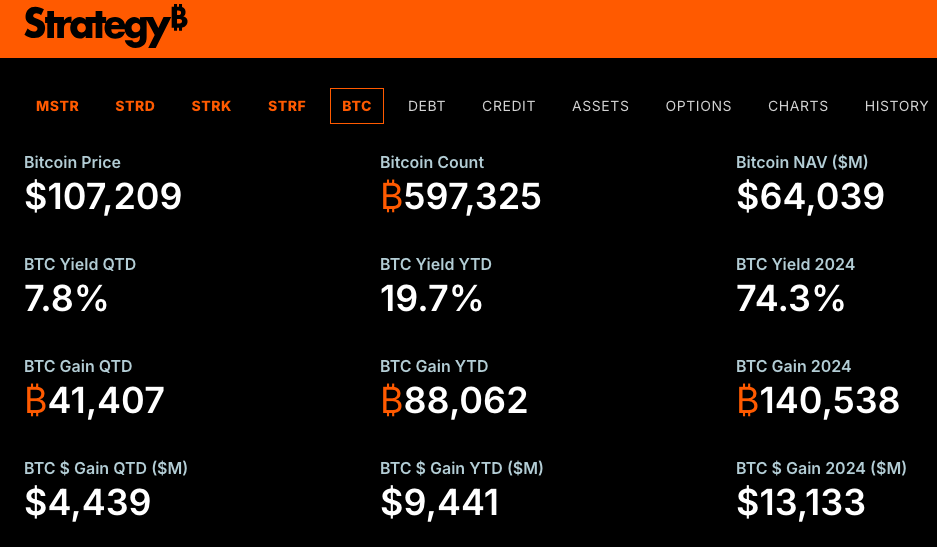

Michael Saylor has announced the purchase of additional $ 500 million bitcoin currencies, to become the possession of microstrategy currently 597,325 bitcoin (BTC) at $ 64 billion, which means its acquisition of 2.8% of its total offer.

Michael Saylor, founder of the strategy, formerly known as microstrategy and its CEO, revealed a new acquisition of a higher value $ 500 million On currencies Bitcoin-BTC Additional, continuing the relentless approach of his business to collect more.

According to the financial disclosure submitted to the American Committee on Securities and Exchange Committee (SEC) on June 30, the strategic company bought 4,980 Bitcoin currencies Additional value $ 531.1 million Last week, with an average price approximation $ 106,801 For a single currency.

After this last acquisition, the strategic company has become detained 597 325 Bitcoin, with a value of more than $ 64 billion and an equivalent average price $ 70,982 For a single currency, with a total investment approximately 42.4 A billion dollars, including secondary costs and expenses.

The strategy acquired 4,980 BTC for around $ 531.9 million at ~ $ 106,801 per Bitcoin and reached BTC yield of 19.7% YTD 2025. At 06/29/2025, we have Hodl 597.325 $ BTC Acquire about $ 42.40 billion at ~ $ 70,982 per Bitcoin. $ Mstr $ Strk $ STRF $ Strd https://t.co/xvwnskfuks

– Michael Saylor (@saylor) June 30, 2025

The strategic company currently controls approximately 2.8% of the Bitcoin Bitcoin (Bitcoin) Bitcoin Bitcoin offer (Bitcoin)

The ownership of the Bitcoin Strategic Company (Bitcoin) represents more than 2.8% of its total offer of 21 million BTC currencies, which means benefit from unreasonable gains estimated at around 21.6 A billion dollars according to current market prices.

Only this year, a microscope collected 88 062 Bitcoin value (BTC) 9.8 One billion dollars, for 140 538 A currency with a value 13 A billion dollars in 2024 according to the company data.

The data show that the unrealized income of the Bitcoin company in 19.7%With the earnings of his destiny 7.8% For the second annual quarter only, the approach to the target return rate 25% At the end of 2025.

Purchases remained in line with the expectations of the market, while Sailor announced its continuation by acquiring Bitcoin assets (BTC) on Sunday thanks to its clues on social networks.

