In an unexpected turn that captivated the community of Memecoin, Stupid coin (stupid) further shot more than 800% within 24 hoursMark one of the most explosive manifestations in the cryptocurrency market this year. The Token increased from $ 0.002033 to a peak of $ 0.02446 before stabilizing by around $ 0.01478. That meteoric movement brought its market capitalization almost $ 14.79 millionwith the daily negotiation volume exceeding $ 14.13 million.

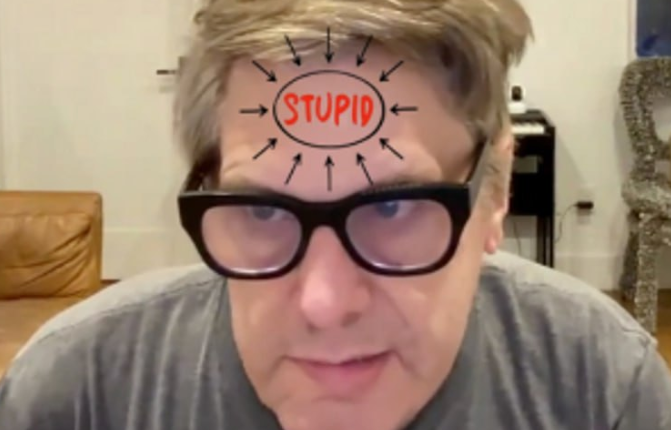

Despite this amazing performance, Fred KruegerThe man behind the project remained remarkably indifferent. As the Internet exploded in emotion, Krueger’s measured reaction raised his eyebrows, and offered an idea of how even explosive growth can mean little without liquidity.

|

| Source: Coinmarketcap |

The story behind the stupid coin

Launched in January 26, 2025Stupidcoin quickly caught his attention, debuted to $ 0.0227 and increased to a historical maximum of $ 0.05374 the next day. However, a liquidation wave led to a strong decrease, and the Token remained relatively quiet for months until its most recent revival.

This resurgence seems to have been triggered by a promotional video again published from the project team. The video painted Stupidcoin as the “next token of Meme Big Meme”, with speculative potential to increase 100x or even 1,000x of its current value. The video emphasized the updated brand of the project, a renovated website (stupid.com) and technical indicators such as an overene RSI, all of which helped renew the interest of the community and viral attention.

What promoted the increase in prices?

Several contributing factors lit the 800%rally:

1. Viral marketing

The promotional video reintroduced stupid to the cryptographic audience with bold predictions and comparisons with heavyweights such as Dogecoin, Safemoon and Pepe.

2. Strong Community Buzz

Once online circulated, the video was widely shared on social platforms. Twitter, Reddit and Telegram illuminated with discussions about the undervalued nature of the currency and its potential to exploit.

3. Market dynamics

With a relatively low market limit and a limited liquidity, an increase in purchase orders caused extreme price movements, common in lower capitalization altcoins and memecors.

4. Technical Commerce Moment

The merchants saw narcotics violate multiple levels of resistance and interpreted it as a breakup pattern. This increased even more fomo (fear of getting lost) and brought more buyers to the table.

From now on, Token boasts more than 20,598 holdersWith the largest wallet controlling 43.6 million stupid chips.

| Source: x |

Fred Krueger’s unexpected silence

While merchants celebrated mass profits, Fred Krueger’s reaction was surprisingly moderate. In X (previously Twitter), Krueger published:

“Thank you for asking, but I have no idea why Stupidcoin has become vertical. However, the new website is great.”

Krueger also revealed that he owns 12 million stupid chipsBut none of them is accessibleThey are blocked up to 2026. In his words, “I didn’t make a penny of the bomb.” According to Krueger, the acquisition period for his holdings has not yet begun and will not begin until January 2026.

Krueger followed the statement with another tweet, changing the approach completely to Bitcoin:

“It’s time to sell New York condominiums and buy Bitcoin.”

This pivot revealed where its long -term confidence is located, not in Memecoins, but in the proposal of proven value of Bitcoin.

| Source: x |

What follows for Stupidcoin?

Although the recent Stormcoin rally is impressive, questions about its sustainability remain. Both experts and merchants are weighing short -term exaggeration against long -term viability.

Technical forecast

-

Rise resistance levels: $ 0.026 and $ 0.03

-

Support levels: $ 0.009 and $ 0.006

-

Volume dependence: A continuous increase in the volume of negotiation could boost the highest price, but if the impulse fades, a strong correction is likely.

Bitcoin remains stable during the stupid bomb

While stupid dominated holders, Bitcoin also showed resilienceincreasing from $ 105,820 to $ 106,643.06 the same day. Its market capitalization remained firm in more $ 2.12 billion. Analysts believe that the contrast between the slow and stable gains of Bitcoin and the Stupid volatile rally underline a broader trend: Memecoins are attracting fast money, while Bitcoin remains the anchor of digital finances.

Fred Krueger: Man with a different vision

Fred Krueger’s reaction, or the lack of it, can reflect a deeper feeling about the current memecoin frenzy. While Stupidcoin co-creeted, his lack of will to capitalize on his rally shows a clear divergence of the typical narrative of Memecoin’s founder.

Why Krueger is not celebrating:

-

Closed parts: You cannot sell or change your stupid chips due to contractual award schedules.

-

Focused on foundations: Krueger has long maintained his position that Bitcoin is a long -term play, unlike speculative tokens.

-

Pragmatic inverter: Your messaging emphasizes strategic investment on exaggeration trade.

Stupidcoin vs Bitcoin: an intelligent inverter dilemma

Today’s investors are trapped between pursued the next viral bomb and keep active in the long term. This is how the two assets are compared:

Stupid coincidence

-

Volatile and speculative

-

Strongly influenced by social feeling

-

Unclear route and utility map

-

Attractive for short -term merchants

Bitcoin

Krueger Bitcoin’s pivot in the middle of Stupid’s rally says a lot. While the stupid can generate headlines and short -term profits, Bitcoin represents long -term condemnation.

| Source: Dexscreener |

The biggest image

The story of the Stormcoin rally is not just a token that jumps 800% in one day. It is How the cryptographic space reacts to speculationHow easily the feeling of the market can change and how even creators can distance themselves from exaggeration.

Krueger’s response reminds investors to deepen more than price graphics. While Memecoins can provide rapid returns, they often lack the stability and security offered by fundamental cryptocurrencies such as Bitcoin.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.