Hype Token Price shoots like sonnet and hyperliquid forge $ 888m crypto treasury powerhouse

In a movement that is sending waves through Wall Street and the cryptographic world, the biotherapy of the sonnet found in Nasdaq has officially merged with Rorschach I, forming Hyperliquid Strategies Inc., a new public entity valued at $ 888 million. This historical fusion represents an important step to unite decentralized finances with traditional financial markets, positioning hyperlichid strategies as a pioneering firm of the Crypto Treasury.

A new paradigm for the management of the Ochain Treasury

The newly formed hyperlylic strategies are not just another biotechnology pivot story; It is a clear sign of how defined assets are moving towards the conventional financial ecosystem. This fusion, backed by inherited finance veterans and some of the most respected cryptographic investment firms, indicates a deeper integration of digital assets in the treasure bonds of the companies that are negotiated publicly.

|

| Source: x |

The center of this strategy is the possession of 12.6 million bomb tokens, now positioned as a critical treasury asset in the chain within the hyperlichid structure. Together with an cash reserve of $ 305 million, these holdings will now sit in the books of a company that is in Nasdaq, an almost unthinkable scenario in the traditional financial world only a few years ago.

Institutional support provides credibility

The importance of this fusion is underlined by high profile investors who support the new entity. Paradigm, Galaxy Digital, Capital Panther and Digital Republic have joined as significant shareholders, bringing credibility and financial power. In addition, the appointment of former Boston Fed Fed Eric Rosengren to the Board underlines the growing intersection between traditional financial governance and the decentralized financial sector.

These institutional associations reflect a strong vote of confidence in the viability of cryptographic treasure assets. The presence of such figures and notable organizations also positions hyperlichid strategies as a potential leader in the redefinition of how corporations administer their reserves in the era of blockchain technology.

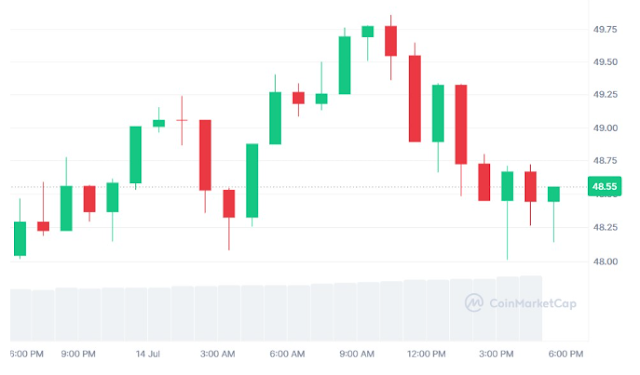

Hype Token Price arises captures market attention

After the announcement of the merger, the price of the hype tokens experienced a notable increase, driven by the enthusiasm of investors and the highest commercial volumes. With the daily volume greater than $ 493 million, the Token of Bombo has quickly become a focal point for both cryptocurrency enthusiasts and institutional investors.

The price, which saw a daily increase of more than 1%, is now under nearby surveillance, since market participants evaluate whether this impulse can maintain after the merger. According to Ochain Tindor analyst, the current assessment of exaggeration remains aligned with income projections, which suggests that despite the increase, the Token is not in an overcompra state.

Biaso token pricing prediction: What follows?

Market observers now closely follow the token bombing to determine their potential career in the coming months. The predictions that currently circulate among analysts suggest:

-

Short term: A potential increase to $ 55 as trade stabilizes after the ad.

-

Midterm: An objective range from $ 70 to $ 85, depending on sustained institutional interests and continuous growth in the adoption of Defi.

-

In the long term (end of 2025): A price of price greater than $ 100, provided that the token reaches the wider utility and integration within the retail and institutional frameworks.

These forecasts, although speculative, are backed by the growing narrative that tokens defi as the hype can function as viable treasure assets, challenging the traditional reserves management methods and the diversification of assets.

Why this fusion is important for Defi and Wall Street

This fusion is not just a transaction between two companies; It is a statement on the evolutionary panorama of financial management. When anchoring its treasure strategy in crypto-national assets, hyperlylic strategies are challenging the status quo of the corporate reserve management, providing a live case study of how digital assets can coexist with traditional finances in a regulated and transparent environment.

The inclusion of hype tokens in the general balance of a company that is quoted in Nasdaq serves as a powerful validation for the Defi sector, which has often been criticized for lacking tangible integration of the real world. This movement can pave the way for other companies that quote on the stock market consider similar strategies, taking advantage of the unique benefits of blockchain -based assets, such as transparency, safety and programability.

Potential impacts on the largest cryptographic market

The success of hyperlycid strategies in the implementation of a cryptographic and focused treasure model could have long -range implications for the broader cryptographic market. It can inspire other companies to adopt similar strategies, further normalizing the use of defi assets in corporate finances and accelerating conventional adoption of blockchain technologies.

In addition, this development is likely to attract greater scrutiny of regulators, particularly as the most public traded companies begin to integrate cryptographic assets into their operations. However, the participation of accredited investors and experienced financial leaders can help navigate regulatory challenges, providing a road map for others to follow them.

Hyperlichid strategies: unite traditional finances with defi

Hyperlichid strategies are positioning themselves at the intersection of innovation and stability, with the aim of taking advantage of the power of decentralized finances while adhere to the rigorous required standards of a company that lies in the stock market. By having a significant bomb tokens reserve together with traditional cash assets, the company incorporates the potential of a hybrid financial model that could redefine how the value is stored and managed.

The measure also underlines the growing maturity of the Defi sector, which has evolved from a speculative patio to a domain capable of supporting the needs of the main institutions. This maturation is essential for the continuous growth of the cryptographic market, providing a basis for legitimacy and stability that can support a broader adoption.

Conclusion: A milestone for defi

The formation of hyperlichid strategies through the fusion of Sonnet Biotherapeutics and Rorschach I represents a milestone on the trip of the assets defi towards conventional acceptance. It shows that crypto-national assets are not simply speculative instruments, but can serve as effective components of a diversified treasury strategy.

As the Token of Bombing continues to capture the interest of investors and the impulse of the market, the success of this initiative will be closely observed by the cryptographic community and traditional financial institutions. If this marks the beginning of a broader trend or remains a unique case, it undoubtedly highlights the growing relevance of decentralized assets in the current financial ecosystem.

For now, all eyes remain in token strategies and hyperlycides as they browse this new land, offering a look at a future where Defi and Wall Street may not be rivals, but partners in the construction of an innovative and innovative financial system.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.