Ripple officially announced its withdrawal from its appeal in the long -term trial with the American Committee on Securities and Exchanges (SEC) marking a decisive end of one of the most famous organizational conflicts in the world of Cripto; It is expected that the committee in turn fell back, which means that the judgments of judge Analisa Torres in 2023 remained a list without beads.

#Ripple Officially put an end to its #SECOND Legal Fight yesterday – but in May 2025, Filt is still important.

He reacts effirms: #Xrp Is not security. pic.twitter.com/ubglzpwbci– Ripplexity (@Ripplexity) June 28, 2025

In his final decision, Judge Torres confirmed that Rippal Rippaux sales (undulation) of the institutions violated the laws of titles, but at the same time, she recognized that sales via trading platforms do not come under this classification. “We fold this page forever.” Legal experts – including Bill Morgan – considered this moment as a victory for solid logic and the entire digital currency market.

Despite the company and the committee agreement to reduce the fine of $ 125 million to $ 50 million and increase the permanent ban, the judge rejected these modifications. The two parties omitting the call, the fine of $ 125 million remains valid, the company definitively preventing the sale of XRP currency to institutions without registration.

The most important legal results:

- XRP was not classified as titles when sold via trading platforms.

- Institutional sales are always under constraints.

- Civil fine of $ 125 million.

- Ripple can now focus on growth and partnerships.

Market reaction to fold the legal file

The end of the conflict helped to improve the atmosphere of the XRP community, while merchants pushed its price to increase by 4.4% in the last 24 hours to reach $ 2.19. The Chief Legal Advisor of the Alderoty Stuart (Stuart Alderoty) confirmed that the XRP classification is still constant, which supports its functional use in institutional financing and international financial transfers.

This legal clarity represents an opportunity for Ripple to expand the scope of strategic uses of the XRP, in particular in the fields of digital financing and institutional payments. Analysts believe that this decination can restore the attention of institutions, in particular in the light of continuous talks on immediate negotiation funds for XRP on the stock market (XRP Spot ETF).

The technical indicators alluded to a possible start of price for the Ripple part (Ripple)

The graphic diagram appears as part of the 4 hours of similar triangle style, because the price is firm under central resistance at $ 2.21. The formation of a series of downs up $ 1.99 led to the formation of an increased support line, while the top of the triangle continues to limit attempts of height.

The “golden intersection”, which is placed between the average movement average of if of 50 days and its measurement counterpart, takes care of 200 days, while the change in the color of the MacD index table refers to the green – associated with its intersection on the signal line – at the beginning of an explanatory moment. On the other hand, the appearance of the Marubozu candle rises when it resists a real test by buyers of the display levels.

Suggested trading strategy:

- Entrance: Buy above the level of $ 2,215 if the penetration is confirmed

- The first objective: $ 2.288

- The second goal: $ 2.338

- Loss of stop: In $ 2,139 (intermediate convergence area with steering line support)

If the resistance proves its strength, the decline can constitute about $ 2.14 the second chance of entering with a calculated risk. If penetration is confirmed, the movement is likely to accelerate towards the psychological barrier at $ 2.50, with the possibility of targeting $ 3.50 if the ascent extends.

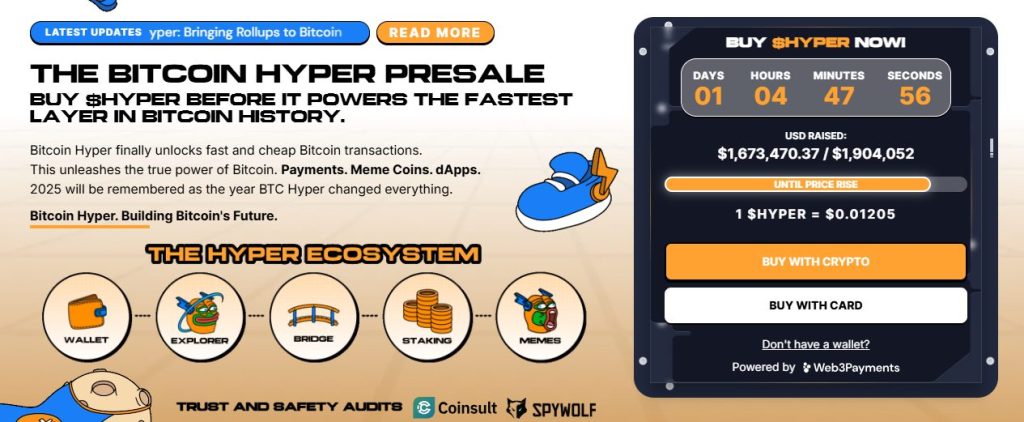

The result of the hyper bitcoin is more than $ 1.7 million: the second layer solution is strongly launched, taking advantage of the momentum

The result of Bitcoin Hyper is more than $ 1.7 million, with $ 1,739,836 on the current stage of $ 1,974,249. Investors can always buy hyper at $ 0.0,012075 before the next price increase in less than two days.

The Project Offers The First Second Layer Solution for Bitcoin Based on the Sevm Virtual Machine (SVM), and Provids Fast and Low -Cost Contracts on Bitcoin BlueCoin, to Combine the Safety of Bitcoin Bluecin and the Virtual Expansion of the Solana Virtual Machine, Allowing the Development of High -Speed DECENTRALIZATION APPLICATIONS AND THE CREATION OF MIM Currencies and Completion of Transactions With Gas Fees very LOW and Smooth Connection With Bitcoin Bluechen.

The intelligent contract for the Bitcoin Hyper Audit project has also suffered Coinsult, which confirms that it is designed to improve confidence, expansion and performance. Similarly, more than 116 million hyper of bitcoin parts have already been mortgaged for annual mortgage (APY) mortgage currently amounting to 450% and can be collected after the official launch of the currency. Hyper bitcoin can be used to push gas costs, access to decentralized applications and participate in the decentralized governance process.

Finally, investors can join the subscription and buy the currency using both digital currencies or visa and maskertard without the need for crypto portfolio thanks to its dependence on web3payments. Thanks to this wonderful mixture between the spirit of MIM currencies and practical uses, Bitcoin Hyper quickly highlights the potential rising star in the world of second layer solutions for the year 2025.

Does the Ripple-XRP Prize post after his company put an end to his judicial dispute with the securities and exchanges committee (sec) and his increase of 4.4% in one day, does it reach $ 3.50? APPLERDIRST on Arab Cryptonews.