seems to be temporary vibrations on the market and not a permanent drop. The price of money is always greater than an average movement of 20 days (SMA-20) at $ 2,167, which currently represents the nearest level of support.

XRP has a key support, Breakout Eyes

XRP is negotiated nearly $ 2.19, holding above its 20-day SMA ($ 2.167) after $ 14 million long liquidations. A break greater than $ 2.208 COUELF Target $ 2.270 → $ 2,333.

Fall below $ 2.169? Look at $ 2.068 afterwards.#Xrp #Crypto #Ripple #Xrpter pic.twitter.com/vagjbsm2f

– Arslan Ali (@Forex_erslan) May 4, 2025

The technical analyst Javon Marks notes that short deadlines send positive references, because the XRP price continues to test the upper limit of the symmetrical artistic triangle model, while the average movement if at 50 days (AMA 50) operates at $ 2.208 as a variable resistance to prices.

Being a level of 2.208 of $ 2,208 can accelerate the pace of the earnings to $ 2,270 and $ 2,333, while the clear drop of less than $ 2,169 can compromise the increasing scenario and pay the price to a drop to $ 2.068, or even $ 1.993.

Suggested trading strategy:

- Entrance point: Be a level of $ 2.208 or decreased below $ 2,169.

- Growing objective:: $ 2.270 and $ 2,333.

- The target downwards:: $ 2.068 and $ 1.993.

- Loss of stop: Slightly lower than the support level compatible with the steering line or the height on the trading candle.

Conflictual signals call patience with the support of the XRP price

Technical indicators are always contradictory despite the preaching scene, because reading the RSI index currently oscillates in the neutral zone at 52.4, but it tends slightly to positivity, while the average RSI index of 54 increasing trends does not return to the level of sectarian confirmation.

As for the monetary influencing index of tchaïcin (CMF) at 0.13 – it is voted with a slight relief of XRP investments, but it approaches enough neutrality so that its transformation into a positive zone can double the price of the price movement. In addition, Bollen Bander’s bands are getting closer with a strong and imminent movement without knowing the direction.

In conclusion, the current technical situation remains under training, but the confirmation of penetration or fracture is very important. While the decision is approaching boxes circulating on the stock market and the growing whale collection, XRP remains one of the most promising alternative cryptocurrencies this month.

The income of the flexible mortgage of 78% draws the attention of investors and means that the BTC bull is a sign of $ 5.28 million

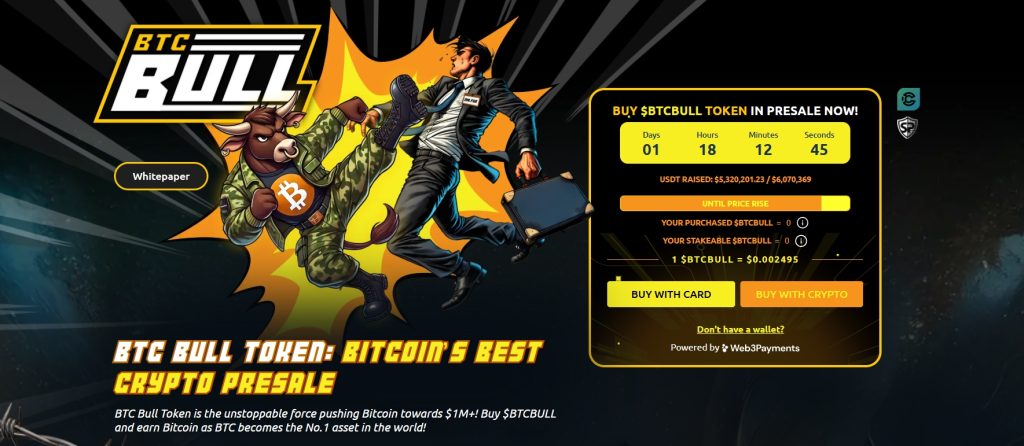

BTC Bull (BTCBLL) continues to attract the attention of investors with the success of its subscription by collecting more than $ 5.3 million so far and its approach to reach its objective of $ 6.07 million. With its price of only $ 0.002495, the currency was able to reserve a higher position than another MIM, because it gives its owners real functional use thanks to a flexible mortgage mechanism with exciting yields.

The economic data of money is derived from its practical uses

BTCBULL continues to impose its distinction from traditional MIM origins thanks to the combination of lymphatic parts and rewarding mortgage bonuses, where users can earn an annual mortgage (APY) of 77% with the ability to withdraw their mortgaged assets when they wish, in the absence of compulsory mortgage periods or their early drawing fines. This model was admired by investors seeking to obtain yields without sacrificing access to their assets, especially in the environment of volatile digital currency.

Current subscription statistics:

- The current result: 5,337,971.02 $ on 6,070,369 $.

- The current price: $ 0.002,495.

- Total mortgaged currencies: 1 362 521 472 BTCBL.

- Annual return (APY): 77%.

With the approach of the next step, which is no longer separated by less than $ 680,000, the remaining time window becomes narrow at an accelerated pace, so that budding investors must make abundant profits without sacrificing the freedom to act in their investments to rush to subscribe to BTCBLL, which becomes a more attractive option during the exciting Cripto cycle of 2025.

Follow us via Google News

The Post-Ribel Prize is preparing up to the task: analysts referring to an ascending wave and promising growth possibilities appeared first on Arab Cryptonews.