Solana -Sol is exchanged at a price of $ 139, with its superiority on the main alternative currencies with the support of the new institutional demand, strategic purchase and long -term collection, led by Janover Inc. – Currently specialized in the development of the decentralized financing sector (DEFI) – which added $ 5 million to the soil currency to its wardrobe; Where it bought 44,158 soil currencies to become a total of 83,084 soil, at an estimated value at $ 9.6 million.

This step is the company’s second big purchase for Solana currency, which reflects an increase of 109% of the ground value per share in order to reach $ 6.59. The intensive assembly operations occur after the company’s management has changed in April, after the previous management of the Kraken platform (Kraken) took responsibility for the company, collecting $ 42 million and has turned into Solana’s mortgage and the development of a decentralized financing structure.

A look at the institutional bets of Janover sur Solana

- Total property: 83,084 soil currencies (worth $ 9.6 million).

- The number of currencies Ground In an arrow: 0.06sol worth $ 6.59

- Growth rate: A 109% increase in the ground value included per share.

Mortgage expansion and whale movements increase the positive soil momentum

Janeover was not the only one to adopt this trend, because you bet that Sol strategies Inc. (CSE: HODL) – A digital currency company based in Canada – is strongly on Solana; Last March, she added 24,000 soil to her closet, with her current property at 267,151 soil, at a value of more than $ 30 million.

In March, STRATEGIES SOL (CSE: HODL) acquired 24,000 soil, bearing total assets at 267,151 soil -alltagnement all that are marked on our network of validators.

Our commitment to Solana continues.

Full article via @Coindesk: https://t.co/zsvxfr1ma– STRATEGIES SOL (CSE: HODL | OTCQX: CYFRF) (@Solstragies_) April 8, 2025

It is also interesting to book most of these currencies for the network audit contract, which means that these companies maintain not only Solana, but also use them for long -term investments in their economy according to the mortgage.

Despite its strong bases, the actions of soil strategies have decreased by 67% since the start of the year, a big difference compared to the price of the soil of 36%. However, the executive director of Leah Wald did not withdraw from her post, confirming her plans to increase mortgage operations on other blockchain networks such as SUA, Monad and Archway.

When $ Soil($ 3.72 million) after 6 months.

It is when $ Soil.

Three years ago, he bought 30,541 $ Soil($ 6.61 million) at $ 216 and has been for sale – even when $ Soil Fallen below $ 10. pic.twitter.com/qmdeqoks7t– Lookonchain (@lookonchain) April 10, 2025

In addition, the purchase and assembly of soil have not been limited to institutions only.

Blockchain data showed the return of whale activity (senior investors) also with a long-term portfolio address bought 32,000 SO (at a value of around $ 3.72 million) immediately before Janver’s announcement, knowing that it itself bought 30,541 soil at a price of $ 216 during the previous market cycle, without selling it even when the price has decreased below $ 10.

An overview of purchasing and assembly operations

- Business property Sol strategies:: 267,151 Coils floor.

- Whale activity: Buy 32,000 soil worth $ 3.72 million.

- Previous purchase: 30,541 soil at $ 216 (kept during the decrease of 2022).

A look at Solana’s technical performance: its prices penetration of $ 145 can release the bulls

From the point of view of technical analysis, the increase in Solana’s momentum is still in progress, after having tested the level of resistance to $ 145 for a short period, the price has decreased slightly to $ 139, while the main level of support remains in a region of $ 136-131 dollars of $ 131 in this region. UT Key Support at $ 136 – $ 131 remains intact. The 50 -day EMA around $ 131 adds confluence to this area.

In addition, Momentum indicators always take care of the bulls (high prices rackets) with the MACD index management above, in a clear indication of buyers’ control on the market. If the ground price can strongly penetrate the level of $ 145, it will target the upward level of $ 153, followed by $ 161.

Trading parameters:

- Entrance point: When the price bounces from $ 136 or enters $ 145.

- Targeted levels: $ 153, followed by $ 161.

- Losses stop: In the level of $ 131 (at the intersection of the average movement index with the steering line).