On June 29, Sailor spoke with the Investment bag in currencies, sending a message saying:After 21 years, you will want to have bought more Of them, “in reference to his recent presentation at the Bitcoin conference in Prague, in which he expected a sign of a sign of a sign of a sign at the cost of Bitcoin ( $ 21 million For two decades.

In 21 years, you will want you to be more about it. pic.twitter.com/s1i607rvda

– Michael Saylor (@saylor) June 29, 2025

Convert into the perception of Bitcoin: 134 companies that currently follow the Silor approach

Bitcoin ownership data data indicates that 134 companies listed on the stock market have adopted Bitcoin in the context of their plans to manage the assets of their treasures, and the list of new membership companies includes twenty UN, Trump Media and Gamesop, followed by the approach of Sailor and his strategic company.

While the Japanese investment company Metaplanet announced yesterday that it had an additional currency of 1,005 BTC, bringing its total possession 13,350 BTC, the Blockchain-Qui group is described as the first European companies to annex Bitcoin to the origins of its treasure 60 An additional BTC currency to reach its total possession at 1,788 A currency with a convergence value 161.3 One million euros.

The Blockchain group acquired 60 BTC for ~ 5.5 million euros at around € 91,879 per Bitcoin and reached a BTC yield of 1,270.7% YTD, 69.3% QTD. At 6/06/2025, $ Altbg Has 1,788 $ BTC For ~ 161.3 million euros at ~ 90,213 € per bitcoin @_Altbg First Bitcoin Treasury Company of Eurobe… https://t.co/bmcqzvfoz – Alexandre Laizet

(@Alexandrelizet) June 30, 2025

This trend also increased in the United Kingdom, because at least 9 companies in different sectors – web design companies emerging from mining companies – have announced its intention to buy Bitcoin or revealed that modern acquisitions include them in the origins of their treasure last week.

London-listd companies are jumping into Bitcoin train, aimed at increasing action prices and reflecting the success of Saylor’s strategy. #Bitcoin #United Kingdomhttps://t.co/vpje86rrri – cryptonews.com (@cryptonews) June 29, 2025

Subsequently, Krembo platforms began to develop new products to take advantage of this institutional trend towards Bitcoin (BTC); On June 28, the Gemini platform launched a digital representative of Microsstry’s shares (MSTR) before investors of the European Union, recording the first arrows of the actions digitally represented in this region.

And strategic efforts to collect additional Bitcoin currencies (Bitcoin) have reflected in the price on his part, to be content with a monthly height in a way 4.92% At $ 390.58 according to Google Finance Data.

The price of Bitcoin seeks to penetrate the barrier of $ 109,000, which can lead to a decrease in speculative transactions of $ 48.7 million

The Bitcoin Prize (BTC) witnessed modest earnings during the weekend 3% After having touched a value $ 108,798 Last Sunday, driven by improving the general mood of the market. After trying to break a barrier $ 108,000Michael Van de Poppe, the most important of them, expected Michael Van de Poppe, founder of MN Capital – that the price of Bitcoin currency will attend a temporary correction before trying to decompose and reach new record levels.

Inevitable escape to an ATH on #Bitcoin Might even happy during the coming week.

Such a bullish configuration. pic.twitter.com/vqft2a2gsr– Michaël Van de Poppe (@cryptomichnl) June 28, 2025

Technical analysis indicates that the level $ 109,000 It represents a major resistance barrier over the deadline for four hours, which is described by Van Dibube like “ The level to penetrate to take an increasing dynamic».

On the other hand, Coinglass data showed an objective for merchants at the main levels, with strong purchase requests without the current level $ 109,000Where there are speculation agreements, to decrease with a higher value 48.7 A million dollars is the highest level $ 109,500.

If the price of Bitcoin (BTC) succeeds by entering the barrier of speculative transactions, it is low $ 110,000–$ 112,300The wave of forced liquidation, which will be subject to these offers, can quickly pay the price of unprecedented levels and thus record new higher levels.

The after billionaire Michael Sailor announces additional Bitcoin-BTC currencies of $ 500 million, when is happening? APPLERDIRST on Arab Cryptonews.