Bitcoin currently oscillates about $ 95,500, now its stability in the middle of the general mood transformation of chipto investors from fear to greed. The Reading and GREED (Fear and Greed Index) index has gone from 24 months to 56 currently according to the Coinmarketca site, which suggests the growing appetite for risks among investors.

Although the price of the BTC has decreased by a slight rate of 0.55% in the last 24 hours, the general price of the sector price with a market value of $ 1.91 Billion of dollars and the 2.85 million BTC offers are stable, because the currency draws its high momentum from artistic stability and improved general mood.

- Read the index of fear and height: 56 (greed).

- Monthly reading: 24 (fear).

- The highest annual reading: 88 (plus greed).

- BTC market value: 1.91 Billion of dollars.

- Total daily trading volumes: $ 23.8 billion.

Improving the general mood of the market has coincided with concrete developments and institutional indicators that suggest the possibility of acquiring the price of additional ruling of the Bitcoin price until the end of the first half of this year.

Adoption and organizational efforts are the formulation of the scene

There is the development of Haman helping to strengthen trust in digital currencies and to consider it as a recognized asset class; The first is an initiative to update commercial transactions. It is expected that 90% of the stores in the French city accept digital currencies as a way to pay by summer 2025, and Lunu Pay reported the launch of training workshops aimed at admitting store owners to adopt payment systems through the third web3 (web3), to reach the city of Cannes to the list of growing cities – the most important.

Cannes merchants, in France, will begin to accept cryptocurrency payments this summer as part of a city initiative to modernize its commercial payment system and attract high-end tourists. Lunu Pay, a web payment company, says that the objective is an adoption of 90% among local businesses.

– Wu Blockchain (@wublockchain) May 3, 2025

The second is the launch of a more difficult organizational campaign. The American authorities have opened investigations with the Cambodian group Huione, saying that they are involved in illegal activities of $ 98 billion linked to digital currencies since 2014. The American Financial Crime Network (Fincen) now classifies the Huione group as “an essential concern for money laundering activities”, in a decision that was appreciated by experts. Compliance and a decisive turning point in terms of law enforcement related to Cripto

Just in: The American Treasury property to cut the Cambodia group from the American banking system, accuse him of helping the Lazare group to launder his crypto. pic.twitter.com/294xfr

– Cointelegraph (@cointelegraph) May 2, 2025

At the same time, the Committee of Securities and Exchanges (SEC) – which is under pressure after a series of legal losses – can adopt a more cooperative approach concerning the regulation of the digital currency sector and can be inspired by its new approach to The “advice before imposing a punishment” followed by the IRS.

SECTED LEAGUE DE L’IRS on cryptography regulations

– Pressors of the Doge’s Doge initiative to reform his cryptographic approach

– Coinbase urges the dry to reimburse legal costs for companies wrongly targeted

Pivot of the dry of prosecution = “Work with it, not against” industry

– Irs offers a …Afv Global (@Afvgloal) May 2, 2025

These trends preach to the transformation of the shit sector from the stage of “chaos and non -organizational compliance”, which distinguished its beginnings towards a more structural and attractive organizational framework for institutions.

Bitcoin technical levels worthy of surveillance

The latest BTC price movements show its success in cohesion to the highest trend line that began to train at the end of April, and it seems that the average movement line if with the last 50 trading candles – each includes two hours – ($ 95,833) as well as the level of correction of Fibonacci 0.382 (at $ 96.048) provides good care for for the reaction.

The reversal of the prices of its current fork at the top can pay it at $ 96,782 and possibly $ 97,329, with the possibility of re-tester the highest levels recently recorded at $ 97,966.

Negotiation transfer parameters:

- Entrance: Between $ 95,500 and $ 96,000 (when confirming the rebound).

- The goal: $ 97,330, then $ 97,960.

- Loss of stop: Close below $ 95,450.

While traders must take care to indicate the MacD index on poor momentum, it is therefore preferable to wait for a breakthrough or a clear confirmation via a positive intersection of the MacD index before opening new purchase offers.

Summary

With the overall mood of the market, the expansion of concrete uses and the increase in organizational clarity, the current stability phase can represent a strong starting point. Despite continuous fluctuations, $ 95,400 continues to provide a purchasing area, promising that the most likely route is the continuous height.

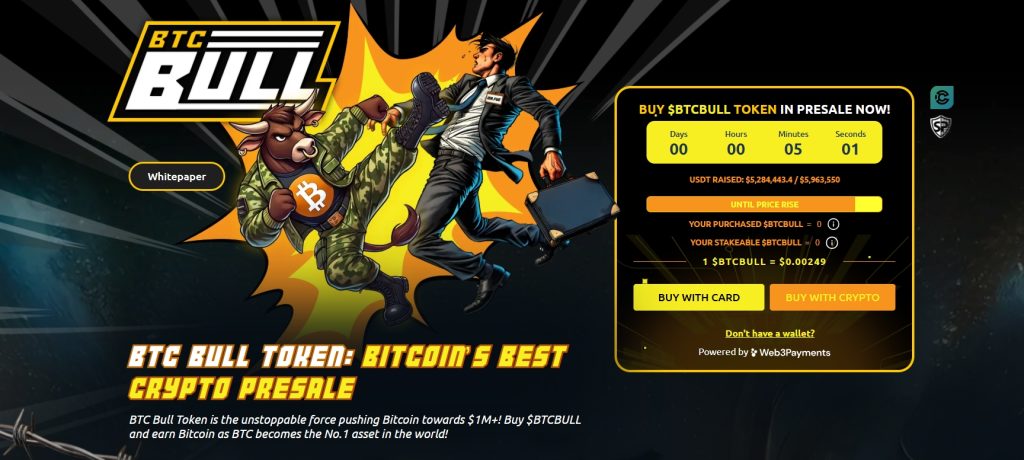

The income of the 78% flexible mortgage draws the attention of investors and makes the BTC bull is a sign of $ 5.3 million

The BTC Bull (BTCBLL) continues to attract the attention of investors with the success of its subscription by collecting more than $ 5.3 million so far and its approach to reach its objective of $ 5.96 million. With its price of only $ 0.00249, the currency was able to reserve a higher position than another MIM, because it gives its owners real functional use thanks to a flexible mortgage mechanism with interesting yields.

The economic data of money is derived from its practical uses

BTCBLL continues to impose its distinction from traditional MIM origins thanks to the combination of the attractiveness of digital currencies and rewarding mortgage rewards, where users can obtain an annual mortgage of 78% with the possibility of withdrawing their mortgaged assets when they wish, in the absence of compulsory mortgage periods or their early fines. This model was admired by investors seeking to obtain yields without sacrificing access to their assets, especially in the very volatile digital currency environment.

Current subscription statistics:

- The current result: $ 5,313,688 out of $ 5,963,550.

- The current price: $ 0.002,495.

- Total mortgaged currencies: 1 342 549 903 BTCBLL Coin.

- Annual return (APY): 78%.

With the next step, which is no longer separated by less than $ 650,000, the remaining time window becomes narrow at an accelerated pace, so that budding investors must make abundant benefits without sacrificing the freedom to act in their investments to rush to subscribe to the BTCBUL subscription which becomes a more attractive option in the exciting cycle for the year 2025.

Follow us via Google News

The price of Bitcoin is adjusted around $ 95,500 with the general mood of the market turning to greed, so what follows? APPLERDIRST on Arab Cryptonews.