Final summary: The institutions are betting strongly on the return of Solana

With institutional purchases, collection, whale activity and solid technical performance, Solana is quietly preparing for its next price movement. Although the main titles focus on other currencies, the excessive institutional interest for Solana is obvious, and this hidden increase can be just for the start for patient investors.

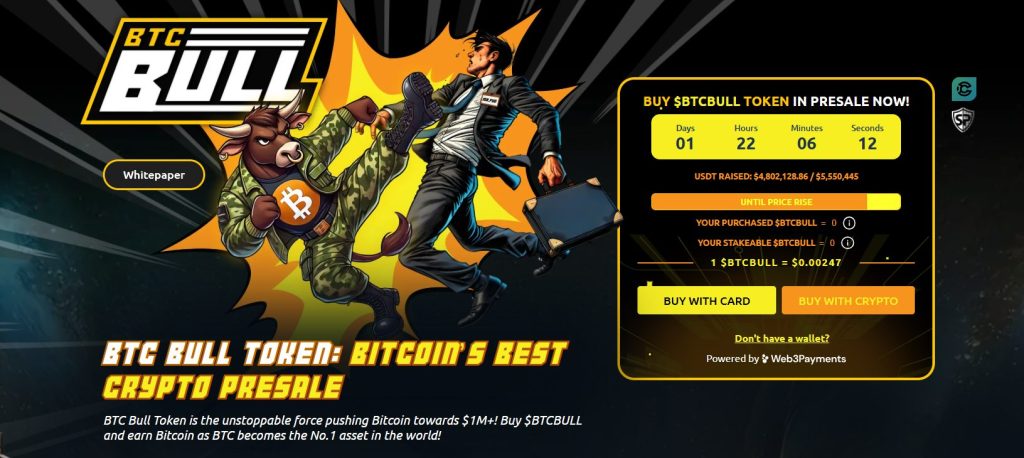

BTCBull’s subscription exceeds $ 4.8 million

While the price of BTC currencies is approaching $ 85,000 and a growing lack of certainty in the macroeconomic economy, the BTCBull project has gained more positive momentum after its interest was increased by small investors and chipto fans. What distinguishes this motto – built on the Ethereum block – other currencies is to provide free distributions in Bitcoin currency for its owners each time BTC reaches important price levels, to bind with the long -term BTC in height.

Get Bitcoin currencies with an annual mortgage of 86%

In addition to free distribution bonuses, the project mortgage program is always a very exciting attraction, because investors can gain income without problem thanks to APY which reaches 86%, while helping to increase the strength of its currency network. In addition, BTCBull parts can be deleted at any time, which offers a lot of flexibility to new and experienced investors.

An overview of the mortgage program:

- Annual return (Apy): 86%.

- Total mortgaged currencies:1,222,531 969 BTCBull.

- The possibility of canceling the mortgage at any time: Yes.

With more than 1.22 billion BTCBLL parts currently, positive Momentum continues to accumulate before Bitcoin is the next price of the price.

The BTCBLL subscription approaches its last step and the high demand for this currency

With the subscription to the BTCBull approach to its end, the subscription is more likely to receive $ 4,801,979.55 of its objective of $ 5,550,445. Despite its availability now at $ 0.002,465, the price could soon increase due to the limited offer and high demand.

Last subscription developments:

- The price of the current subscription: $ 0.00247.

- The result so far: $ 4.80 million on the financial target of $ 5.55 million.

Perhaps the time is your last opportunity to acquire BTCBLL at its current low price before the next increase. Thanks to remunerative mortgage yields and the reward of its owners with free bitcoin balances and by increasing its technical system, BTC Bull is distinguished as a solid competitor in the MG currency sector with the support of its functional uses linked to the future Bitcoin path.

While his subscription approaches his end and his growing request, he may be worth traveling quickly to buy BTCBLL at his current price before the next price increase.

Follow us via Google News

The Solana Prize position is $ 139, surpassing other alternative currencies; Why do investors buy it? APPLERDIRST on Arab Cryptonews.