The most important points:

- The portfolio which holds more than 10 Bitcoin-BTC currencies controls 82% of its offer, leaving only 17.5% of young investors.

- Adult buyers – such as strategy – can have 50% of newly planned bitcoin parts, which increases their rarity.

- Bitcoin is assisted by an increasing centrality which is the aim of its founder, Satoshi Nakamoto.

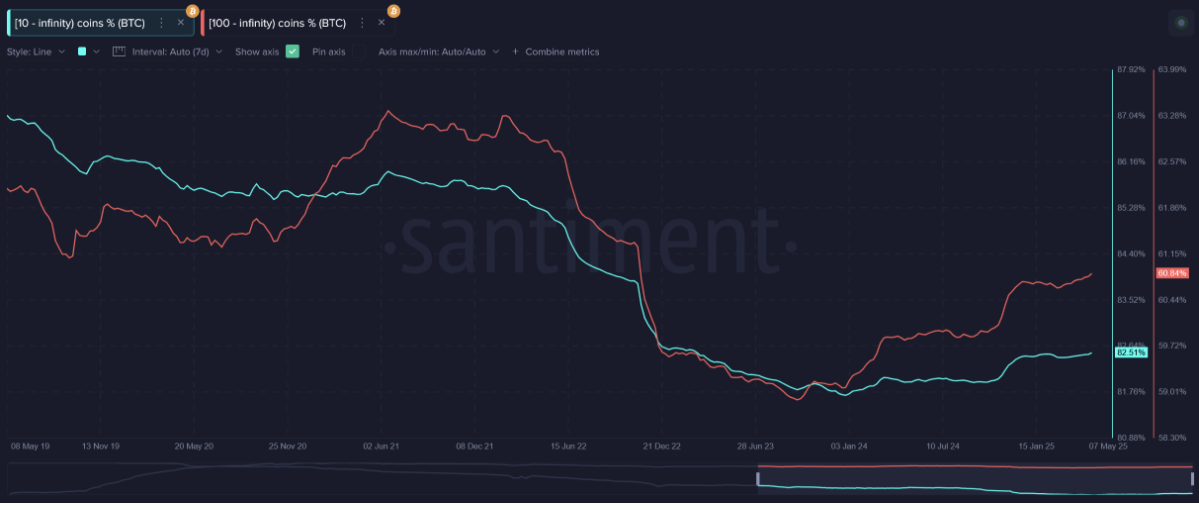

The new data shared by the Santiment website on May 13 indicate the increase in the domination of Bitcoin adult investors on the market, in particular the governor which contains more than 10 BTC currencies (with a value of almost a million dollars), which holds 82% of the supply of mining currencies.

How to determine the portfolios with a score of more than 10 liquidity from the BTC market

Bitcoin balance increases in the hands of institutional investors and certain eminent traders, according to a report by the Santiment website.

From the Bitcoin Strategic Reserve of Trump to the retail power games and the sale of minors who feed the Instituteal power, our last overview explains how the future of Bitcoin and the crypto is reshaped behind the scenes.

pic.twitter.com/fqfihewma2

– Santiment (@santimentfeed) May 15, 2025

In this context, the sum of 19.86 million BTC currency operated maximum supply of 21 million, and the portfolio with a balance exceeds 100 BTC (at a value greater than 10 million dollars currently) has a rate that its value is for a million dollars.

The maximum offer of Bitcoin is 21 million currencies, of which 94.57% are already and 1.14 million BTC will be launched over a period of 115 years, and although large investors are increasingly acquisitions of this future limited offer before reaching the free market, this will help increase the scarcity of money in partnership with its software restrictions.

Strategy is the best example of the unfair possession movement; Last month, she bought 15,355 BTC and announced on May 1 a plan to receive funding of $ 84 billion to buy more, and she also bought 13,390 BTC a few days later. This excessive acquisition affects Bitcoin supply and market movements, where Circassian analyst Adam Livingston calls on this phenomenon with the effect of “artificial digital imprint”, after bitcoin acts which reduce the extraction bonus to half almost every 4 years, and gradually limit the new foreign mine, which increases half.

The strategy is synthetic in two bitcoin and will set the cost of capital for the next 100 years.

Most people think that the Bitcoin supply curve is sacred.

Fixed. Immutable. Untouchable.

They are wrong.

The strategy manually rewrites the rarity calendar of Bitcoin at the moment with …– Adam Livingston (@adambliv) April 27, 2025

The big players, such as the strategy, also contribute to the strengthening of this rarity with the runner protocol, by buying large quantities of newly prepared bitcoin currencies as soon as they enter the market, where the production of metal after the last building is 450 BTC per day or 13,500 BTC per month, which means that the purchase of the strategy is sufficient for this month. Conjunction with the immediate disappearance of new currencies.

Young investors in the face of the influence of the “artificial race”

The concentration of Bitcoin ownership is accompanied by large portfolios with large consequences on the currency market, in particular young investors, because liquidity decreases considerably when a large part of the offer is entered; This drought can increase volatility and make price oscillations to make the task of investors more difficult and allow sale at fair and appropriate prices, and the Santiment report indicated that the governor’s balance which contains less than 10 BTC is currently 3.47 million currencies (equivalent to $ 358 million).

This portfolio belongs to young investors, hostiles and modest traders who are at the center of the principle of decentralization adopted by Bitcoin, but adult investors continue to undermine this principle by collecting more currencies and pressing at low prices, and this course continues to repeat themselves to increase the size of their assets and deepen the distribution gap.

The central Bitcoin paradox: his journey from rebellion against centralization to its adoption

In 2008, Satoshi Nakamoto revealed that Bitcoin, which represents a digital financial system of the counterpart aimed at creating a decentralized currency which is not subject to the control of banks and governments, and the white paper of money formed an explicit rebellion against the defects of the financial system which witnessed this year a collapse which exposed the riss of the central chilly egonym. The difference in Bitcoin is to move away from the control of the main entities and put them in the hands of a global network of users and metal which maintains justice, continuity and availability of the system for everyone, or that is at least expected from what we expected.

Perhaps Satoshi moved his attention to the other application of decentralization which he found “interesting” at the time; The one that has been naturally centralized over time.

– SAOL

(@Uptownsaul) April 24, 2025

Consequently, this promise has faded after 17 years, the majority of the Bitcoin balance has focused on a few portfolios similar to the traditional financial pyramid that Bitcoin sought to dismantle from the start, and Bitcoin will be under the control of the rich elite in the absence of interference on this path, whether by broad adoption or redistribution or staging of new policies; The mockery of fate is the transformation of the financial editing tool at the end of the system that was created for its destruction.

Current questions

Large players – who have a large Bitcoin balance – can move the market with a negotiation process, where prices are increasing in the event of purchase and decrease in the event of sale, and this force allows significant and unexpected price oscillations.

This cannot be achieved now, because the laws focus on the fight against counterfeiting and crime and not forcing the rich to share the assets of Bitcoin, because the authorities can confiscate the currencies of criminals, but the taxation of redistribution is legally chaotic and thorny.

Young investors can compete by following the activity of whales using decentralized financing tools (DEFI) and by sharing their ideas in trading companies, and they can discover opportunities early and quickly adapt to whale activities that move the market, where knowledge and flexibility are more important than the financial block on the rapid movement markets.

Follow us via Google News

The governor of the post, who has more than 10 Bitcoin currencies who control 82% of his supply – are we going to enter the stage of extreme rarity? APPLERDIRST on Arab Cryptonews.