Solana currency is negotiated at $ 227.69, now its stability after a week full of major institutional investments in conjunction with high market confidence, and commercial data indicate that blockchain and derivative contracts for a significant change in the market structure, where the conviction of institutions increases while small investors remain their prudent position.

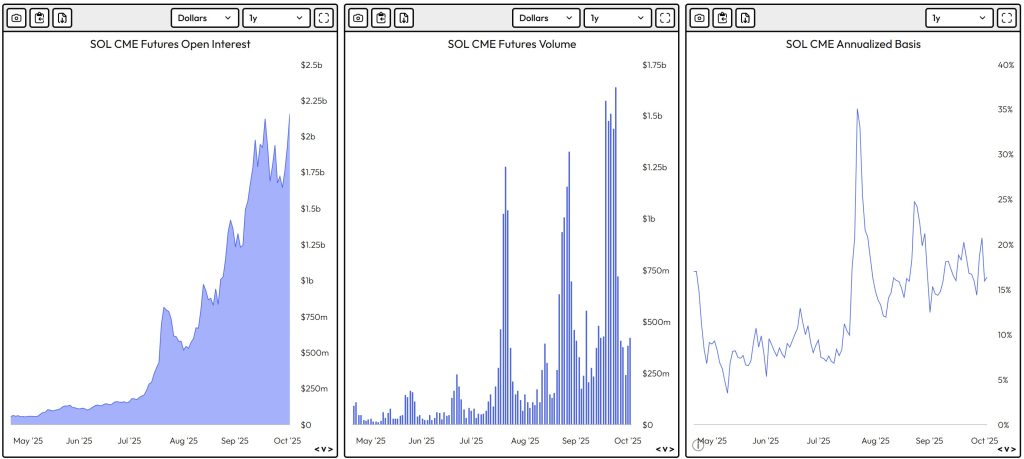

Velo.Data data also show that the size of the term contracts on Solana Open for the Chicago Commercial Stock Exchange (CME) has reached an unprecedented level at $ 2.16 billion, in conjunction with the price increased from $ 23% to $ 235. This institutional concentration occurs before the decision of the exchange of American titles and prompts for invites for October 10 on the Solana Exchange Exchange (ETF), and the prints of the SEC) are professional programs Preparation for the possibility of high fluctuations.

On the other hand, the basic annual average on the Chicago Commercial Stock Exchange (CME) decreased to 16.37% against 35% in July, which means that current activity does not represent speculation. On the other hand, the value of open contracts for small investors via other platforms has remained completely stable, while funding rates are close to neutrality.

This image provides a clear vision; Where institutions are bought in force while small investors are still recovering from the liquidation wave of $ 307 million on September 22, when speculative centers were liquidated for $ 250 million.

This scene also shows a healthy balance that tends to increase, because institutional assembly operations increase a high price for the price, while leverage for small investors remain low. Historically, this style structure style leads to progressive and studied altitudes, rather than sudden price peaks.

Investments received in products negotiated on the Solana ETPS scholarship strengthens confidence

Another sign is on institutional demand in the investment of boxes circulating on the stock market of ETF Solana, after the total assets managed by these funds exceeded $ 500 million led by the SSK negotiation and mortgage fund of the SSK of Rexshares, whose value exceeded $ 400 million. In the same context, the value of the assets managed by a solara mortgage product on the Stock Exchange has exceeded BSOL, a barrier of $ 100 million, and the two producers have attended a large spread since their launch.

This represents a structural change in the way investors are exposed to Solana’s part (Solana), based on the transmission of speculation to organized products which offer mortgage yields, which is a sign of market maturity and confirms that Solana is one of the most complete alternative currencies in 2025. Chicago (CME) that institutional concentration has become the main driving force in the price movements of the Solana currency.

Solana currency rate: technical view

Technically, the expectations of the Solana currency prices remain a rise, because they move in a clear rise trend and are broadcast at $ 227 after its height of $ 205 last week, and the average movement is located for 50 days ($ 214.50) and 100 days ($ 216.35) below the current price, indicating an upward intersection confirming the continuous positive direction.

Japanese candles show smaller bodies with alaouite optimism, which indicates price stability after a large movement, and the RSI power index (RSI) is a value of 55.9, which means that the market has calmed down and that there is room for a new wave of height.

Resistance levels are also $ 237.00, then $ 244.85 with a potential target of $ 253.44 if the momentum continues. As for the negotiation prospect, the area between $ 224 and $ 225 represents an ideal purchasing area during the retraction near the price channel.

As long as the price of the Solana currency remains on the average movement, the general trend remains up, which puts money in a strong place to carry out a breakthrough towards new pricing peaks in the coming months.

Maxi Doge-Maxi

Maxi Doge is one of the new most important coins that mix the spirit of humor and the enthusiastic energy of trading lovers, and it was specifically designed for adventurers who are looking for double -benefit opportunities using a financial lever of 1000 times, with a societal culture centered on passion, ambition, caffeine and competition.

Once Maxi Doge has the Maxi Doge, investors receive mortgage bonuses, commercial competitions and the possibility of participating in future events and partnerships, and the intelligent contract has been verified by Solidproof and Coinsult, which gives additional confidence in project security.

For its part, the subscription witnesses a strong momentum after having received more than $ 2.7 million, and the currency is currently sold at a price of $ 0,000,2605, but this number will increase with the progress of the subscription steps, which makes early entry a smart step.

Currency owners obtain advantages that include:

- Various annual income (APY).

- Commerce of competitions with prices against exporters.

- Community events and future partnerships.

Finally, Maxi Doge can be purchased directly on the official website using Ethereum-Eth, Binance-BnB or Tether-USDT compatible with the ERC-20 or BEP-20 standard, as well as the possibility of buying it by Visa and Masksard.

يمكنكم زيارة الموقع الرسمي لعملة عملة ماكسي دوج (Maxi Doge) من هنا

The Solana-Sol post: a huge liquidity that improves confidence, the price is approaching the recording of an unprecedented summit? APPLERDIRST on Arab Cryptonews.