Republican Senator Cynthia Lummis is moving to assert one of the key decentralized finance (DeFi) provisions in the Senate bill’s overall market structure as its own text, alongside Democratic co-signer Ron Wyden, as the crypto industry and its lobbyists in Washington await the unveiling of the new plan on Monday.

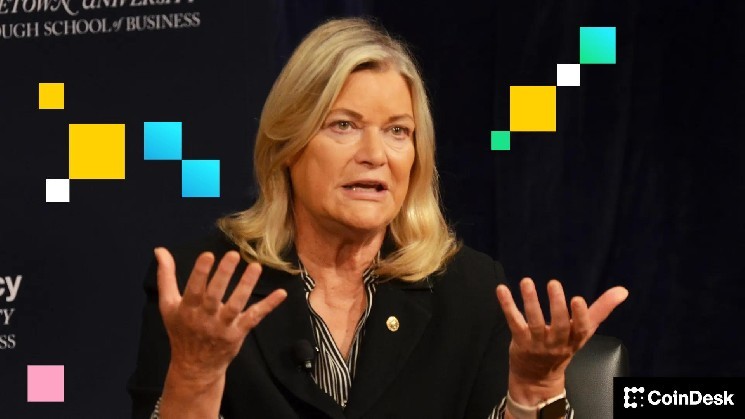

Crypto’s DeFi sector has repeatedly stated that it is non-negotiable that market structure legislation protects software developers who do not control people’s money from being processed by money transmitters. Although a section of an earlier Senate bill protected these developers, it is back on the negotiating table. Meanwhile, Lummis and Wyden, an Oregon Democrat, are introducing the provision as a standalone bill. “It’s time to stop treating software developers like banks just because they write code,” Lummis said in a statement.

A person familiar with the effort said the goal was to emphasize that this particular issue has bipartisan support, although introducing it separately will certainly raise questions about whether it will remain as a section of the larger bill.

The Blockchain Regulatory Certainty Act, which excludes the money transmitter label from developers who do not have custody of customer assets or control their movements, was originally a bill in the House of Representatives. It was eventually taken up as a section of the Senate’s market structure bill, and now the Lummis-Wyden bill gives the original House version a match in the Senate.

This and a number of other topics are still being hotly negotiated as part of a much larger Senate bill that would establish regulators for U.S. crypto markets. Another person familiar with the conversations said the most important debates appear to be around issues of illicit financing; the ins and outs of the DeFi treatment of the bill; the issue of stablecoins associated with rewards and yield; and Democrats’ demand to address senior government officials who profit from the industry — a provision that clearly has President Donald Trump in mind.

Lobbyists are preparing to publish on Monday evening a draft which would be the text defined for the markup during a hearing of the Senate Banking Committee on Thursday, announced last week by Chairman Tim Scott.

Passing major legislation is always a challenge, but this negotiation is particularly complicated, with so many groups involved. In addition to both political parties and the White House, which are heavily involved, the effort seeks buy-in from banking lobbyists who put an eleventh-hour damper on stablecoin yield negotiations, as well as the crypto industry itself. Each of them suggested “red line” issues that could cost their support if their demands were not met.

The industry is not a monolith in itself, as it represents divergent views from its DeFi insiders and its more centralized companies such as the Coinbase and Kraken platforms. While the industry has represented a combined front on issues such as protecting software developers from legal liability, as shown in a letter signed last August by more than 100 companies and organizations, the possible bill could test whether red lines declared in one crypto segment are defended in others.

For his part, Brian Armstrong, CEO of Coinbase, said in a December 26 post on the social media site.

“Red line problem for us,” he wrote. “And we will continue to defend our customers and the crypto industry.” Coinbase said it earned $355 million in stablecoin-related revenue in the third quarter of 2025.

New draft incoming

Close observers of the negotiations predicted Monday that the bill would fail to satisfy the Democrats’ list of sticking points. If the bill gets only party-line approval in committee this week, that raises the question of whether it can win the seven Democratic votes the bill would need, assuming the entire Republican caucus is on the board.

For Republicans, the upside of a failure to compromise may be particularly evident for Tim Scott, who in addition to his committee chairmanship also leads the National Republican Senatorial Committee (NRSC) charged with supporting Republican candidates in this year’s midterm elections.

The crypto industry was among the top campaign benefactors in 2024, and it could potentially have more than $200 million on the table for its favored congressional candidates. If Democrats can be portrayed as opponents of crypto legislative progress, much of that money could end up in the Republican cause.

Read more: Cryptocurrencies Could Still Opt Out of US Market Structure Bill if DeFi Needs Not Met